Today we are announcing the availability of Abra on iPhone and Android for consumers in the US. Now, anyone with the Abra app in the US or the Philippines can send money for free to anyone else with the app by funding their Abra wallet (buying digital cash) with their bank account. This release is the next step in taking Abra global.

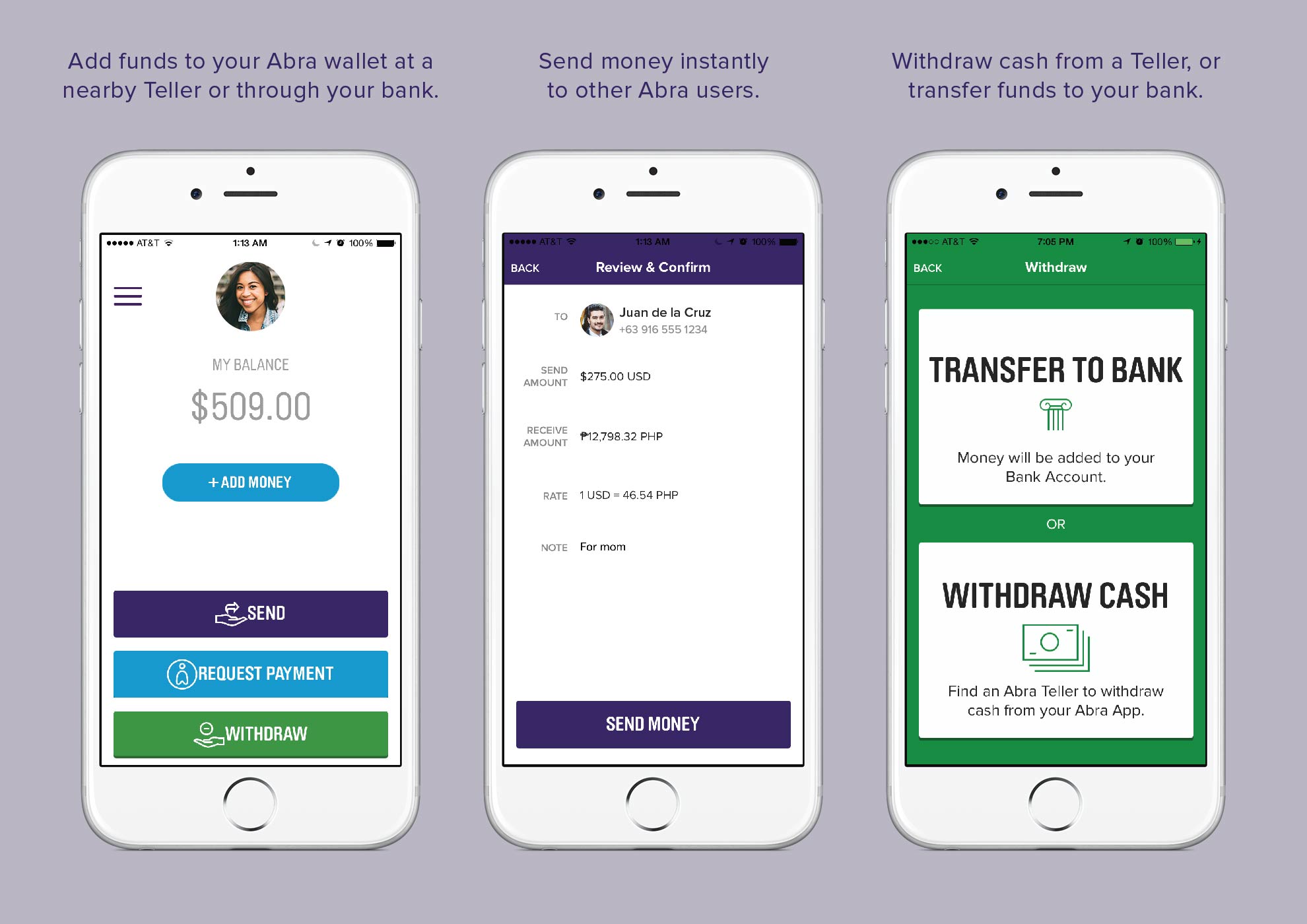

How does it work? Abra is a digital wallet that allows you to store digital cash on your smartphone.

Once your money is on your phone, you can send it instantly to anyone else with the app. For example, an Abra user in the US can add digital cash directly to the Abra app using any major bank account. The US user can then send digital cash to any user in the US or the Philippines simply by typing in the recipient’s phone number. Recipients in both the US and the Philippines can withdraw their digital cash to their bank account: recipients in the Philippines can also withdraw their digital cash for physical cash at an Abra Teller in their neighborhood. And it’s just as easy to send money from the Philippines to the US, even if the sender doesn’t have a bank account.

Our vision at Abra is to make it possible for the first time to send money across any two smartphones regardless of location, currency, or mobile phone operator, just like WhatsApp does for messaging. Why does the world need this? Cross border remittances now top $500 billion per year generating over $25 billion in fees. Most of that flows from the developed world to the developing world, but there’s still a significant amount being transferred in the “reverse” direction, as well as within “minor” corridors, which have traditionally been ignored (or exploited) by existing payments and remittance players. For example, parents send close to $100 billion per year to their children studying and traveling abroad. The e-commerce opportunity is even bigger: Analysts expect cross-border e-commece to top $1 Trillion by 2020 even though most consumers don’t have a bank account or credit card.

We believe that Abra is uniquely qualified solve these problems. To realize our vision of a free peer-to-peer money transfer network, we’ve been building a global ecosystem for person to person payments that works on any smartphone in any country in the world. While traditional remittance providers look at the world in terms of “corridors,” we see the world as one big connected global network. Our blockchain based platform helps us realize that vision.

Over the coming months, Abra will launch in several additional countries beyond the US and the Philippines. Our goal in this first phase of launching Abra is to get as many “largely banked” countries online as quickly as possible. These banked consumers will later have the option of becoming Abra Tellers when we enable that option in their country. We’ve already had pre-registrations for Abra Tellers in over 75 countries – and we haven’t yet spent a dime on marketing.

In addition to supporting “banked” consumers, we’ve ramped up our ability to support cash consumers via our Abra Teller model. The Abra Teller acts like a “human ATM,” helping consumers get digital cash on and off their phone in exchange for a small fee. Abra has begun the process of deploying our retail teller network, starting with the Philippines. We have thousands of locations under contract and the broad deployment of these locations is underway.

Ultimately, our goal is to enable Abra across every country in the world so that consumers can simply send money between any two phone numbers, regardless of location, telco, or currency. We’re excited to take yet another major step towards realizing this goal.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Tim

2751 days agoHello Abra team!

You guys are doing fantastic work! Are you guys considering offering this as a service? Something developers can build on top of?

-Tim

Liz

2747 days agoHi Tim!

We’re not a platform, if that’s what you’re asking. But we do have a couple of APIs. The merchant API, for example, which allows online and mobile merchants the ability to accept Abra as a form of payment (see https://www.codashop.com/ph/ for an example).

What sort of development would you be interested in?