Non-Fungible Tokens (NFTs) are everywhere. Touted as the newest thing in collecting and investing — content creators, celebrities, and artists are making millions from the sales of their own NFTs. According to a Bloomberg report, the total NFT market size topped $40 billion in 2021.

Some of the more notable collectors include Justin Bieber, Kevin Hart, Paris Hilton, and other celebrities who bought Bored Ape Yacht Club (BAYC) NFTs.

However, NFTs can have several different definitions depending on who you ask. Some people think of them as collectible art; others state they’re a smart contract, while others may be unsure of how they work.

This explainer will attempt to define NFTs and clarify how they work and how you can use them. After reading this, hopefully, you can explain NFTs to your friends.

NFTs are Digital Collectables

The closest physical analog to NFTs are collectibles — sports trading cards, “Magic: The Gathering” decks, vintage lunch boxes, film ephemera, or the painted and sculpted works of the masters. Collectors can grade these physical objects by their quality, real or designed scarcity, and unique traits.

NFTs combine the elements of uniqueness, scarcity, and authenticity. However — this is where NFTs differ from collectibles — they act as a digital record of ownership.

You can buy and own a unique digital artifact. But, blockchains prove the authenticity of NFTs and create a verifiable public record of ownership.

How Dollar Bills and NFTs are Fundamentally Different

Currency — the coins and paper bills that we touch — is fungible. Each coin or bill is essentially interchangeable, reasonably indistinguishable from another one of the same denomination. This means each unit has the same value as the next.

NFTs are different because each unit may have a different perceived value from the next. For example, one NFT in a series of 1,000 NFTs may be worth more or less depending on its uniqueness, quality of the specimen, and who owns it.

Abra’s CEO, Bill Barhydt, explains the difference between fungible and non-fungible tokens in the “NFTs on the Blockchain” episode of Money Talks. He compares NFTs to concert tickets, which helps simplify how we think about these new tokens. Listen to his explanation.

Just Pretty Digital Pictures of Cats or Monkeys?

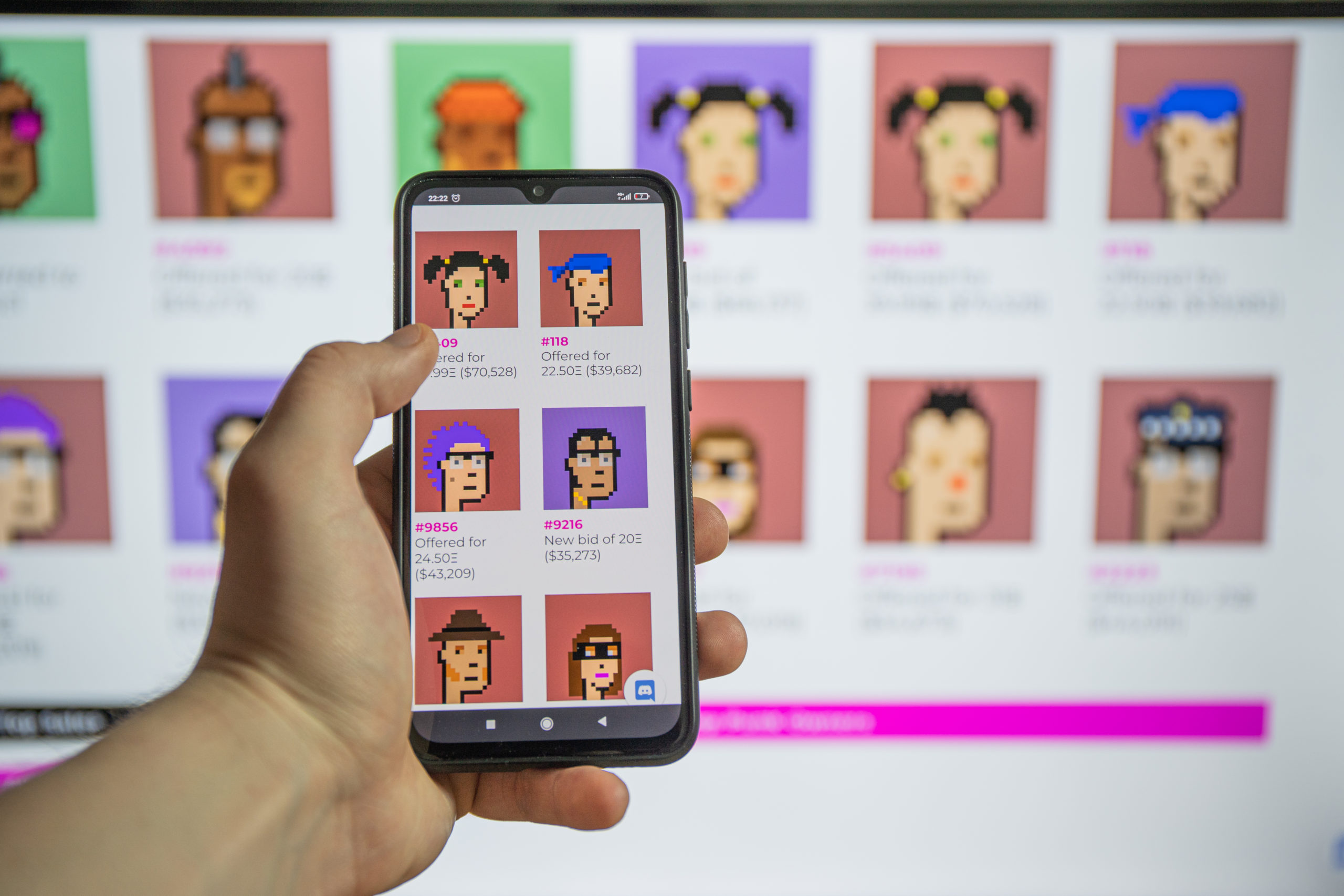

At first glance, it’d be easy to think that NFTs are just a collection of stylized cats or monkeys. CryptoKitties and the Bored Ape Yacht Club collectibles are certainly highly visible — the digital children of Beanie Babies — but they’re far more critical because they’re the first foray into the new world of decentralized finance (DeFi).

How Do NFTs Work and What Can You Do With It?

An NFT uses a smart contract — like the ERC-20 standard — to move its content, description, unique ID, and chain of ownership from buyer to seller.

As Ethereum defines it: “The ERC-20 standard introduces a standard for Fungible Tokens, in other words, they have a property that makes each Token be the same (in type and value) of another Token.”

The majority of non-fungible tokens use ERC-721 and ERC-1155 standards. This lets NFT creators issue digital assets through smart contracts on a blockchain, which creates a record of ownership for each NFT.

Once you own an NFT — especially if it’s artwork — you can display it. You can trade or hold it. Sites like Decentraland can provide a platform for you to buy or sell more NFTs.

Investing in NFTs to Build Your Art Collection

One aspect of investing in fine art is the pride of ownership that comes from having scarce artwork, either one-of-a-kind or part of a limited edition printing.

NFTs have the same characteristics and are seeing an investment boon. A notable early example was the sale of the very first tweet from Twitter co-founder Jack Dorsey.

The price appreciation of the future fine arts value of NFTs has added enthusiasm to the artistic, creative process, especially when combined with the star-studded celebrity aspect. Specialized knowledge of trends, artistic significance, and an eye to what’s next combine into an exciting fine arts experience.

Trading NFTs

Collection and investing go hand-in-hand when each NFT can be a true one-of-a-kind piece or part of a collection with thousands of similar pieces (collected by other fans, yielding even more buzz).

There’s a natural progression from evaluating and purchasing NFTs to trading them with others. The proof of ownership aspect of NFTs makes it easy to build a respected collection and showcase artistic and investment savvy.

Creating NFTs

As mentioned before, anyone can create NFTs using ERC-721 and ERC-1155 standards.

If this is something that interests you, visit sites like OpenSea, an NFT marketplace that lets you mint your own NFT. As an NFT creator, you have the option to set listed prices, host timed auctions, customize royalty fees for future re-sales of your original creation, and more. Your users buy and sell NFTs with fungible coins like ETH, BNB, SOL, etc.

Although OpenSea (based on Ethereum) is the most popular NFT marketplace, several other NFT marketplaces are poised to rival it in 2022 and beyond.

Conclusion

Now that we’ve covered the basics of NFTs, here’s a recap of what you learned.

- NFTs are digital collectibles that you can buy, sell, collect, and create.

- NFTs provide proof of authenticity, uniqueness, and ownership of digital items.

- NFTs live on blockchains and are a kind of decentralized finance (DeFi) smart contract.

- You can collect and create NFTs for fun and perhaps even profit.

Abra supports 75+ cryptocurrencies and counting.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.