Abra has created a simple product that provides a perfect solution for self-send money transfers. Whether you are moving money from USA to Philippines or from Philippines to USA, Abra has a brilliant solution.

Let’s say that you’re an overseas Filipino living or residing in the United States. It’s common that you have a need to send money back to the Philippines. Most remittance companies are set up for sending money to another person or a named beneficiary — like sending money to friend or family member. But, remittance companies often don’t allow you to send to your very own bank account. This is often called a “self-send” or “send to myself” in remittance jargon.

Alternatively, maybe you want to move money from your bank in the Philippines to your own bank account in the United States. Most remittance companies don’t move money from the Philippines to the United States. Abra is bi-directional, meaning that it’s just as easy to move money from Cebu to Chicago as it is the other way around.

Recognizing the market need for people to move money freely, we’ve re-framed the problem and come up with a great new solution. Since Abra isn’t a traditional remittance company, we don’t have a lot of the constraints that many other companies do. Instead, we create a digital wallet that allows you to freely move cash. It’s like holding cash in your traditional wallet with a big difference – it’s digital and fast.

With Abra, you are simply digitally moving money from your US Bank Account into your Abra wallet and then quickly withdrawing the money from your Abra Wallet to your Philippines Bank Account. Think about the old world ways where you might have taken some cash out of your leather wallet and then deposited into a bank account. Now fast forward with Abra. You are virtually doing the same thing with your very own Abra wallet.

For the free, simple and fast way to send money to your own bank account and in a bi-directional way, here’s how! Truly, it’s free, it’s fast, and it’s very cool!

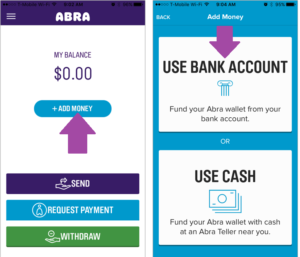

Step #1: Go to your Abra Wallet, Tap “Add Money”, Select “Use Bank Account”

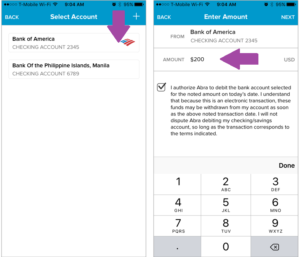

Step #2: Select your USA Bank Account, Enter the Amount you would like to deposit into your Abra Wallet

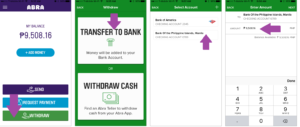

Step #3: Now, change your currency to PHP (don’t worry you can always change back to $-USD)

Step #4: Select “Withdraw”, Select you Filipino bank account, enter the amount. That’s it! Your money will move from your very own wallet to your bank in the Philippines.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app on Android or iOS to begin trading or earning interest on cryptocurrency today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Nor

1937 days agoI am new to this ..but I have few questions and pls help me unsderstand..how this works.

1. Can this transfer be done via bank to bank ( from my phil dollar account to my US dollar acct) assuming both banks are affiliated with abra?

2. How much would it cost for say 2,000 dollars transfer. And how long will it take for the transfer.( we’re talking about the money is in and ready for withdrawal )

3. Aside from my bank accounts what other documents are needed for this transaction/ transfer.

I would need a list of us banks and Phil banks affiliated with you.

Thanks for your help

Daniel McGlynn

1934 days agoNor,

Your best bet is to email [email protected]. They’ll be able to answer your questions more specifically.