Latest happenings in crypto this week:

-

- Michael Arrington on The Pomp Podcast (Pomp Podcast)

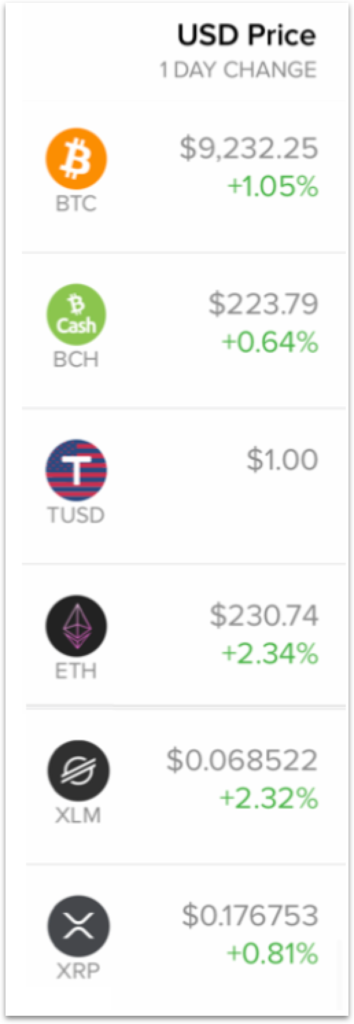

Market data summary via Abra App as of 5:00PM PT July 1

This week on Money Talks, Friday at 9AM PDT (noon EDT)

Our next Money Talks AMA will air live on Friday at 9AM PDT on our YouTube channel at https://youtu.be/AYRGtUZS8wQ. I’ll be going deeper on topics covered in this blog as well as answering Abra community questions on any topic. You can submit topics or questions for the team in real time in the chat stream or in advance to [email protected]. See you all on Friday!

Latest on Bitcoin

Bitcoin has traded sideways for quite a while. As you can see it’s touched the $9,300 price point almost every single day since April 30th. That’s incredibly low volatility by Bitcoin standards.

Technical analysis says that Bitcoin is gearing up for a major move. This is called a consolidation phase. Generally, these consolidations are either continuation patterns or show failed attempts to break through resistance. The typical analogy is winding up a rubber band in place and then letting it go. The more you wind it up the crazier the action you get when you let it go. This rubber band can’t be wound too much tighter. It looks like the consolidation may be set up to let go and blast off in the August time frame. So if we do get a big bull run I expect to start in September/October and then skyrocket in 2021.

As I’ve said before, I believe now is the time to put 5% of your savings in Bitcoin and dollar average in for the next 6 months given these potential S&P 500 induced price swings (i.e. Bitcoin at $3,000 before $300,000 is always possible.) As a reminder I don’t give investment advice, I give personal opinions. Please do your own research and make an informed decision commensurate with your risk tolerance.

DeFi – What Gives?

DeFi and Decentralized Exchanges (DEXs) are all the rage right now. I define Decentralized Finance (DeFi) as financial services that have no central off switch. Bittorrent is to DeFi as Napster was to CeFi (centralized.) Napster could ultimately be shut down, Bittorent can’t be. We haven’t yet achieved true DeFi as every project that I’m aware of in the DeFi space could be terminated by an angry regulator. Pricing oracles, which provide information such as the value of real world assets inside of a smart contract, are a major chokepoint of the DeFi idea that has yet to be addressed. They can be shut down at any time. Synthetix is such an example. They simulate traditional CFD’s (Contract For Difference) on the Ethereum network in what is claimed to be a DeFi model but without these centralized pricing feeds there is no smart contract. Dai and Compound are also examples of DeFi projects that aren’t yet decentralized. I believe we will see sufficiently decentralized pricing oracles soon. Then the regulators will have a major problem on their hands if they want to regulate these services. Hopefully, they will realize that they can not.

Compound, the latest darling of the DeFi movement has been on a particular tear of late. According to Decrypt, “Compound is a company that allows people to earn money on the crypto they save. The project is part of Ethereum and more broadly, DeFi. Users can also borrow crypto from Compound by putting up collateral above a threshold defined by the project.” Again, how can Compound be DeFi if Compound is a company? Companies can be shut down. The answer (again) is that it isn’t truly DeFi yet. Time will tell if these interesting first steps truly get us to a DeFi world. I think they will and I’m very bullish on the concept. Ben Forman of Parafi Capital put it succinctly in a recent online comment: “Compound sparked the beginning of a new agricultural revolution where so-called yield farmers are siphoning volume through [automated market makers] instead of centralized exchanges. This isn’t ideological behavior – it’s the same CeFi users now shifting to DeFi because it’s more efficient and profit-maximizing,”

Here is a presentation I did at MIT talking about synthetic assets that were used in an earlier version of the Abra system (they are no longer in active use). Not dissimilar to some of the other DeFi concepts that are out there.

I’ll definitely have more to say about this in the future.

Cardano – Staking is where it’s at.

Staking, or in some cases the future promise of staking, is proving a very lucrative market for traders this year. ADA is up over 120% this year, Ethereum, soon to see its own upgrade to proof of stake, is up 80%, Tezos (XTZ), also a staking token, is up 93% this year.

Gold – On the Move (what about Bitcoin?)

Gold is close to $1,800 per oz. spot price not seen since 2011. This comes after Goldman Sachs upgraded its pricing forecast for the metal. A sustained close above $1,800 is likely to put gold on target for a chance of hitting an all time high of over $2,000 this year.

As I said last week, I see Bitcoin becoming a true digital gold to commodities investors and fully expect that Bitcoin and gold will become price correlated with Bitcoin being the more volatile of the two for the next three to five years. Bitcoin is not yet seen as digital gold by institutional investors. That will change. I’ve presented to myriad hedge funds, family offices and other investors the past 90 days (yeah i’m a Zoom’er) and it’s clear that there is still much basic educational work to be done. The early movers that get this are going to win big.

Tweet of the Week

This week you get two!

1/ HOW TO UNDERSTAND WHAT’S GOING ON IN FINANCIAL MKTS. Western world built up a debt bubble of stunning proportions over past ~50yrs. It’s deflating now, just as it tried to do in 2008, 2001, 1997, 1994, 1987, 1981 & 1974. Each time, tho, there was enuf balance sheet capacity…

— Caitlin Long 🔑 (@CaitlinLong_) March 14, 2020

Revisiting a great tweet storm, from Caitlin Long, CEO of Avanti Bank (yes a bank.) Tweet storm is from mid March but is still prescient and relevant now as we enter phase 2 of the pandemic. If you want to understand how the Federal Reserve Bank of the US really thinks then understand this.

In Plan B’s latest tweet he makes the case that Bitcoin and the S&P are correlated (at least for the time being), something I’ve also written about in this newsletter. You should definitely follow Plan B on Twitter and keep in mind that all models are wrong, some are just more useful than others. Correlated doesn’t imply 1 to 1 correlated. In fact, here it implies that a 2x movement in the S&P correlates to a 400x movement in Bitcoin. So while they are correlated the return potential of Bitcoin is clearly asymmetrical.

So we know #bitcoin and S&P500 are correlated and cointegrated. Chart shows both BTC and S&P. Last 3 dips in BTC and S&P (yellow) were caused by anti-China measures, FED taper tantrum, corona virus. Important lesson from this is IMO: BTC futures or whales did NOT play a big role. pic.twitter.com/xfcZnSdZxh

— PlanB 🔴 (@100trillionUSD) June 23, 2020

Lastly, we have some big news coming up for Abra very soon. Now is a great time to install Abra and get ready to take advantage of what’s coming. See you Friday on the next Money Talks!

Peace and Love,

Bill

Disclaimer:

Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary, and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.