Today’s Topics:

- Abra raises interest rates on Bitcoin and Ethereum

- Good Crypto Banks, Bad Crypto Banks

- Why Bitcoin and Altcoins will Co-exist

- DeFi Update

- Tweet of the Week

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

On this week’s episode of Money Talks: We’ll provide an update on the crypto markets and give more details on the Abra Interest Account product. Don’t forget to leave us a comment on Twitter to tell us what you’d like us to talk about. As always, we answer all your burning Abra questions!

Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT: https://www.youtube.com/watch?v=vSc4L8rNttY

Abra Raises Interest Rates on Bitcoin and Ethereum (Again!)

We’re pleased to announce that we just raised interest rates (again!) for Bitcoin and Ethereum to 4.5% while keeping the US Dollar rate steady at 10%. As always the dollar rate includes all supported stablecoins.

As a reminder funds can be deposited via bank wire, ACH (US), cash at retail (where supported), transferred via external crypto wallets or transferred from an existing Abra trading balance.

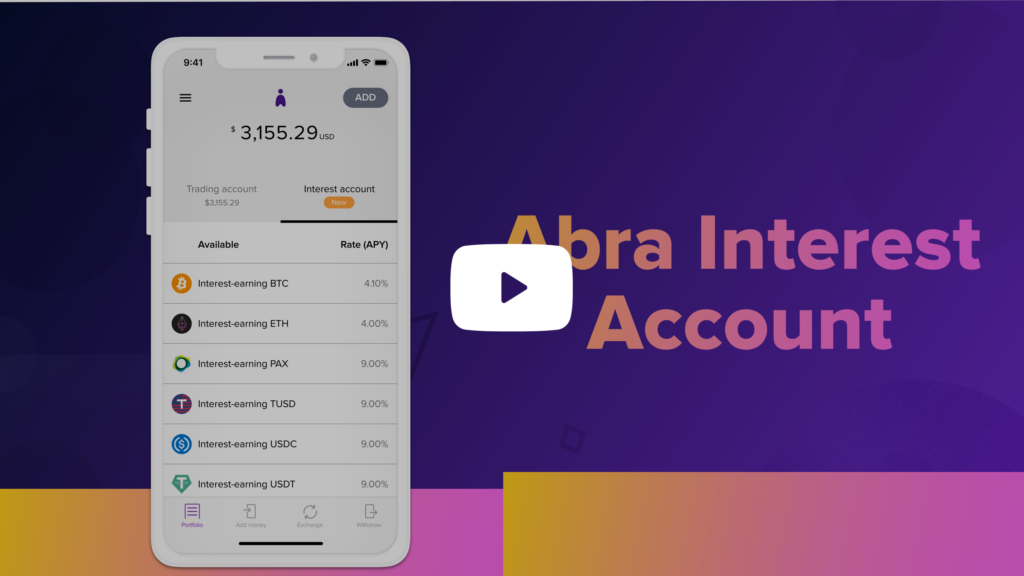

Here’s a video showing how it works:

Good Crypto Banks, Bad Crypto Banks

For as long as Bitcoin has existed many banks have blocked their users’ ability to directly transact in cryptocurrency by not allowing customers to send money to exchanges or services like Abra. Other banks have acknowledged that customers are perfectly within their rights to purchase crypto. It’s ridiculous that we’re still having this discussion in 2020 but we are.

Just this past week an Abra investor, Brad Stephens of Blockchain Capital, was doing a large bank wire into his Abra app to generate 10% interest on his USD when he was subsequently informed that his UBS bank account was being investigated for transacting with a crypto company. Brad then informed Abra that because UBS is investigating his account he’ll be closing his UBS account and transferring even more money into Abra.

My advice to all of you who support crypto is to close your accounts at crypto unfriendly banks immediately. That is what I have done.

It’s time to start calling out these bad actors for their behavior. According to Moon Banking, a website that tracks the crypto friendliness of US banks, the worst actors are Chase, UBS, Capital One, Wells Fargo, Citi, Deutsche Bank, and Fifth Third. This bad actor designation doesn’t mean that these banks block all crypto transactions but they do block some. Most block credit cards but support debit card transactions. Some will close your account for doing a large bank wire to a crypto company. If you support crypto as the future of banking as I do then that is enough to warrant moving to a different bank. But where?

Fortunately, there are a few crypto friendly good actors as well. Moon Banking also highlights these good actors in their research and they include Ally, Bank of the West, Fidelity, BBVA Compass, Schwab, USAA, Simple, Navy FCU, A+ FCU. Unfortunately, banks are constantly changing their policies in both directions so stay diligent and be willing to move when banks show they aren’t friendly to our cause.

Ultimately what we need are crypto centric banks. In the United States, Wyoming has been leading the charge in creating a crypto friendly banking environment where pure crypto banks can flourish. This is all new and none of these crypto banks are fully live yet but it appears that at least two will be live in 2021. I will definitely be supporting them.

Why Bitcoin and Altcoins will co-exist

If you’re interested in investing in or supporting other crypto projects besides Bitcoin it’s inevitable that you feel attacked by a Bitcoin maximalist. A Bitcoin maximalist is a Bitcoin supporter who believes that Bitcoin is the only real cryptocurrency and that there is no point for other cryptocurrencies to exist. Altcoin supporters believe that there are more opportunities to solve problems via blockchain and crypto than simply the digital gold use case. Let’s look at the argument from both sides.

Maximalists believe that Bitcoin is the only proven use case for a decentralized cryptocurrency. The use case of Bitcoin as digital gold, or store of value is what drives them. They generally believe that Bitcoin will ultimately be the only winner and that all other cryptocurrencies will die. They feel a moral obligation to make this point clear. Perhaps most importantly, they believe that we have evolved past Satoshi’s original whitepaper and vision such that p2p money transfer via Bitcoin is not possible at scale and that the core developer community are the purveyors of this technical truth and wisdom.

Altcoin supporters basically believe that Bitcoin is winning and will win as the best software for enabling digital gold or a better store of value, but that there are many other important use cases that need addressing. These use cases include private money transfer, digital dollars, i.e. stablecoins, smart contracts for financial services, i.e. DeFi, digital collectibles, i.e. NFTs (or Non Fungible Tokens,) rewards program tokens, and many others. There are also forks of Bitcoin that have integrated different technologies or simply changed the settings in Bitcoin to have different block sizes. Ethereum, Litecoin, XRP/Ripple, and Bitcoin Cash are all examples of software that address these use cases and have flourished with millions of users over the years.

Ultimately no one knows what will happen but I would be shocked if we didn’t evolve to an ecosystem in crypto where dozens of cryptocurrencies co-existed to solve all sorts of different problems. Bitcoin will likely remain the stable king and best example of decentralization and that is great. Other projects will address different needs and take technology risks that Bitcoin can’t.

DeFi Update

As I said last week, ultimately DeFi may win but I believe that in the next 3 years, at least, CeFi services like Abra will continue to rule. There are simply too many things that can and will go wrong with DeFi at any kind of scale.

The rage in DeFi investing in August has cooled dramatically in September with the DeFi token space down about 40% in September as a whole according to the DeFi index tracked by FTX. The big story is of course UNI, the native token of UniSwap which, after hitting a record high of $8.40 last Friday, hit a low of $3.44 Tuesday morning and has since rebounded in the past 24 hours to a price of $4.80. Still way off its highs. However, the native tokens for both yEarn and Band, two alternative DeFi protocols, have surged 7% in the past 24 hours, according to CoinGecko data.

We continue to believe that the smart money in crypto will be in CeFi for the next few years. Abra’s team of experts spends long hours hunting for high quality yield generating opportunities. No DeFi system will be able to reliably do that and not end up generating a high percentage of losing scams. Eventually, that may change but not now.

For now, the smart money will stay with Abra!

Tweet of the Week

This statement is pure bullshit. I’m happy to debate anyone who disagrees. (And I still love Jimmy and his work.) https://t.co/WYuCYNXQ0a

— Bill Barhydt (@billbarhydt) September 23, 2020

The tweet of the week really belongs to Jimmy Song but I just couldn’t let his tweet go unanswered. Where’s the fun in that? We love Jimmy and the work he has done evangelizing Bitcoin. You should buy his books! We simply disagree that there will only be one winner and are happy to debate this point until a winner emerges in the coming years. In the meantime, the debate continues!

See you all tomorrow (Friday) on the next Money Talks. The Revolution has begun!

Don’t forget to follow us on Youtube, Twitter, and Facebook to stay updated with the latest from the crypto world.

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.