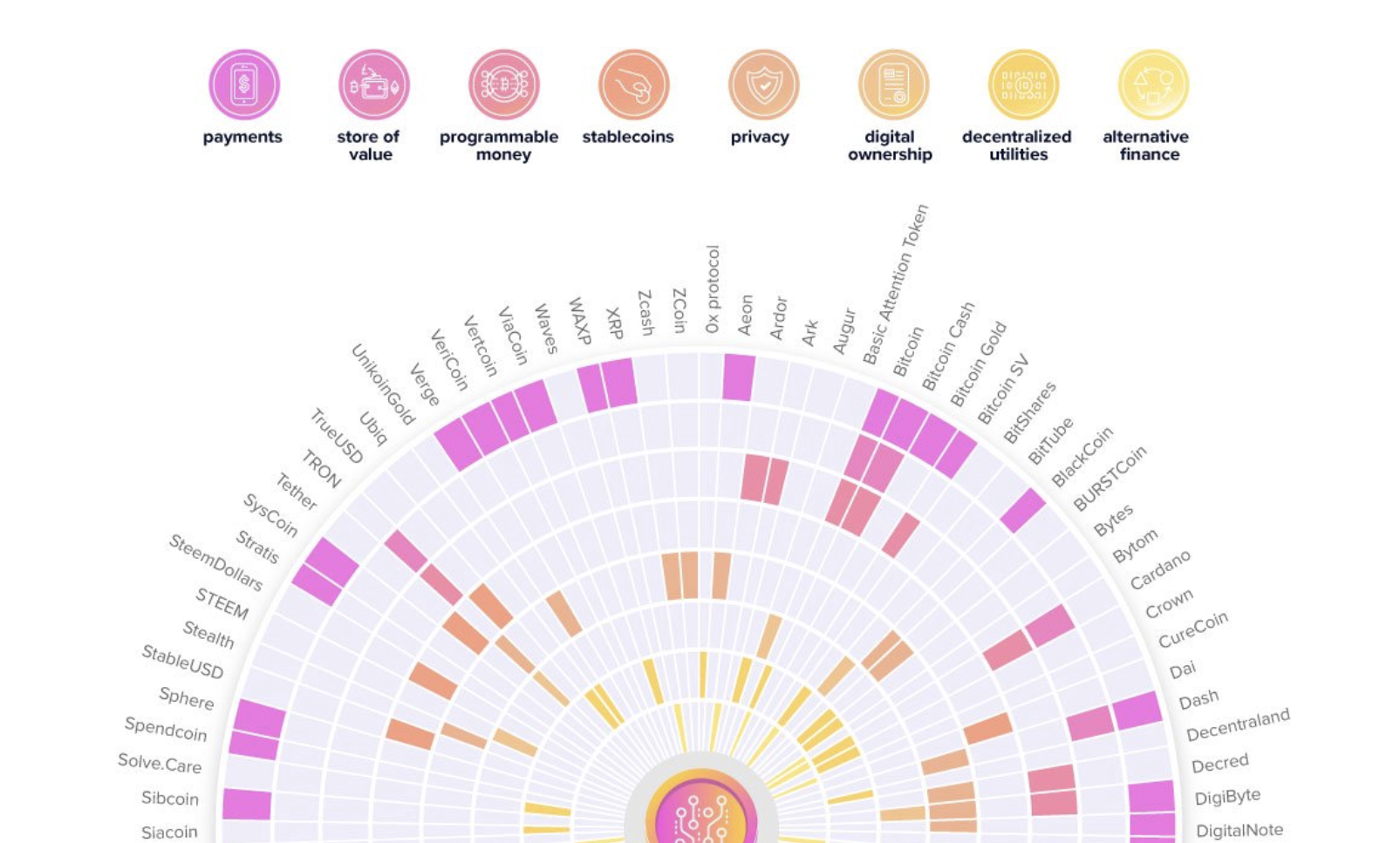

Following our big news that Abra users around the world will now have unprecedented access to invest in the cryptocurrency economy, we partnered with Visual Capitalist again to create an infographic and new taxonomy to help investors make sense of the emerging crypto use cases.

Bitcoin was first created by Satoshi Nakamoto so that people could use the internet to safely and privately exchange value with others without the need for a centralized third-party or intermediary.

Today, ten years later, the economy inspired by Bitcoin is still growing — and using the foundations of decentralization, peer-to-peer, and open-source as a means to solve some of the problems of interacting and transacting on the internet.

Below is a list of problems that cryptocurrencies are trying to address and a visualization of a new taxonomy that shows which projects are working to solve these use cases:

Payments

Many cryptocurrency projects are creating new forms of internet-native payment systems that will be faster and more efficient than traditional payment systems, especially for sending large sums of money, micro-payments, or cross-border payments.

Store of value

Another use case for some cryptocurrencies is as a digital store of value, which means people can more easily store, transfer, and exchange value over the internet.

Programmable money

Some protocol-level cryptocurrencies can be considered programmable money, which means that computer code contracts can be written and executed to perform a number of financial functions.

Privacy

Some cryptocurrencies are created with privacy in mind. They are designed to protect the details and integrity of financial transactions, with the goal of increasing freedom in the digital age.

Digital ownership

The monetization structure of the current internet makes it difficult for content producers to maintain control over their original work, or to make money from their content without selling advertisements. New cryptocurrency-based schemes are aiming to change that, and in the process make it easier for content creators and consumers to transact without advertisers getting involved.

Decentralized utilities

Decentralized utilities and applications are using cryptocurrency technology to build new kinds of products and services that will allow people to interact without having to go through a centralized institution such as a bank or payment provider. Decentralized apps are being developed for all kinds of things from finance and communication to gaming and gambling.

Alternative finance

One of the major use cases for cryptocurrencies is as alternative financial models that will open up access to credit and banking products and services around the world. Leveraging internet-scale and lower costs, alternative finance will be more customizable and easy-to-use.

Stablecoins

Stablecoins — or cryptocurrencies that have values that are pegged to other assets such as the US dollar or other currencies — are designed to provide the features of cryptocurrencies with the steady value of traditional assets. Stablecoins are often viewed as easy on-ramps and off-ramps between the digital and physical worlds.

Check out the full graphic

Here’s the full “Visualizing the new cryptocurrency ecosystem” from the Visual Capitalist.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Allen Hena

1607 days agoThis is such a inaccurate categorization of the cryptocurrencies listed. Why is ETH and ADA not a store of value? Or any crypto for that matter? Why can’t all of them be used for payments? All of them can be effectively used as programmable money. Why do only a few have it? This sort of labeling based off personal bias is absolutely toxic to the digital asset and cryptocurrency space. I am surprised Abra actually put this out. Yea it looks nice but the content is bad and misleading. I have a fairly distributed amount of many of these(e.g. BTC, ETH, BCH, etc), my comments have nothing to do with my bags.

Daniel McGlynn

1605 days agoAllen,

Thanks for your comment. Addressing your specific critiques: In terms of the store of value, we used overall supply and general market cap positioning as a metric. The thinking was that an asset with an infinite supply can not be a store of value as traditionally defined, and an asset with low liquidity is also not suitable as a store of value. Not all cryptocurrencies are designed for payments as their primary use case. And not all of them are base-level protocols (which is how are defining programmable money for the purposes of this graphic).