This post has been updated in December 2021.

In this post, we’ll look at how buying Bitcoin with a supported bank account works, and the steps you need to take to start #StackingSats.

One of the biggest things to understand is that you can use the Abra app to send, receive, and HODL Bitcoin all right in the app. (On a related note, check out this post on crypto-cost averaging.)

Several ways to buy Bitcoin with a bank account

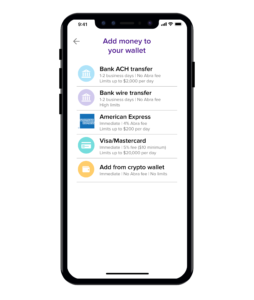

The Abra wallet supports several ways to buy Bitcoin in-app:

- Bank account ACH transfers

- Bank wire transfers

- By using a credit card

Bank account (ACH) transfers are available in the US and the Philippines; SEPA bank transfers are available in Europe.

We’ll cover how to buy Bitcoin with your bank account via ACH transfer. If you are interested in investing in other supported cryptocurrency assets via Abra, follow these instructions.

Buying Bitcoin with bank account (ACH) transfers

As mentioned above, bank account transfers are available in the US and the Philippines. In the US, Abra works with the fintech company Plaid to make thousands of banks and credit unions available to connect via the Abra app.

STEP 1: Add money to your Abra wallet from your bank account

If the bank transfer option is available, and you want to initiate a bank transfer, select the “Bank ACH transfer” button and then select your bank account.

Note: The sequence of steps is different for the Philippines, so please follow the in-app instructions.

ACH transfers are subject to a transaction limit; for higher amounts, check out the Abra wire program.

It usually takes one to two business days for your funds to become available after the bank deposit is initiated. You will receive a notification from Abra once the funds are in the app and ready to use to purchase Bitcoin. (Make sure you have push notifications enabled on your phone.)

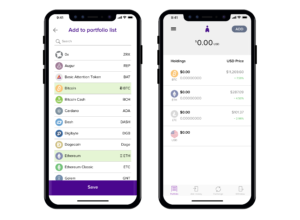

STEP 2: Adding Bitcoin to your portfolio

To check that Bitcoin is part of your portfolio, look at the list on your home screen. If it’s not on that list, tap the “Manage Assets” menu from the upper right corner of the app. Then select Bitcoin from the crypto asset menu. Once selected, Bitcoin will be added to your portfolio. You will also see the other available assets from this screen.

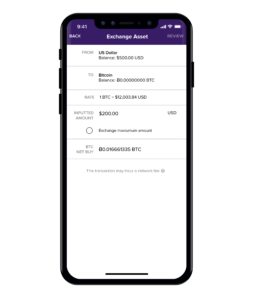

STEP 3: Converting assets to Bitcoin

Navigate back to portfolio screen by hitting the back button. Then hit the “Exchange” button in the bottom part of the app.

Navigate back to portfolio screen by hitting the back button. Then hit the “Exchange” button in the bottom part of the app.

Next, input the amount you want to transfer. In this example, we’re converting the entire USD wallet balance into the Bitcoin wallet, so we would select the “convert maximum available balance” button.

You will then be asked to confirm the transaction, so make sure everything is correct. Once you confirm, your transaction will process, and you’ll get your Bitcoin.

Success! You have just completed a purchase of Bitcoin with your Abra wallet.

(Note that all Bitcoin transactions are subject to a blockchain confirmation time, which ranges from 10 minutes to several hours, depending on network congestion. Until the transaction is confirmed, you will not be able to move your Bitcoin from Abra to an external Bitcoin wallet. That is why your “available balance” might differ from your wallet balance for a short period of time.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app on Android or iOS to begin trading or earning interest on cryptocurrency today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

katherine

1711 days agoThanks for the article, this is very interesting information.