We recently published a paper about how adding small amounts of crypto to a traditional investment portfolio consisting of stocks and bonds can greatly help overall performance.

This is the second in of series of posts about the paper and its conclusions.

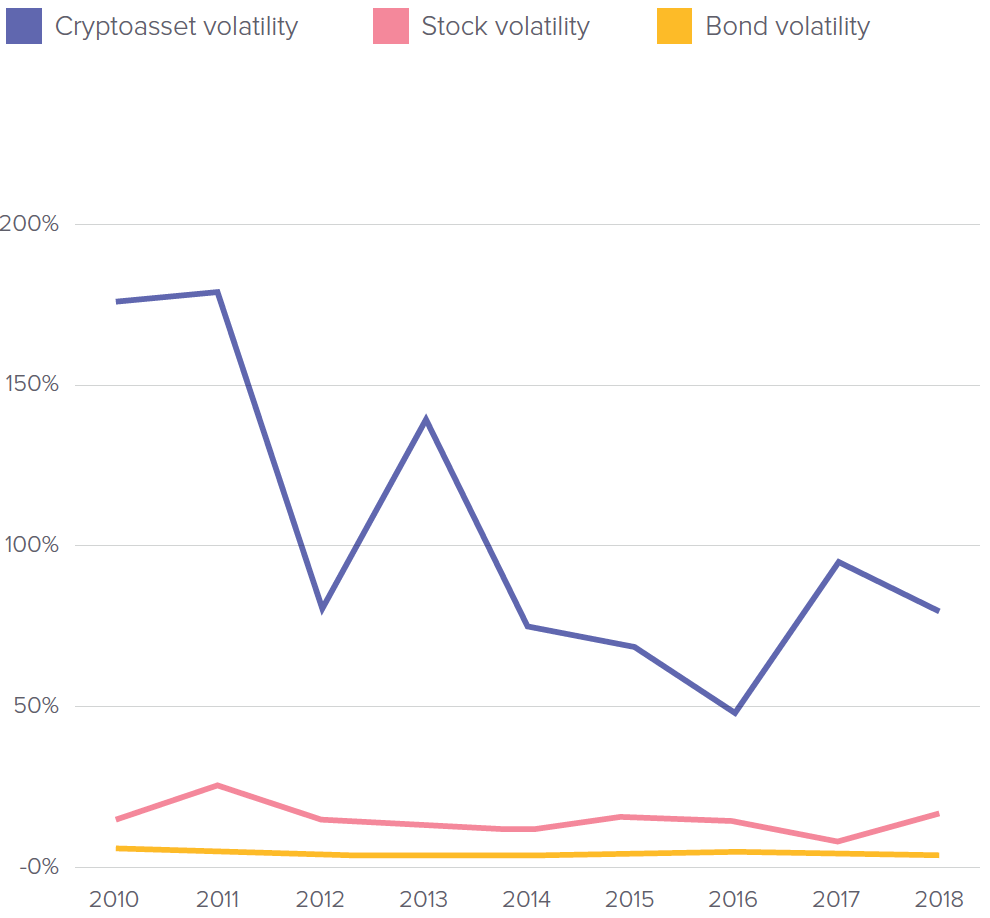

In the first post, we briefly outlined the biggest takeaway of the paper, which is that cryptocurrencies are a useful way to add the right kind of volatility to a portfolio. The paper shows, this strategy can lead to better overall returns.

Understanding investing portfolio dynamics and how crypto applies

If nothing else, the recent crypto market downturn offers a chance to learn more about smart investing and the mechanics of building a sound portfolio over time.

“The new frontier” paper looks at a few different useful concepts that are useful for making sound portfolio decisions.

Correlation

Correlation is one of the key fundamental investing principles to understand.

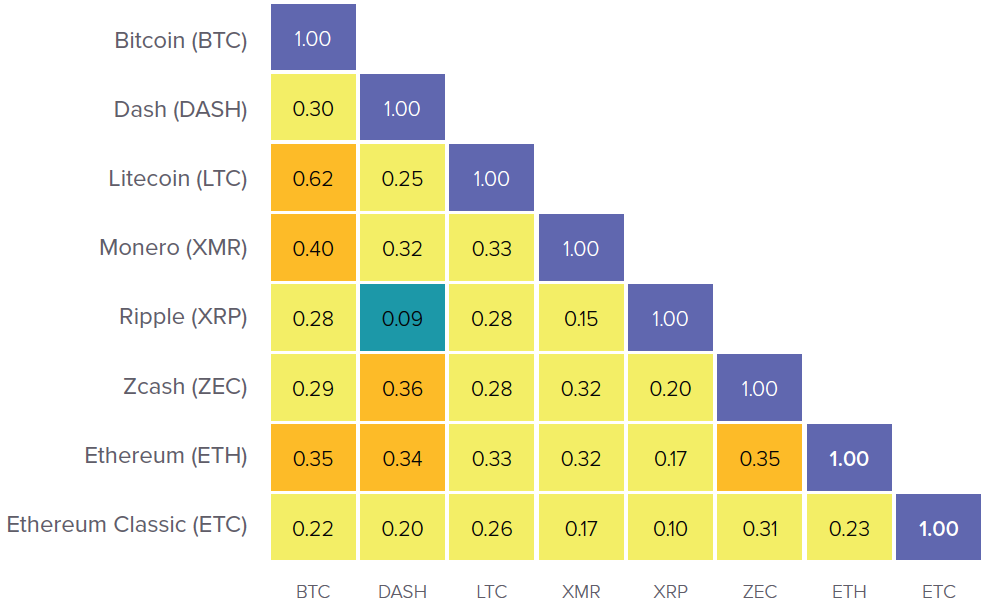

Crypto is an emerging asset class. So far, it is a correlated asset class, meaning that when the price of bitcoin goes up, generally, the price of other cryptos also goes up.

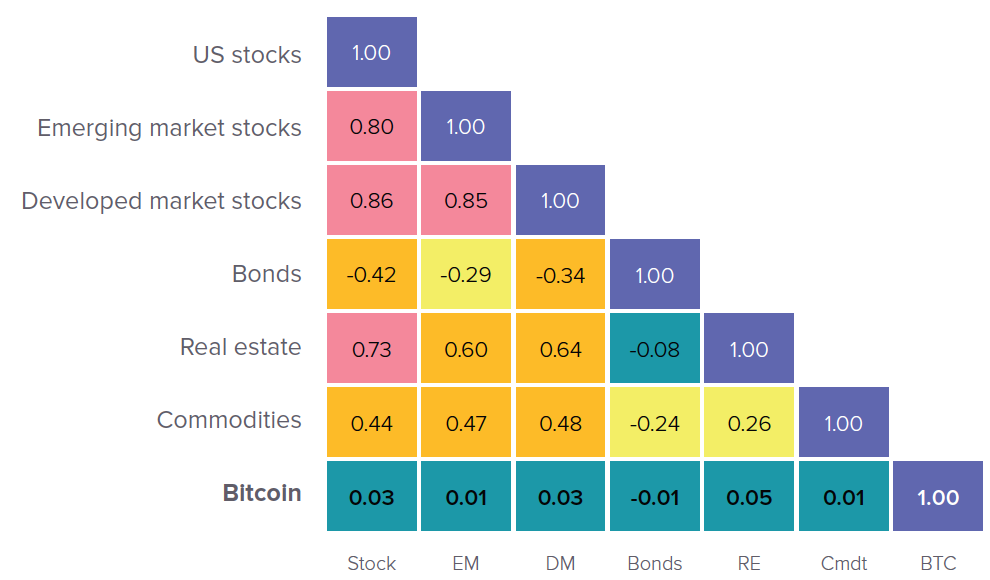

When the price of bitcoin goes down, so too does the price of other cryptoassets. But, crypto remains uncorrelated to other traditional assets, which makes it a useful portfolio ingredient. In other words, fluctuations in prices of other assets do not affect the price of cryptoassets.

Sharpe ratio

Another investing concept discussed in “The new frontier” paper is the Sharpe ratio concept.

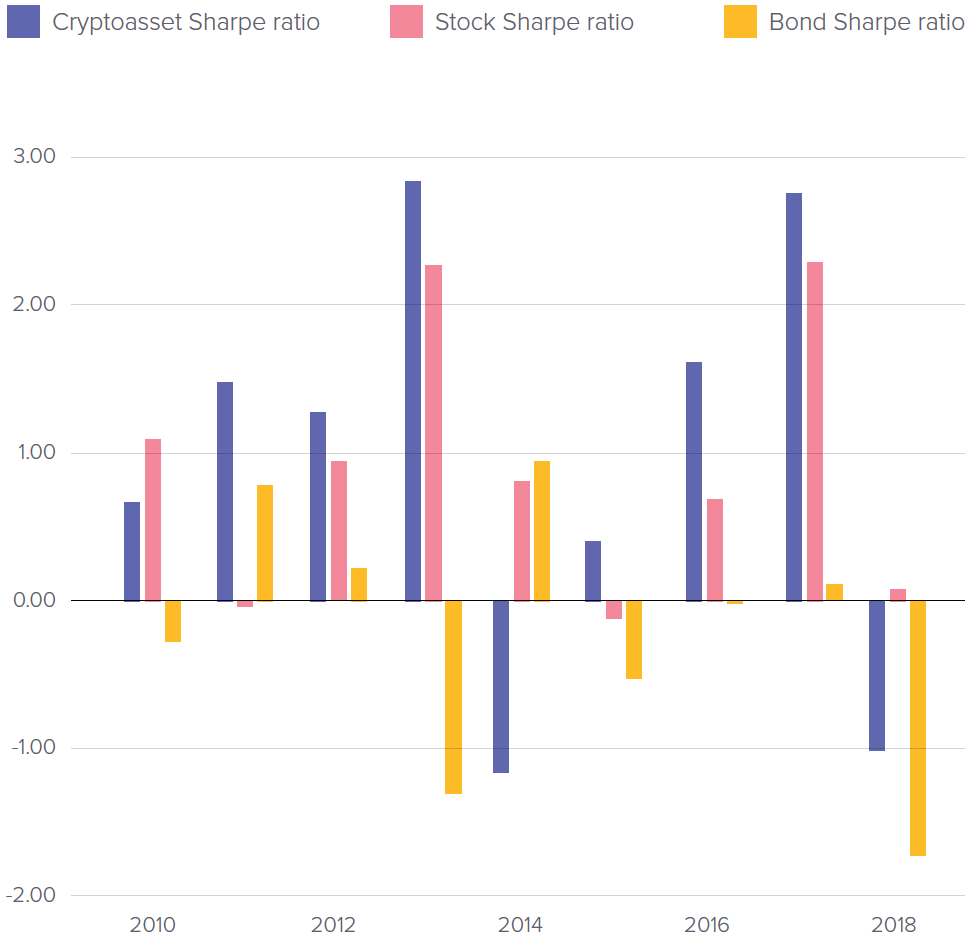

Not all investments perform the same. Some are risky but might offer high returns, others are might be less risky, but might have a low rate of return. The Sharpe ratio is a method of adjusting risk so that it’s easier to compare different kinds of assets to one another. Crypto generally have a higher Sharpe ratio when compared to stocks and bonds, which means they can provide an overall benefit to investment portfolios looking to take on risk in search of returns.

Efficient frontier

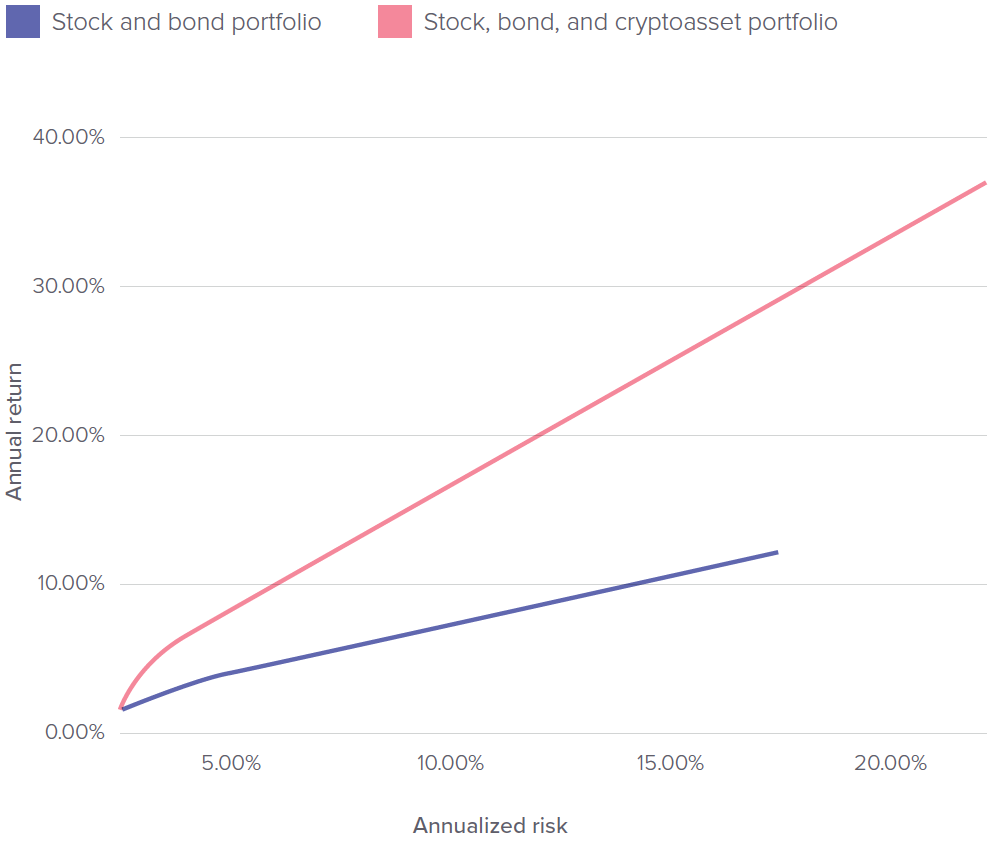

Efficient frontier: The efficient frontier is a concept used to examine how well the balance between risk and reward is working within a portfolio. The efficient frontier is a conceptual tool to compare the returns and volatility of different portfolios and is often visualized in a graph.

Key takeaways

Since cryptocurrencies are still a maturing asset class, they aren’t often thought of as having a place in a traditional investment portfolio. But, the research in “The new frontier” paper shows, that there is a potential benefit to adding cryptoassets as a way to diversify.

The paper goes into more depth about different investment risk scenarios and portfolio constraints.

As a reminder: Any content contained in this blog post is provided for informational purposes only and is not intended as financial or investment advice.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.