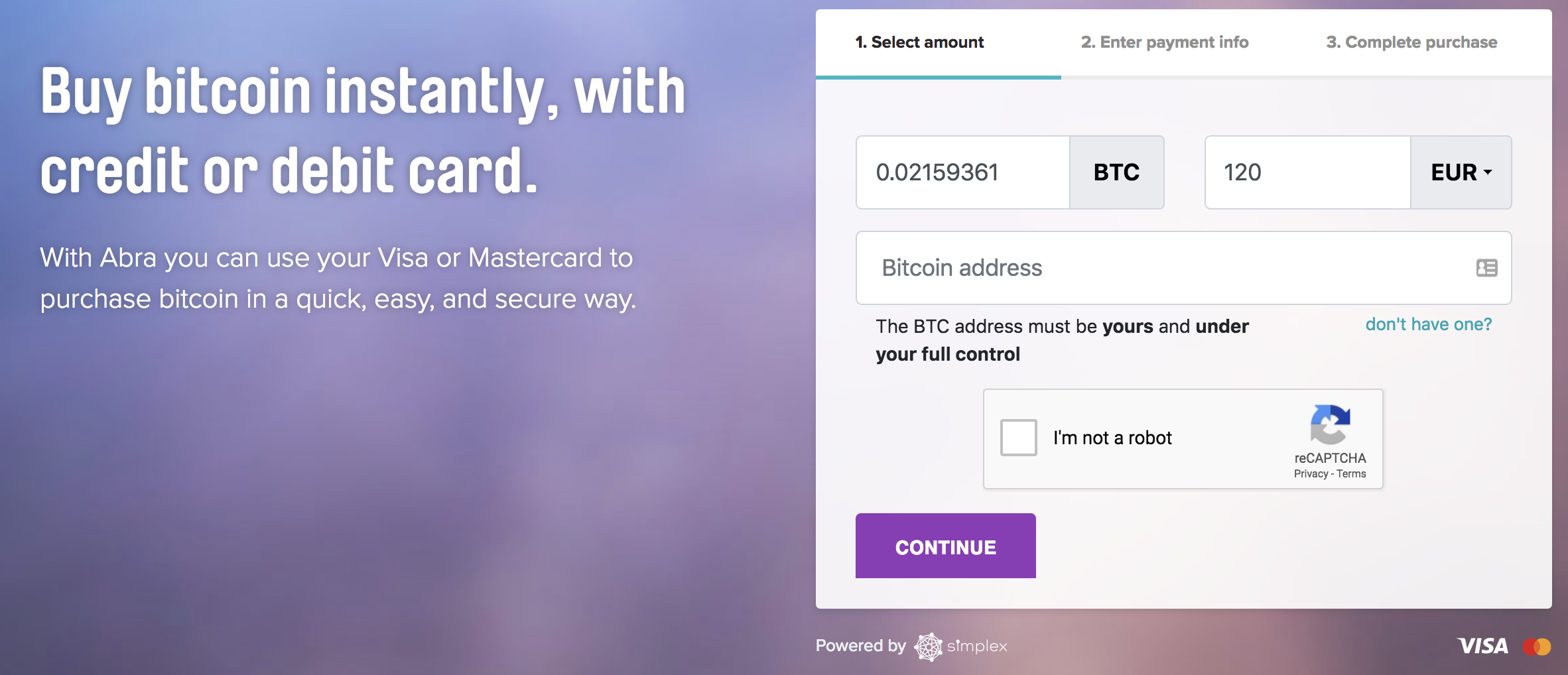

We are really excited to announce that now you can buy bitcoin with a VISA or MasterCard credit card or debit card from anywhere in the world at abra.com or via the Abra app.

That means buying bitcoin is super easy.

Up until now, Abra users have been able to fund their wallets using a lot of different methods, including bank and wire transfers, or by transferring bitcoin or litecoin purchased elsewhere. Additionally, users based in the US have been able to make bitcoin credit card purchases using American Express.

All of those options are still available, but now users will also be able to use a VISA or MasterCard credit or debit card to make bitcoin purchases too thanks to a new partnership with Simplex.

The upside of buying bitcoin with a credit card or debit card

Some of the advantages of the new credit/debit card set up are the buy limits, the time it takes, and the accessibility.

A few key features of buying bitcoin with a credit card or debit card through Abra:

- Bitcoin buys can range from $50 to $20,000 at a time.

- Buyers can direct their bitcoin buys to any supported wallet, or set up a new wallet with Abra, which enables investing access to 24 altcoins and 50 fiat currencies.

- The purchased bitcoin is usually available in 20 to 30 minutes, depending on blockchain processing times.

The actual purchase of bitcoin with a credit card is as easy as conducting any other kind of transaction on the internet. All you need to do is enter the amount of bitcoin you want to purchase, enter a bitcoin wallet address, enter your credit card or debit card information, and then confirm all the details.

And, with certain exceptions, this service is available across the globe.

Sign up for the newsletter:

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Denys

2032 days agoHi! I can’t fill registration form. Can’t find my country in the country list. I live in Ukraine

Daniel McGlynn

2032 days agoDenys,

Please reach out to our support team by emailing [email protected]. They will be able to help troubleshoot.