Today’s Topics:

- Earning Free Crypto with Abra

- Bitcoin Rubber Band is Winding Up. Get ready!!!

- Chinese Government Appears to Promote Crypto to Millions of TV Viewers

- The Long Arm of the US Law

- Tweet of the Week

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

Don’t forget to join us as we have a very special guest on Money Talks – Charlie Lee, Founder of Litecoin. We’ll provide an update on the crypto markets and give more details on the Abra Interest Account product. Don’t forget to leave us a comment on Twitter to tell us what you’d like us to talk about for a chance to win $200 in any cryptocurrency supported by Abra. As always, we answer all your burning Abra questions!

Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT: https://youtu.be/HZKS_zGgNUs

Earning Free Crypto with Abra

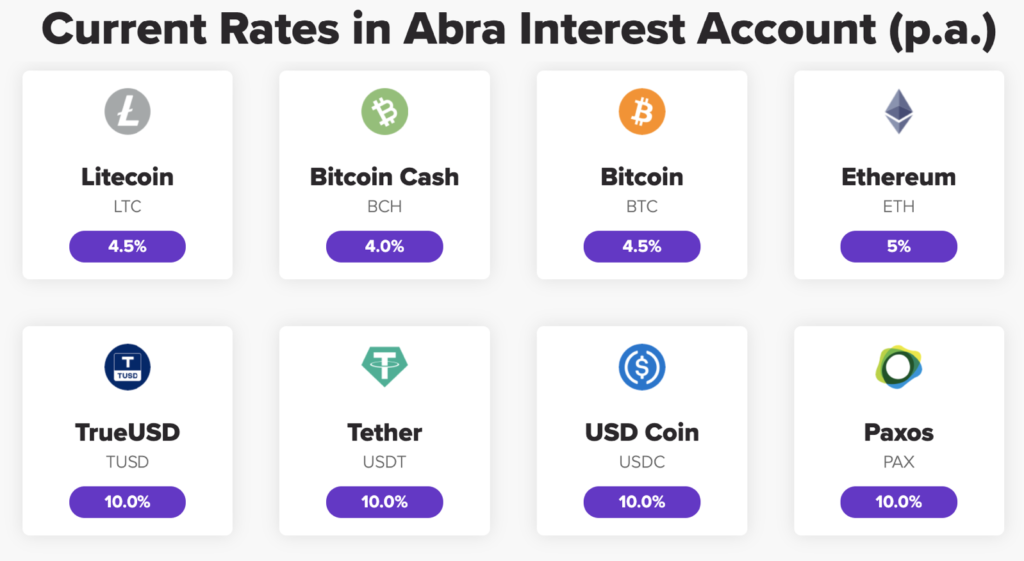

Abra’s Industry Leading Interest Rate Now Includes 8 Currencies

Abra now supports earning interest on USD, Bitcoin, Ethereum, and starting this week Litecoin and Bitcoin Cash. Our interest rates remain the highest in the space at 10% on USD and up to 5% on cryptocurrencies. Install the latest version of the app to start earning interest on your crypto and USD balances.

Bitcoin Rubber Band is Winding Up. Get ready!!!

This is one of the best setups I’ve ever seen for an asset price to move dramatically higher.

I’ve been so excited by this setup that I’ve personally decided to increase my personal exposure to Bitcoin and I’ve written a couple of tweetstorms on this topic. So many factors are in Bitcoin’s favor right now:

- Bitcoin has now been above $10k for 10 straight weeks, shrugging off Trump’s hospitalization, the BitMEX lawsuits, and even the UK news of derivatives being banned.

- Bitcoin has been less volatile than many stocks this year while its price has appreciated over 25% in 2020 with current volatility at historic lows.

- Looking at the technical analysis, the long-term price chart is showing a super bullish descending triangle (continuation) pattern off the Jan 2018 highs.

- Tether, the most used USD stablecoin is now worth $15 billion, $5 billion more than a few weeks ago. USD inflows into Tether have invariably found their way into Bitcoin in short order.

- Recently, Chinese state-owned media outlets have made coordinated reports describing cryptocurrencies, i.e. Bitcoin and Ethereum, as the year’s top performing investments.

- As a hard asset with stock to flow that will approach infinity, Bitcoin is the perfect hedge against inflation which the government is now trying to dramatically increase.

Bitcoin 30-day historic volatility

Bitcoin bull Raoul Pal just pointed out that Bitcoin’s 30-day historical volatility is currently in the 20’s. Six of the past seven times it hit 20% the price exploded higher almost immediately, and volatility hit 80% in a few months. I agree with Pal that a BIG move is coming before the end of the year.

…The rest of this week’s newsletter is about the intersection of crypto and government. Governments are clearly getting bolder when it comes to injecting themselves into consumer crypto transactions….

Chinese Government Appears to Promote Crypto to Millions of TV Viewers

China dominates cryptocurrency mining. The Chinese government is highly incentivized for crypto to succeed on many levels.

According to Coindesk, A branch of Chinese state television that has hundreds of millions of viewers recently did a segment on cryptocurrencies in which it discussed Ethereum, Bitcoin, and DeFi, amongst other topics. The segment purportedly covered how digital assets are the best-performing asset class year to date, outperforming gold and stocks. And in a key part of the segment, the reporters discussed Ethereum, mentioning how it is a top performer in the cryptocurrency markets, having outpaced Bitcoin, XRP, and a number of other top altcoins.

The Long Arm of the US Law

We’ve seen many regulatory actions in the crypto space by US regulators over the past few years. This past week was unique in that not only have we seen regulatory enforcement actions but criminal indictments against the same actors at the same time. The big news being regulatory and criminal actions against BitMEX and its founders as well as John McAfee, a well-known entrepreneur and crypto pundit.

Last Thursday, just after we delivered last week’s newsletter, BitMEX found itself knee-deep in both civil and criminal cases with the US Commodities Futures Trading Commission (CFTC) and the US Department of Justice (DOJ).

On the civil side, BitMEX was hit with two lawsuits. The CFTC accused the derivative exchange and its operators, CEO Arthur Hayes as well as co-founders Ben Delo and Samuel Reed, of running an unregistered commodity-derivatives trading platform and violating anti-money laundering and know-your-customer regulations.

At exactly the same time, the DOJ filed a criminal indictment against Hayes, Delo, Reed, and their head of business development Greg Dwyer for multiple violations of the Bank Secrecy Act. Reed himself was arrested almost immediately as he was already in the US. The other founders are all believed to reside outside the US.

In more crazy crypto news, the U.S. Securities and Exchange Commission filed suit against crypto investor and promoter John McAfee for promoting Initial Coin Offerings (ICOs) on social media. Specifically, the SEC stated: “From at least November 2017 through February 2018, McAfee leveraged his fame to make more than $23.1 million U.S. Dollars (“USD”) in undisclosed compensation by recommending at least seven “Initial Coin Oofferings” or ICOs to his Twitter followers. The ICOs at issue involved the offer and sale of digital asset securities and McAfee’s recommendations were materially false and misleading for several reasons.”

Specifically, McAfee was accused of not disclosing “that he was being paid to promote the ICOs by the issuers,” that he “falsely claimed to be an investor and/or a technical advisor when he recommended several ICOs,” that he “encouraged investors to purchase the securities sold in certain of the ICOs without disclosing that he was simultaneously trying to sell his own holdings and had paid another third-party promoter to tout the securities” and that he “engaged in a practice known as “scalping” as to at least one digital asset security, by accumulating large amounts of the digital asset security and touting it on Twitter without disclosing his intent to sell it.”

In a separate action announced by the Department of Justice, McAfee has been charged with tax evasion. McAfee has been arrested in Spain “where he is pending extradition.”

I strongly believe in a level playing field for all businesses competing for the same customers. However, I also believe in minimal regulation and believe that regulators have it mostly wrong as it relates to crypto. Of course, my opinion doesn’t matter at all as Abra follows all laws and regulations whether we like them or not. 2020 is like your crazy aunt that just won’t leave after coming to visit.

UK bans the sale of crypto derivatives

The US FCA announced this week that it is banning the sale of crypto derivatives to retail customers starting in January 2021. This is a big deal. Why? In the UK a big percentage of retail trading in all products is done via CFD’s (contracts for difference.) Most Americans are unfamiliar with CFD’s as they are generally illegal here.

What is CFD? Think of a CFD as a simple bet between two parties. I bet the price of Apple will go up. You bet the price of Apple will go down. We record the current price at the time of the bet. At settlement time whoever won the bet pays the difference in Apple’s price to the other party. Apple shares themselves never change hands. A CFD can be used to bet on anything, the weather, stock prices, sports results, or even the price of crypto. Furthermore, CFD’s allow for massive amounts of leverage with some services offering up to 100x leverage on the underlying bet. It has been reported by many outlets that over 85% of retail users lose money on these CFD bets.

Why would consumers want to use CFDs to invest in Bitcoin? Well, the biggest benefit to CFDs is that profits aren’t taxed as income as they are considered gambling winnings which aren’t taxable in the UK. Crazy right?

I suppose the big question is whether or not 85% of retail customers should be allowed to lose their money if they want to? How is that any different than choosing to lose your money at the slots in Vegas?

In case it’s not clear, BitMEX’s crypto futures contracts (all Bitcoin settled) clearly fall under this UK ban.

Tweet of the Week

I considered investing our treasury in fiat, bonds, stocks, swaps, index funds, options, real estate, commodities, precious metals, art, & intangibles before settling on #Bitcoin. It seems like the ideal long duration asset – I don’t understand why anyone would want to trade it.

— Michael Saylor (@michael_saylor) October 7, 2020

Michael Saylor, CEO of MicroStrategy, has become a prolific evangelist of the Bitcoin Standard as the future of money in recent days. In his most recent tweet shown here he opens up about how he looked at and considered every other asset class available to his corporate treasury before deciding on Bitcoin. I’m sure we’ll see many other companies and even governments follow suit.

See you all tomorrow (Friday) on the next Money Talks. The Revolution has begun!

Don’t forget to follow us on Youtube, Twitter, and Facebook to stay updated with the latest from the crypto world.

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.