Eleven years ago today, Satoshi Nakamoto sent 10 bitcoin to the now legendary Hal Finney.

Just two days prior — and a day after Satoshi released the first version of the Bitcoin protocol, Hal tweeted what would become, after the Bitcoin Whitepaper itself, the beginning of the Bitcoin canon.

Running bitcoin

— halfin (@halfin) January 11, 2009

In a lot of ways, the transaction between Hal and Satoshi was a culminating event. In the preceding decades, computer scientists and entrepreneurs theorized and even built some of the technology and similar-sounding software that would act as the forerunner to Bitcoin.

But until Satoshi put all the pieces together while writing the code that would become Bitcoin, sending a unique, private, and verifiable transaction of value over the internet — or solving the double-spend problem — was vexing. The solution required a multifaceted and secure protocol that enabled things as specific as a cryptographically-backed private and public key and ideas as big as an algorithmically-controlled asset issuance system.

At the time the launch of Bitcoin was like laying the missing cornerstone for a free and open internet. Ultimately, Bitcoin allows people to interact without the friction, cost, or surveillance of any kind by a third-party.

So in some ways, when Satoshi sent Hal 10 bitcoin it was signaling the end of centralized command and control on the internet. In other ways, it signaled the beginning of something — a grand vision of what the world could look like if the internet could finally be used to foster individual freedom.

And this was all happening without fanfare, or marketing, or hyped PR. Maybe one of the most interesting things about that day 11 years ago was that at the time bitcoin had no monetary value. It would be several months before people would figure out how to put a price on bitcoin, and a few more years before bitcoin’s erratic price would become a media fascination.

It might go down as the quietest beginning to a transformational revolution, ever.

Because January 12, 2009, was the first step in what would continue to morph and grow into an independent asset class and a massive global movement.

Bitcoin has not only survived but flourished because it was the right idea at the right time. And it all started as a simple transaction between two people.

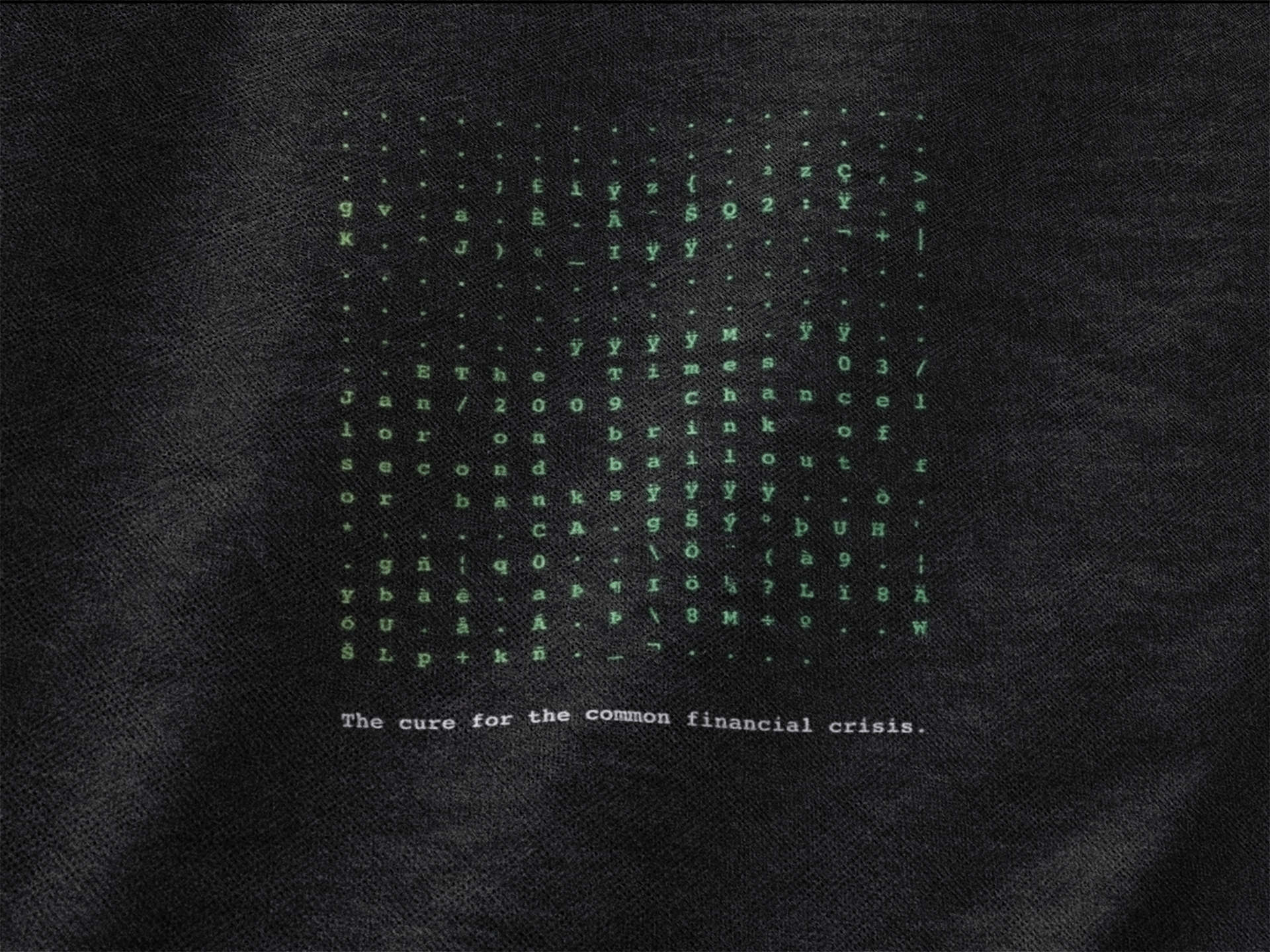

At Abra, we are celebrating today with some fresh Bitcoin-themed t-shirts.

While creating new shirts is not even in the same orbit as the significance of the first bitcoin transaction, we do believe that the next decade will be defined by more innovation and mass adoption of cryptocurrencies.

So why not help us celebrate and rep Bitcoin in the process? Check out the latest designs on our new Abra store.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.