At the beginning of any journey into the world of bitcoin, one is faced with a daunting amount of information about this new technology and the economy forming around it. The team at Abra is in the unique position of being one of the first points of human contact on this journey, and so we are able to help many of our customers answer their beginner questions about bitcoin.

One question that often comes up is the question about what options are available for buying bitcoin. Abra is one of many options that are out there, so when should someone use Abra instead of the others? To answer this question, it is worth reviewing the options and seeing where Abra fits in.

Where to buy

Exchanges

Bitcoin exchanges are companies that create a live market for buying and selling bitcoin. Customers will deposit bitcoin or fiat currency into their accounts and then place different order types that are recorded on an order book managed by the exchange. Some exchange offer simple limit orders, while others offer advanced order types such as stop loss orders and margin trading.

Having an account with a bitcoin exchange is like having a seat on the NYSE. Bitcoin exchanges are great for day traders and institutional traders who trade bitcoin full time. They often require an advanced knowledge of financial markets to use correctly.

Brokers

Bitcoin brokers are individuals and companies that take buy and sell orders and execute those orders on an exchange on behalf of their customers. The broker will often receive a fee for their service and the customer will receive the bitcoin they placed an order for in exchange.

If having an account at a bitcoin exchange is like having a seat at the NYSE, then doing business with a bitcoin broker is like having an e*Trade or Charles Schwab account. The advantage of using a broker is simplicity. The customer asks for a quote, places an order, and receives what they asked for, and the broker removes the complexity of dealing with an exchange.

OTC markets

Bitcoin OTC markets are “off-the-books” decentralized exchanges that occur through face-to-face meetings and remote trades. In a face-to-face exchange, the buyer and seller will meet at a designated time and place and exchange cash for bitcoin at an agreed-upon rate. In remote exchanges, the trade is coordinated by telephone, email, or another remote communication method. After a price is agreed upon between buyer and seller, the buyer will send an electronic funds transfer to the seller and the seller will send the bitcoin to the buyer’s bitcoin address.

OTC markets are most useful for either buying bitcoin with cash or purchasing large blocks of bitcoin at a guaranteed price. These trades protect against “slippage” that can occur when purchasing large amounts of bitcoin on an exchange.

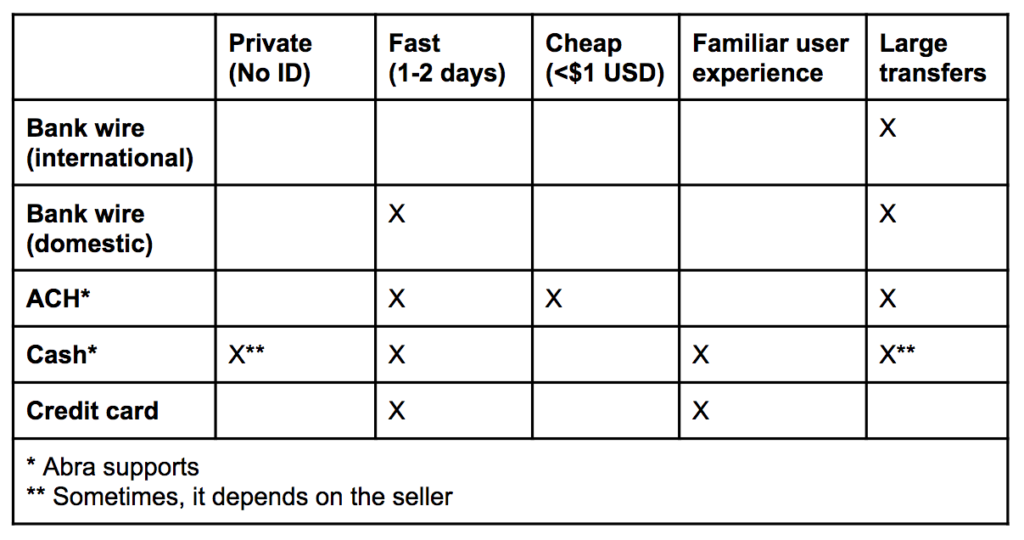

How to pay

Every bitcoin buying service supports at least one method of payment for purchasing bitcoin, and each payment method comes with advantages and disadvantages. These payment methods are often chosen with these trade-offs in mind so that the experience for both buyer and seller is optimized for the smoothest possible trade.

Cash

Most commonly used by OTC traders, but some exchanges and brokerages also offer cash deposit funding methods.

- Advantages: no chargeback risk; potentially faster and more private transactions

- Disadvantages: depends on local liquidity i.e. cash-in locations where the buyer is located; transaction size can be limited due to security, liquidity, or regulatory issues; fees charged can be higher to offset the operational costs of dealing in cash

Bank wire

Widely used by OTC traders, exchanges, and brokerages.

- Advantages: faster settlement time than ACH for domestic transfers; better for large transactions

- Disadvantages: unfamiliar or poor user experience; can be expensive in some cases; international settlement can take a long time and involve additional foreign exchange costs and counterparty risk

ACH

Widely used by exchanges and brokerages.

- Advantages: fast and cheap; better for smaller transactions

- Disadvantages: unfamiliar user experience; long settlement period; chargeback risk leads to low transaction limits and more stringent KYC requirements

Credit card

Accepted by very few exchanges, always with a large markup.

- Advantages: familiar user experience; ubiquitous adoption by consumers

- Disadvantages: due to the insecurity of credit cards, chargeback risk is a big problem; due to chargeback risk, fees for using credit cards to buy bitcoin are very high

When to use Abra

Abra is a digital wallet that supports holding, sending, and receiving over 50 different currencies including bitcoin. Abra also facilitates buying and selling bitcoin with two payment methods: cash and bank transfers (ACH in the US, BillPay in the Philippines). Due to the limitations of the banking system, bank transfers have daily, weekly, and monthly transaction limits. For transactions that exceed these limits, customers are advised to either see if there is an Abra Teller in their area who can facilitate a larger cash transaction, or else find a suitable bitcoin exchange, brokerage, or OTC market that supports larger purchases using a bank account.

The best time to use Abra to buy bitcoin is when you want to buy an amount of bitcoin with your bank account that falls within our transaction limits, or when you want to buy bitcoin with cash from an Abra Teller in your area. We have Abra Tellers in over 170 cities, with over 1500 Tellers in the Philippines alone at the time of this writing, and this network is growing larger every day. We are also working to increase our bank transaction limits and expand the number of countries where we support bank transfers.

With any task, it’s important to use the best tool for the job so that you have the best outcome possible. Buying bitcoin is no different. We hope this guide helps you make an informed decision about when it is best to use Abra and when it makes sense to find a different solution so you can have the best experience possible when buying bitcoin.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app on Android or iOS to begin trading or earning interest on cryptocurrency today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

John Milner

1570 days agoHow do I purchase BTC with American Express? Can you please help me understand this?

Daniel McGlynn

1570 days agoHey John,

Have you checked out this page? https://www.abra.com/blog/fund-abra-wallet-with-american-express-card/.

If that doesn’t provide the info you need, please email [email protected] and they will help you out.