Global Investor Insights

What happens when you tear down barriers for the world to invest? What’s important to them? Where do they invest?

To answer these questions we’ve been poring over early data collected from our recent product update. A few weeks ago, we launched a global investment

app that allows users around the world to invest in fractional shares of popular stocks and ETFs using Bitcoin.

What follows are early insights into how the world is investing. The data presented represents an analysis of initial investments of over 12,000 equity holders in Abra. The data shared here are preliminary results, but the findings are so compelling we’re committed to publishing a quarterly “Global Investor Insights” to share how decentralized finance is making financial markets more accessible and affordable to all.

Meet the new global investor, powered by Bitcoin

At Abra, we believe in the core tenets of cryptocurrency and that Bitcoin will become the ultimate collateral asset the world uses to access and invest in other markets. We put this belief to the test one month ago with the launch of our new stock and ETF investing feature (for users outside of the United States) using Bitcoin. The results so far are fascinating and show this technology has the power to deliver on the promise of decentralized finance (#DeFi) and global financial inclusion.

154

Number of countries with equities wallet

82

Number of countries with active investors

$49.18

Median total investment per users

24.65

Median investment per asset

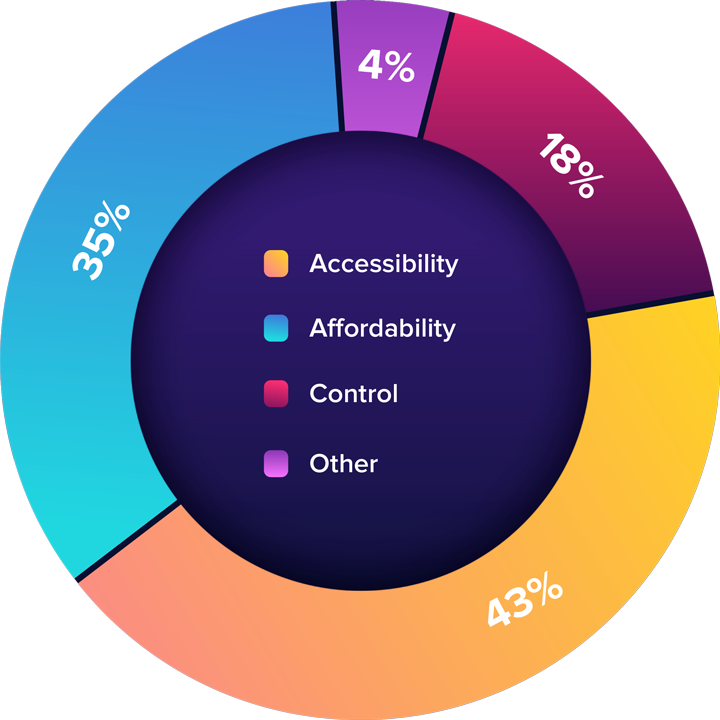

#DeFi makes investing accessible, affordable, and secure

We pulsed a survey to all of our active investor and found the top three problems Abra’s decentralized investment app solved for them were:

| 01 | Accessibility. The number one reason cited by Abra users outside the United States is that investing in financial markets — especially US equities — was not possible before. Or very difficult. |

| 02 | Affordability. Users love the ability to buy fractional shares of stocks for as little as $5 USD. As proof, the median investment per user is only $49.18 and median investment per asset is $24.65. |

| 03 | Control. People globally also cited Abra’s privacy, security, and control. |

Tech dominates top 10 investment assets globally

Most popular stock and median investment

We launched our global investment app with over 50 assets that featured a variety of stocks, bonds, commodities and ETFs.

The world is bullish on tech and overwhelmingly loves Tesla. We couldn’t get over how many users went long and strong on Elon Musk’s Tesla. Not only did $TSLA take the number one stock pick by number of users investing in the stock, but also with a median investment 191 percent higher than the overall median investment on Abra.

The world bets long on $TSLA

South Africa bets on hometown hero Elon Musk

#1

Most Popular Stock

191%

Higher median investment

$71.64 vs $24.65

Top 5 countries going big on Tesla

1. South Africa

2. France

3. Argentina

4. Austria

5. Philippines

Top investments around the world

Disclaimer

* The services described herein are provided by Plutus Technologies Philippines Corporation (Abra International). You are not allowed to access or use the services of Abra International if you are located, incorporated or otherwise established in, or a citizen or resident of: The United States of America, Cuba, Iran, North Korea, South Sudan, Sudan, Syria and Ukraine. Persons or businesses in these countries or in any jurisdiction where it would be illegal according to applicable law (by reason of nationality, domicile, citizenship, residence or otherwise) are forbidden to access or use the services of Abra International.