This week on Money Talks, Friday at 9 AM PDT (noon EDT)

Friday on Money Talks

- Bill will be starting an intro series to explain the basics of crypto starting with Bitcoin.

- Don’t forget to leave us a comment on Twitter for a chance to win $200 in any cryptocurrency supported by Abra.

- Guest Nathaniel Whittemore from Coindesk will be joining Bill to talk about the latest crypto news.

- As always, we answer all your burning Abra questions!

Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT: https://youtu.be/16ICmCw3ais

Back to the Basics!

We’re seeing record numbers of people trying to get into crypto for the first time. So we’re going to take a step back and focus on the basics. For the next 4 weeks, we’re going to do an intro series in addition to our regular updates. The intro series will cover:

Part 1 – Bitcoin: Getting started with Bitcoin, why Bitcoin matters.

Part 2 – Stablecoins: What are stablecoins and how to use them for earning interest, trading, and money transfer.

Part 3 – Ethereum & Defi: What is DeFi and how does Ethereum enable it? The easiest way to get started in DeFi.

Part 4 – Altcoins, why they matter, and how to use them.

Bitcoin: Getting started with Bitcoin and why Bitcoin matters

At some point, we’re all going to start going to dinner parties again. At that point wouldn’t it be fun to be the person who can easily explain Bitcoin to everyone at the table? Here a super easy, highly understandable explanation you can take and use. We also recently wrote an illustrative guide to understand the origin of bitcoin. You can check it out here.

Why do we need Bitcoin?

Before I give you my party trick of explaining Bitcoin easily to your friends, it helps if you understand why we need Bitcoin in the first place.

We need Bitcoin for 2 big reasons:

- We need Internet money to transact on the Internet: Before Bitcoin, we didn’t have money for the Internet. Money for the Internet should ideally exist purely in the digital realm while being completely secure. Without money for the Internet, transactions are subject to chargebacks by banks, the cross-border settlement is extremely complex and expensive, and private transactions are all but impossible. And of course, governments can print as much paper money as they want eroding the value of your money to zero.

- We need to eliminate trusted third parties to securely transact on the Internet: Money for the Internet would ideally have no central banker that everyone needs to trust. The bank of Bitcoin should simply be the Internet itself and be completely decentralized just like the Internet itself. By eliminating trusted third parties we can create money that doesn’t erode in value over time and initiate transactions that can’t be arbitrarily rolled back by some arbitrary overseer.

So what is Bitcoin? (Use these 6 sentences at your next party and people will love you for it.)

Bitcoin is money for the Internet. Bitcoin is a massive network of computers all connected to each other to run a new type of banking system. This banking system has no central authority and no off-switch. Bitcoin’s banking system really only does two things. First, it mints new coins from nothing into existence. Second, it allows any two parties to share coins with each other. ← Those are the basics that anyone should be able to understand.

Sounds simple, but it isn’t. Let’s break this down in more detail…

Bitcoin is a massive network of computers all connected to each other to run a new type of banking system. Like the Internet itself, this Bitcoin banking system has no central authority and no off-switch.

The Bitcoin banking system comprises three types of participants: wallets, nodes, and miners.

Wallets hold your coins and initiate new transactions that are published to the network. Publishing a transaction is kind of like recording it in your checkbook but then calling everyone else in the world so that they can record the transaction in their checkbook as well. That way if you run into a conflict in the future you don’t have to rely on just one checkbook record but instead you have tens of thousands of copies of the same checkbook record to validate any prior transaction.

Nodes are basically copies of every transaction that has ever been done by everyone since the beginning of time. Think of nodes as people maintaining a copy of a global checkbook that links every transaction that has ever happened to every other transaction. We call this global linked checkbook a blockchain.

Lastly, miners are the participants who mint new bitcoin into existence while inserting new transactions into that global checkbook, called a blockchain. Miners are the ones who call all of the nodes’ checkbooks to tell them to add new transactions. They do this so that you don’t have to. They do this in exchange for a little bit of Bitcoin that you pay them for telling everyone to accept your transaction.

As we said above, Bitcoin’s banking system really only does two things. First, it mints new coins from nothing into existence. Second, it allows any two parties to share coins with each other. Minting new bitcoin into existence means exactly what it sounds like. But we don’t want to just keep creating more Bitcoin forever as that could erode the value of the coins we already have. So the Bitcoin network solves this by regularly decreasing the rate at which new Bitcoin is created which puts a maximum supply cap on the total number of coins that can ever be minted.

How does Bitcoin’s banking system mint new coins into existence? Well it’s quite clever, think of all the Bitcoin miners as basically playing a global game of sudoku, a puzzle game. Each miner is given the same puzzle to solve every ten minutes. The first miner to solve the puzzle wins Bitcoin. In addition to winning the Bitcoin, the miner who solves the puzzle also adds a bunch of the pending transactions that haven’t been added to the global checkbook yet while keeping the extra fee that each person is paying to get their transaction into the global checkbook (or blockchain.)

If lots of miners are trying to solve the puzzle the banking system makes the puzzle harder to guarantee that the miners don’t solve the puzzle too quickly, if fewer miners are playing the puzzles get easier. This guarantees that the puzzle should be solved more or less every ten minutes, forever. Every few years the amount of bitcoin you win for solving the puzzle gets cut in half. That means that eventually no new coins will be minted.

Lastly, we said that Bitcoin’s banking system allows any two parties to share coins with each other. But we also said that there is no central bank. So that presents us with two questions. How does sending my coins from my wallet to your wallet work? What prevents me from sending the same coins to two different wallets at the same time? Bitcoin ingeniously solves both of these problems at the same time. Your wallet doesn’t communicate directly with the recipient’s wallet. Instead, your wallet tells the miners that it wants to send Bitcoin. The miner that wins the puzzle game also tells the other wallets that your transaction has taken place. That means that the global checkbook knows that I sent money to someone else’s wallet. It also prevents me from sending the same coins to a different wallet as the global checkbook would reject me sending the same coins twice. That addresses my second question.

The sum total of all of this is that Bitcoin represents money for the Internet that has no central banker. The bank of Bitcoin is the Internet itself. Bitcoin is minted over many years after which no new coins are minted. Bitcoins are sent from wallet to wallet via miners who communicate new transactions every few minutes. If you know that you know a lot!!

What Gives Bitcoin its Value?

Recently Bitcoin has been trading at a price of about $11,000 per Bitcoin. What gives Bitcoin its value? Ultimately it comes down to scarcity. Bitcoin is more scarce than gold which up until now was the scarcest commodity on earth in terms of our inability to replicate the existing supply. Bitcoin is even scarcer than gold.

At least 4% of Bitcoin (probably more) is now locked up in long term holdings by institutional investors. Corporate treasuries globally are sitting on $trillions in cash. A tiny fraction of that has made its way into Bitcoin.

Think about this for a moment, nine companies alone in the S&P 500 are sitting on close to $600 billion in cash and short term investments. 5% of that money moving into Bitcoin (or $30 billion) would likely mean a 5x for the price of Bitcoin.

A Fidelity report this week cited the alternative investment market to be worth over $13 trillion. None of that money is in Bitcoin today.

Stone Ridge just revealed a massive $115 Million Bitcoin Investment and is now holding custody of over $1Billion worth of crypto.

Grayscale, an investment trust that securitizes Bitcoin investments now holds over 2% of all Bitcoin and growing.

Anthony Pompliano sent out a fantastic letter outlining the bull case for why Bitcoin is way undervalued by a factor of 10-20x over the next 15 months. Link to the letter is here.

All of this means that there simply isn’t enough Bitcoin to go around. That’s what gives Bitcoin its current and growing value.

Next week, we’ll talk about stablecoins and discuss how stablecoins are making it easier to get money into Bitcoin as well as facilitate money transfer and lending on the Internet.

Earning Free Crypto with Abra

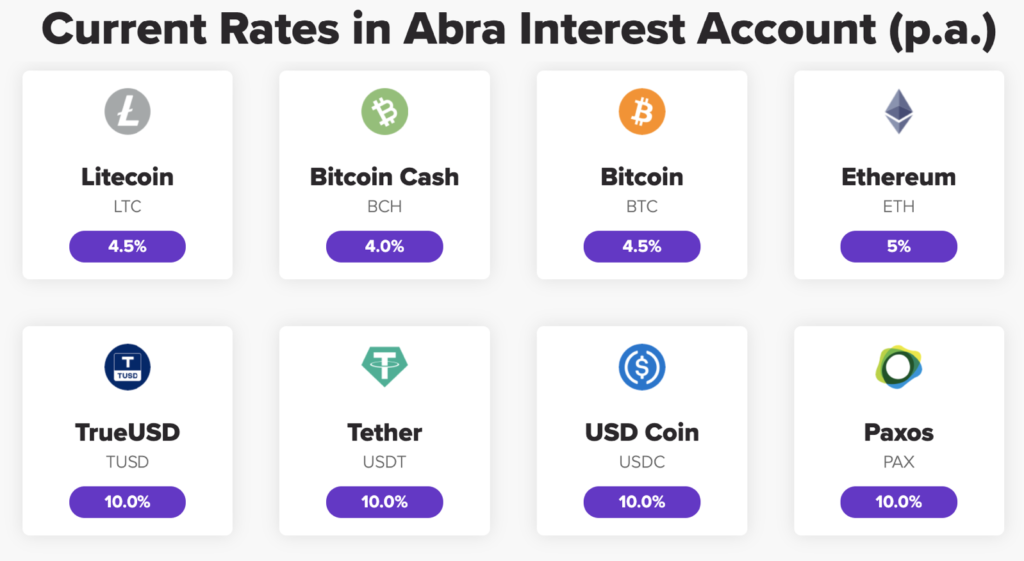

Abra’s Industry Leading Interest Rate Now Includes 8 Currencies

Abra now supports earning interest on USD, Bitcoin, Ethereum, as well as Litecoin and Bitcoin Cash. Our interest rates remain the highest in the space at 10% on USD and up to 5% on cryptocurrencies. Install the latest version of the app to start earning interest on your crypto and USD balances. Of course, you can use Abra to buy Bitcoin and trade crypto as well! Just link your bank account or existing crypto wallet to get started.

Tweet of the Week

Our next #MoneyTalks will have a special focus on how to get started with #crypto

– Tell us what made you a believer, OR tag any friend just starting with crypto.

– Retweet this post1 winner will get $200 worth of any crypto supported by @AbraGlobal https://t.co/uDira7OvTA

— Abra (@AbraGlobal) October 13, 2020

For this week we want to celebrate the spirit of crypto with our own Tweet. We would like to invite all of you to come and share your personal crypto journey and tell us what made you a believer. We are even giving away $200 worth of any crypto supported by Abra to a lucky winner. Please checkout the tweet for more details on the contest.

See you all tomorrow (Friday) on the next Money Talks. The Revolution has begun!

Don’t forget to follow us on Youtube, Twitter, and Facebook to stay updated with the latest from the crypto world.

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.