Topics this week:

- Abra Interest Accounts Update and Milestones!

- Ethereum Goes BOOM

- Bitcoin Winding up for a Spring Blast?

- Alts on the Move

- Thoughts on Lightning

- AMA with Bill

Join us for Money Talks, Friday (1/22) at 9 am PT.

Friday on Money Talks, we will be taking a deeper dive into the crypto market and covering the topics of the week. As always, we answer all your burning questions about all things crypto and Abra.

Check out our Bitcoin giveaway on Twitter, and you may end up with a $100 Bitcoin surprise. Not a bad way to start the new year in crypto style!

Abra Interest Accounts Update and Milestones!

The Revolution is Underway – Generate 10% on US Dollar Deposits, and up to 5% on Crypto Deposits with Abra.

Our steady march towards becoming your global crypto bank continues.

Since we announced that all Abra users could generate 10% on USD and up to 5% on Bitcoin and Ethereum deposits, thousands of you have taken advantage of this to the tune of hundreds of millions of dollars. We are honored and humbled at the response, and we take this responsibility seriously. We built a product we wanted for ourselves, and you’ll be happy to know that we also have our money in the Abra Interest Account. I wouldn’t dream of managing my money or crypto any other way.

We’ve also improved the Abra Interest Account in a few key ways:

- Unlimited deposits from anywhere in the world – Wire unlimited amounts into the Abra Interest Account from over 100 countries. All incoming international wires automatically convert to USD.

- Deposits from Abra’s new Crypto Marketplace on our website with local payment types like SEPA in Europe, FasterPay in the UK, as well as payment options including Apple Pay, Google Pay, and credit/debit cards issued by Visa and Mastercard

- Abra’s new OTC desk allows customers to perform large deposits enabling them to trade between currencies without leaving the Abra app. For example, if you’re holding a large amount of USD generating interest and want to buy Bitcoin, just fill out a simple form on our website (www.abra.com/otc-services/), and we’ll get you set up to trade into Bitcoin even before your USD withdrawal is processed. This way you won’t miss the best possible price! (only available for trades larger than $25k.)

- Deposit cryptocurrencies or stablecoins directly into your Abra wallet from any external exchange or wallet such as Coinbase, Binance, Kraken, Gemini, Huobi, Okex, etc. Once funded, customers can start generating daily compounding interest on your crypto deposits immediately. We’ve raised interest rates on USD to 10% and Ethereum to 5%. Our competitors try all kinds of marketing trickery with their interest rates. Not us. The rate you see is the rate you get.

Abra is simply the crypto product that I’ve wanted from day one. Now I’ve got it for myself. Invest, Boost, Trade, and Send. Awesome. And we’re not done yet. We’ve got some super cool stuff coming, and we can’t wait to show it to you!

The Abra Interest Account is a breakthrough for investors. For the first time, investors can make fiat or crypto deposits into an app and then automatically generate up to 10% interest on those deposits.

How does Abra Interest Account work?

Abra Interest Accounts are accessible from the Abra app on iPhone and Android. These are a new type of account inside the Abra app. We partnered with Prime Trust, a US Chartered Trust Bank based in Nevada, to issue these accounts. Once you register for the Abra Interest Account in the Abra app, Prime Trust will verify your details. Verification can either be instant or can take a few hours, depending on the details provided.

After being approved (push message received to your Abra app), you can deposit your US dollars, Bitcoin or Ethereum into the Abra Interest Account. You can wire the money, transfer existing crypto or use the abra.com marketplace to make your deposit.

We update the interest rates offered weekly. Interest rates are set similar to how a bank sets rates for cash deposits, with the difference is that the rates we’re able to offer are much higher than what a bank typically offers on USD deposits.

How can Abra offer a 10% interest rate on USD deposits when a bank can’t even offer 1%?

The answer is Abra’s Institutional Lending Desk. Our lending desk, run by Young Cho, Abra’s Chief Investment Officer (CIO) and a veteran of the lending business, enters into lending relationships with borrowers throughout the crypto universe. As our volume of assets under management (or AUM) continues to grow, we continue to diversify our crypto investment portfolio to continually lower risk. All new potential institutional borrowers go through Abra’s investment committee process, which reviews the borrowers and determines a risk profile that sets various parameters for terms, including interest rates, collateral requirements, and other relevant terms. Ultimately our investment committee, including myself, must approve all new institutional borrowers. Counterparty risk is mitigated through a combination of high collateralization rates, appropriate interest rates, and review of the use of funds via an investment committee. Collateral calls to borrowers ensure that any price movement in the underlying collateral (such as Bitcoin) doesn’t put investors’ funds at risk. Abra has never had a loan default or had a counterparty miss a collateral call.

Failing currencies? Just Move to USD and Bitcoin

One of the things I’m most excited about regarding our new Abra Interest Account product is that it works globally. That means people in countries with failing currencies can convert their money to bitcoin and deposit them into the Abra app and store them as Bitcoin or USD. Either way, they can generate interest on their deposit and not be a victim of their government’s hubris.

We’re seeing this with our large and growing user base in the Philippines and have seen strong interest across Latin American countries, including Mexico and Central America.

So many government issued currencies have failed that it’s almost impossible to keep track. Here is a short list: Lebanese Pound (2020), Argentinian Peso (2019), Venezuelan Peso (2018), Zimbabwe Dollar (2006-2012), and the list goes on and on. In the case of Argentina, this Tango is nothing new. It just keeps happening over and over again. I recently saw a google sheet tracking the history of failed currencies, and it was in the hundreds over a few hundred years. We welcome all of you in these markets with open arms and look forward to helping you preserve and grow your hard earned money.

Ethereum Goes BOOM

Ethereum is now clearly in charge in crypto land. While it looked that Bitcoin was leading the price action through November, Ethereum stepped up its spot price game in December and is now up almost 300% since November. Bitcoin is up over 200% in the same period but has pulled back around 14% over the past 24 hours as of Thursday morning Pacific Time.

As the world’s leading platform vying for the title of the “world’s computer” Ethereum is raging. Questions remain around the 2.0 upgrade and its ability to deliver the required scalability enhancements. The phase 1 upgrade, which turned on staking, has been a resounding success. Now comes the hard part, actually upgrading the network itself. I’m super bullish on Ethereum and believe we will see $5k Ethereum in 2021.

Bitcoin Winding up for a Spring Blast?

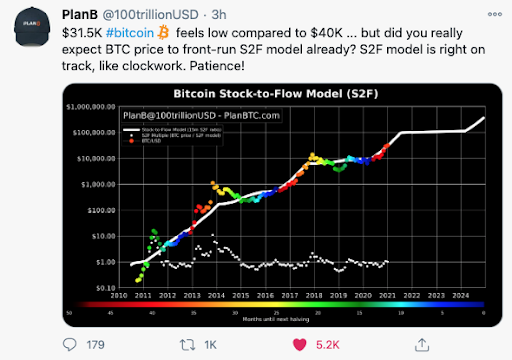

The 1 hour Bitcoin price chart shown here was in what we call a consolidation pattern. The best way to think about a consolidation pattern is the calm before the next storm. Large triangles are traditionally very weak consolidation patterns, and a break to the downside like this during a bull market is exactly what I want to see. Weak hands get washed out. Large buyers buy the dips, and the next run up is even stronger. I believe that’s what we’ll see here over the next 6 weeks. I’m not an oracle. Be patient.

I was reading a report from another crypto hedge fund predicting that Bitcoin would reach $115k by August. Does that seem nuts to you? First, you should consider that such a run up would be a smaller percentage run up than what Tesla experienced during its best 8 month timeline of 2020. What might such a run up look like? I created a simple model shown in the blue line in the daily Bitcoin price chart above. The green and red candles represent the actual prices through today. Modeled after similar run ups in the past you’ll notice that as we march higher Bitcoin’s price can range for a few months, such as May through July in this made up model, and can have very large pullbacks of 20-40% along the way. I basically used the previous run ups, as modeled via stock to flow, as a guide in creating this hypothetical scenario.

As you can see above the stock to flow model predicts Bitcoin is exactly where it’s supposed to be. In case you’re wondering, the report I mentioned above also predicted that Bitcoin would be at $35k in January, just as we were on Monday. Astounding! Keep in mind that this is just a model and ALL models are wrong; some are just better than others. In the meantime, be patient. Have a plan and work your plan. Don’t invest what you can’t afford to lose.

Alts on the Move

Altcoins are showing serious signs of life. Let’s take a look at the DeFi world and the alt market as a whole.

DeFi Tokens are skyrocketing…. Again.

Decentralized Finance (or DeFi) was all the rage in the summer of 2020 as Uniswap started processing more trades than the largest centralized order books in the world. For now, these trades are limited to Ethereum based tokens, but I suspect not for long.

Now DeFi is on the move again! As you can see here an index of DeFi tokens tracked by trading house FTX shows a 4000 point run up in DeFi tokens over the past 90 days. Abra users have been trading DeFi project tokens, including COMP, LINK, 0X (ZRX), and Augur V2 in large quantities of late.

It’s very early in the DeFi game and things can and will change significantly in the coming months and years. If you choose to make a longer term trade keep it small and don’t be afraid to take profits.

Altcoins are on the move, with Ethereum leading the way.

An Index of altcoins, unfortunately, referred to as the Shitcoin Index managed by FTX, is up over 1300 points since November. I really wish FTX would change that name although even serious traders get a good laugh out of it.

For Abra users trading alts Hedera has been leading the way with a 30 day run of over 190%. Top performers over the past 30 days include: Hedera (199%) Cardano (129%), DOGE (98%), Stellar (77%), Verge (69%), and Algorand (53%.) For reference, Bitcoin was up 48% in the same time period.

My best guess is that Alts will have a better run than Ethereum or even Bitcoin in 2021 but they will be crazy volatile along the way. So please be careful. Only trade what you can afford to lose. Set alerts on the coins you trade and don’t be afraid to take profits. Altcoin trading is not for everyone but if you do your homework and have a plan you may find that 2021 is going to be quite the ride.

Thoughts on Lightning

I’ve been testing out a new service called Clubhouse. Clubhouse allows anyone to create an audio chat room on any topic. As you can imagine there are already lots of rooms popping up on Bitcoin. On Sunday I participated in a 1-1 chat with Andreas Antonoupolous with about 400 attendees listening to our back and forth regarding Bitcoin’s Lightning Network. It was a fascinating conversation that shed some light on some of the changes that have been made to Lightning since the original white paper was released several years ago. These changes have fundamentally changed my opinion on Lightning. I’ve always been bullish on Lightning’s usefulness but now I’m more bullish than ever on both the value of the current reference design and its ability to scale Bitcoin even further. Lastly, I’m starting to get a feel for the potential economics that could make Lightning a viable solution for p2p payments within the Bitcoin Network. I’m going to try and post a separate blog just on this topic in the coming days. I’m crazy busy right now, but I plan to get to it asap.

Have a great weekend. See you on Money Talks on Friday!

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.