Today’s Topics:

- New Bitcoin Highs!

- The New abra.com Crypto Marketplace (including Apple Pay support!)

- PayPal – Getting into Crypto

- DeFi – Decentralized Finance Stack – By Joey Krug (CIO, Pantera Capital)

- Tweet of the week

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

- We’ll continue the “Back to the Basics” mini-series with a discussion of Ethereum and DeFi.

- Don’t forget to leave us a comment on Twitter for a chance to win $200 in any cryptocurrency supported by Abra.

Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT:https://youtu.be/qiCft6nthTU

New Bitcoins Highs!

It’s hard to find bearish sentiment anywhere in Bitcoin-land right now. Earlier this week Bitcoin reached a new 2020 high of $13,859 and is once again reconsolidating, as it has after every major price jump since the March lows. What was impressive about this is that not only did the price blow through short term resistance it also happened while global stocks were falling. US stocks had one of their worst days of the year the same day. This divergence of stocks and Bitcoin is incredibly bullish for Bitcoin. If Bitcoin breaks through 14,000 which is not only the next psychological hurdle it’s also near the 2019 high’s, the next resistance line is the 2017 high of about $19,800. If we eventually blow past these prices, which I expect we will, then the real price accumulation will begin and then we will start to see a massive influx of retail buying which will feed on itself. I mentioned in a tweet a couple of weeks ago that the momentum of a price rise to $25k will lead to a price of $50k. Nothing in investing goes straight up. Expect big price pullbacks and corrections along the way!

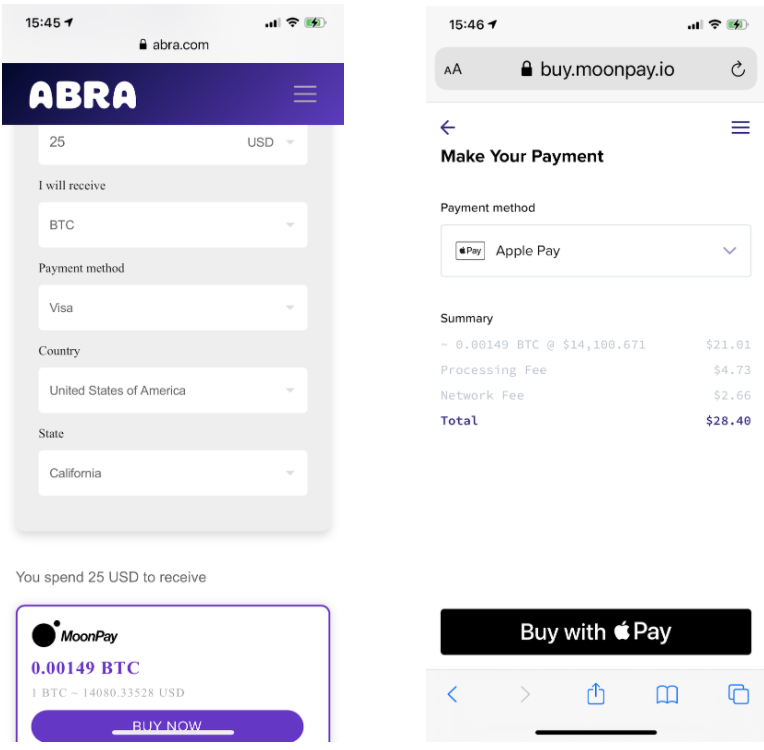

The New abra.com Crypto Marketplace (including Apple Pay support!)

Last week Abra launched a new experiment… a simpler and easier way to buy Bitcoin and other cryptocurrencies via abra.com. If you’ve ever used a travel comparison website then you know exactly how the new abra.com marketplace works. You tell us which crypto you want to buy, which currency you want to pay in (USD, EUR, GBP, etc), how much you want to buy, and which payment method you want to use. We present all of the options available for you along with the total amount of crypto you’ll receive for each payment option. You paste in the Abra wallet address you want to use to receive your new currency and Abra handles the rest. I’ve been using it to buy bitcoin via Apple Pay every week since we launched it and I love it!! It’s the best and easiest way to demonstrate buying Bitcoin that I have ever seen and works great with Apple Pay.

PayPal – Getting into Crypto

This week PayPal made good on the rumors from earlier this year that they would be integrating crypto into their services. This is great news for Abra and the broader cryptocurrency space. We believe that the market is so early and so young that a rising tide will raise all boats in the crypto space. With ~350 million users globally and 26 million merchants using PayPal, this can only be seen as great news for the broader crypto space. This is especially great news for PayPal merchants that want to accept Bitcoin for payment.

“The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly,” Dan Schulman, President and CEO, PayPal.

However, it’s not all one big “wow!” Similar to Cash App’s initial launch, PayPal will not allow users to self-custody the crypto that it offers, it will “only” allow users to gain price exposure to these crypto assets and use them to make payments across the PayPal network. But it’s a start for sure! I basically see PayPal becoming its own lightning network or a so-called layer 2 solution for crypto to address payment scalability issues. In other words, eventually I can self custody my Bitcoin and then put it in my PayPal wallet when I want to pay. That will be reasonable to many people. Many people will not like this as it seems to violate the first principles of Bitcoin. Time will tell how this plays out.

PayPal users will not own any crypto assets. PayPal will own them and provide users a third party IOU and custody solution via Paxos. Paxos is the same company that manages the PAX dollar stablecoin available in the Abra app.

PayPal’s moves remind me of a move Apple made with Motorola about 15 years ago before they released the iPhone. They partnered with Motorola on a crappy music phone, learned how to do it right, and then built it themselves. I think PayPal is taking the same approach here and will try to build an entire crypto stack themselves over the coming five years including becoming a major player in the central bank digital currency (CBDC) ecosystem. This is great news for the entire crypto space. The more builders in crypto the better off crypto will be.

DeFi – DECENTRALIZED FINANCE STACK – BY JOEY KRUG

This week’s newsletter includes a guest post from Joey Krug, CIO at Pantera Capital a crypto hedge fund and venture fund, and one of Abra’s earliest investors. Joey is also a co-founder of Augur (listed on Abra) and is an expert in all things crypto.

If you’ve tried to research how DeFi works and what the various components of the ecosystem are, you probably saw many references to vegetables, farming, and even Japanese cuisines.

We’d like to help make sense of the DeFi landscape. Below is an overview of the core components of the ecosystem with project examples.

Separately, we’d like to invite you to join us for our conference call on November 3rd at 9:00 am PST, Deconstructing DeFi – a discussion of the DeFi ecosystem to better understand the long-term value of the space. Acala co-founder and CEO Ruitao Su and Alchemy co-founder and CTO Joe Lau will join us for the discussion.

You can register via this link: https://info.panteracapital.com/general-information-conference-calls

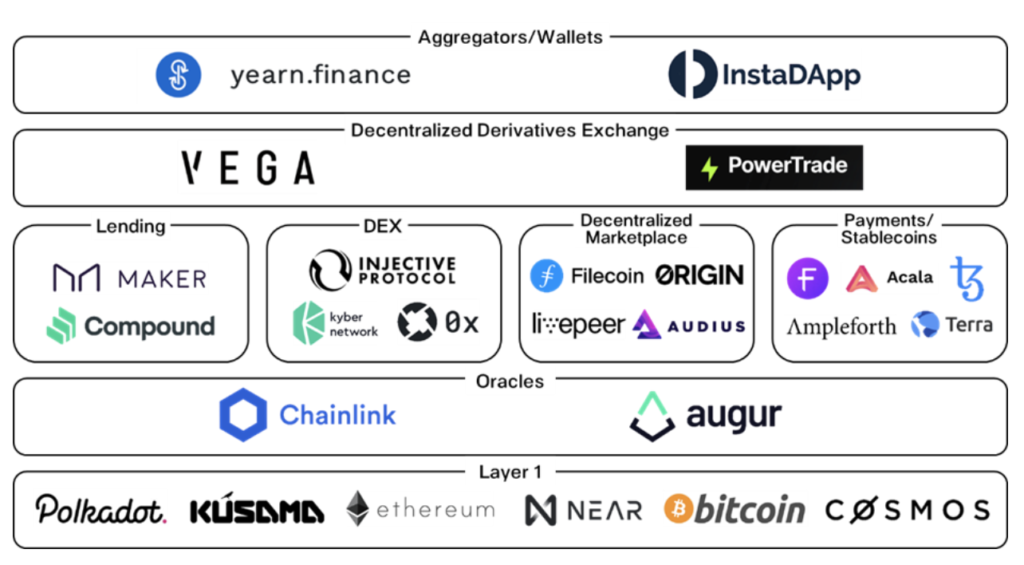

Aggregators/Wallets

These are basically interfaces that will allow you to interact with the decentralized finance ecosystem. Yearn.Finance and InstaDApp are examples of two main options at this point. With Yearn, you basically give them your money and they manage it. You can do this for ETH or various stablecoins, and they’ll charge you a small fee on it.

InstaDApp is more of a “do it yourself” platform. It’s sort of more like the E-Trade model. You go there, they show you all the different things you could invest in, and you choose the ones that you like. It’s sort of like a broker or a bank, but it’s decentralized and you have control over your own money.

Decentralized Derivatives Exchange

Decentralized derivatives exchanges are really important for the ecosystem. Keep in mind, most value in the traditional financial system is in derivatives. Vega is one of our portfolio projects that is launching a decentralized derivatives exchange and they’re supposed to go live sometime in the next few months. Injective is another portfolio project that recently launched.

Lending

What has propelled DeFi forward this year has been investors borrowing and lending crypto assets using protocols like Compound, Maker, and Aave. Many investors have been lending out their assets to generate additional yield on their holdings at rates of 5-15% or even more in certain cases.

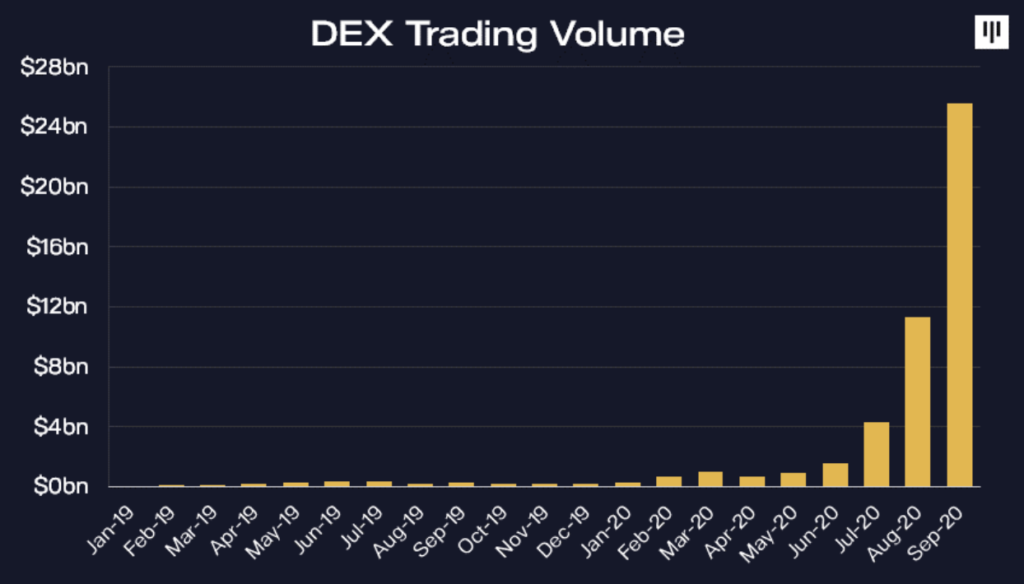

Decentralized Exchanges

Decentralized exchanges allow for peer-to-peer exchange of crypto assets without the need for a middleman. They are non-custodial, meaning users don’t forfeit control over their tokens to the exchange. Different types of DEXes have created innovative ways of swapping in and out of tokens. For instance, Uniswap removed the concept of an order book altogether and introduced liquidity pools that allow for instantaneous swaps. In September, DEX trading volume exceeded $25bn.

Decentralized Marketplaces

These are marketplaces that connect merchants and consumers together without the need for a third party intermediary. An example of this type of marketplace is Origin which allows developers to create decentralized versions of companies like Airbnb or Uber.

Payments/Stablecoins

When we first entered the space, everyone was talking about how crypto is going to be used for payments, it would be used for remittances, etc. But it didn’t really happen for a long time. Now it’s beginning to happen with projects like Terra and the abundance of stablecoins like USDC. The total value of the stablecoin market now exceeds $20bn.

Terra is based in Korea and they power a lot of payment volume there. They process over $4bn in annualized TPV or payment volume. They’ve actually gotten product market fit using crypto for payments in the Korean market and they’re eventually going to expand outside of there.

Oracles

Oracles help you get real world data into the blockchain. If you imagine a new parallel financial system, it does need to know some data about the real world. Augur uses oracles to figure out things like who won an election? Or what was the price of something when it closed on the Friday closing bell. Chainlink uses oracles for things like what’s the price of ETH? What’s the price of OmiseGO token? Whatever it is, it gives you those prices on chain.

Layer 1

The very bottom of the stack is layer one or the actual blockchain are you building on. Ethereum is definitely the market leader right now. People are working on a bunch of different ways to scale Ethereum. There’re lots of competitors to Ethereum. Projects like Polkadot, NEAR, and Cosmos are similar platforms that are much more scalable at the moment. Most or all of those are actually working on bridges to Ethereum to get data to and from the Ethereum network. Down the line, we might have a world where there are some projects built on Polkadot, some on NEAR, and some on Ethereum, all interacting with each other.

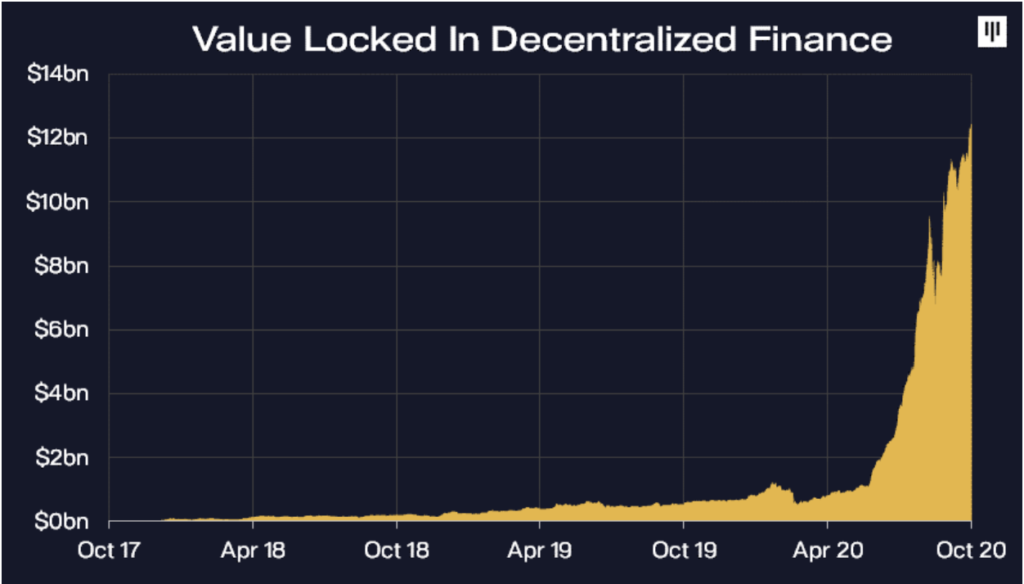

DEFI GROWTH METRICS

There has been a surge in growth of decentralized finance this year. There are two main metrics you can look at, one is how much value is locked up in these DeFi protocols, and the other is how much trading volume is actually happening. Two years ago, there was only a couple of hundred million locked up in DeFi projects. Now there is over $12 billion. This year alone, the value locked in DeFi has risen over 1,500%.

This year, decentralized exchanges (DEXes) have seen unprecedented growth. There have been many days where the leading DEX, Uniswap, has facilitated more trading volume than Coinbase. In fact, for the month of September, Uniswap did more volume than Coinbase. This is something we didn’t expect would happen this year – eventually, but probably not by now. Two years ago, trading volume was just a rounding error. It was basically non-existent for the most part. Now, decentralized exchanges are trading about $22 billion a month, and that’s before scalability is really even here yet. Once scalability is resolved, DEX trading volumes will snowball, and in some cases surpass centralized exchange volumes consistently. It’s already happening for certain trading pairs and assets.

These graphs remind me of a classic line in Hemingway:

“Two ways. Gradually, then suddenly.”

— Ernest Hemingway, The Sun Also Rises, 1926

We’ve been investing in DeFi for years. DeFi happened gradually, then suddenly.

Thank you Joey for the amazing work!

Tweet of the Week

Bitcoin is eating the world…

It has become a supermassive black hole that is sucking in everything around it and destroying it. This narrative is only going to grow over the next 18 months.

You see, gold is breaking down versus bitcoin…and gold investors will flip to BTC pic.twitter.com/ox7KRY5VRo

— Raoul Pal (@RaoulGMI) October 27, 2020

We’re going back to one of my favorite twitter feeds this week, Raoul Pal of Real Vision, for our tweet of the week. As we’ve told you for about 6 months now Bitcoin is looking more and more bullish. Here Pal shows that there is no asset class that even comes close to the bullish set up of Bitcoin right now on a macro basis. Well done!

See you Friday morning for Money Talks, 9 AM PT sharp!

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app on Android or iOS to begin trading or earning interest on cryptocurrency today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Charito Z. Fernandez

1265 days agoGood day Sir/Madame

Can i start to 500 pesos because this is the only amount i have. I dont have work and i care my father have prostate cancer hes 84 yrs old. And we can used the everyday expenses to my father governmet assistance. And I dont have any idea about this trade. Ill try 500 pesos . Anyone can help me.