Today’s Topics:

- Bitcoin & Ethereum – The Bulls are in Charge

- The FED wants to help Bitcoin

- Update on Abra Interest Account

- Tweet of the Week

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

On this week’s episode of Money Talks: We will dig into what’s driving the latest bull run on Bitcoin and Ethereum. We’ll provide an update on the new Abra Interest Account product. As always, we answer all your burning Abra question

Please update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT at https://youtu.be/u9_7puu72uA

Bitcoin & Ethereum – The Bulls are in Charge

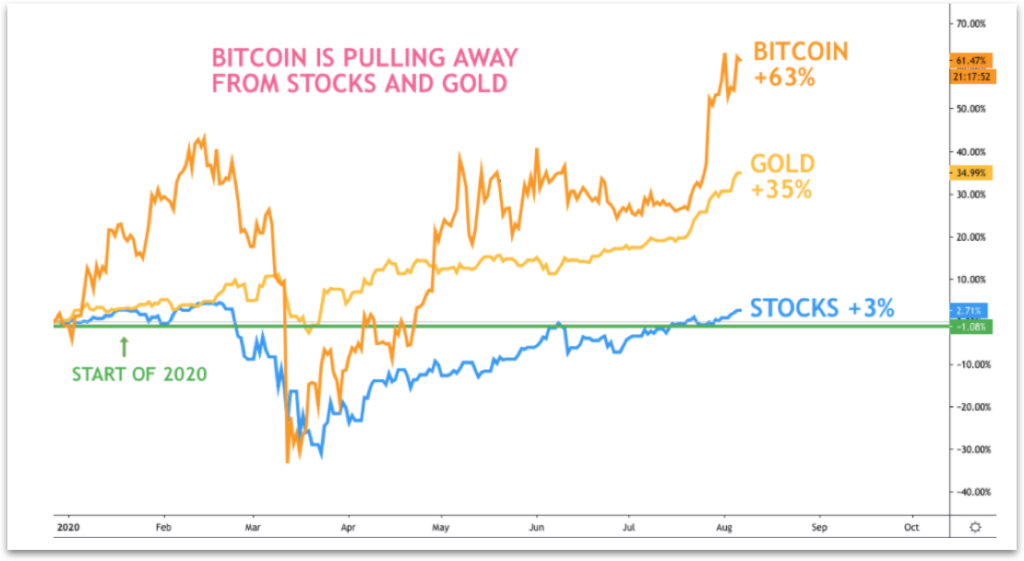

There is no doubt we’re in a clear uptrend for Bitcoin and Ethereum since bouncing hard off the March lows. Bitcoin is now up about 63% for the year while US stocks are up about 3%. Bitcoin is up almost 3.5x since the March lows. After a further 5% price surge on Wednesday, the bulls are clearly in charge. Gold is also making new highs as the FED looks at changing inflation policies and US congress debates more Coronavirus stimulus.

Bitcoin’s year-to-date returns versus gold and the S&P 500. (TradingView)

I read a Bloomberg article yesterday that said “bitcoin mania appears to be almost back in full bloom.” No doubt that’s true as we’re now seeing more user activity at Abra than ever before.

Bitcoin 4-hour price chart over the last 25 days. (TradingView)

Coindesk summed it up quite well: “Bitcoin is seen by many digital-asset investors as a hedge against inflation, and the bets are growing that governments and central banks will have to pump trillions of dollars more into the financial system to stimulate the economy out of the worst recession since the 1930s.“

It’s clear that Bitcoin’s price, for now, is no longer correlated with US stocks.

Ethereum has had an even more impressive run and, we might say, is now paving the way forward for Bitcoin and the altcoin spring we’re experiencing. Ethereum is up almost 300% since its March lows and has clear skies ahead with minimal resistance as it starts its march towards $500. The upcoming migration to proof of stake and other new technologies as well as Ethereum’s key role in the stablecoin mania have clearly created a bullish environment for the cryptocurrency to soar.

Ethereum 4-hour price chart over the last 25 days. (TradingView)

Ethereum is currently struggling with some price resistance at $409 near the 2018 highs. If it can’t break through $409 then I expect a short term pullback and consolidation before retesting so any pullback is likely a buy opportunity here. If Ethereum breaks through $410 then I expect Bitcoin to march towards $12,500 in short order, if not then expect Bitcoin to retest $11k, again any consolidation there is likely a buying opportunity.

Today’s Grayscale SEC announcement certainly won’t hurt Ethereum!

The Fed Wants to Help Bitcoin

As if the current macroeconomic situation weren’t bullish enough for Bitcoin, gold, and stocks the Fed is here to help. The US Federal Reserve appears ready to announce a policy that will make raising inflation to up to 4% a priority. Yes, in an economy with the highest level of unemployment since the great depression the geniuses at the Federal Reserve want to substantially increase your cost of living.

Make no mistake about it. This is probably the most bullish policy affecting the price of Bitcoin that we’ve ever seen.

In a fantastic newsletter article yesterday, Anthony Pompliano likened the Fed to the Wizard of Oz knowing that the wizard was really a fraudster and trickster using fake magic tricks behind the scenes to make everyone think he was all powerful. The Fed’s tricks are based on the assumption that the majority of the public is ignorant to what they’re doing and how money really works. In other words, buy Bitcoin.

Update on the Abra Interest Account

Last week we announced that all Abra users can earn 9% on USD stablecoins and 4% on Bitcoin and Ethereum deposits with the new Abra Interest Account.

The reaction has been awesome. We’ve seen millions of dollars in new account inflows since the announcement and our average deposit size in both cryptocurrencies and dollars has never been higher.

Whether you’re holding dollars or cryptocurrency Abra is now clearly the best place to hold both.

Tweet of the Week

Publicly traded companies are starting to diversify their cash holdings into bitcoin. Boardrooms across the country will begin to ask, “Should we be diversifying into bitcoin too?”

Hyperbitcoinization can happen faster than you can imagine. Be prepared. https://t.co/hRaMvr7Zdo pic.twitter.com/t86fNIOgFr

— Marty Bent (@MartyBent) August 5, 2020

Interesting find by Marty Bent as MicroStrategy lays out the case for buying Bitcoin in their quarterly earnings call. As corporate treasuries look to diversify out of dollars in the coming months Bitcoin and gold may be the clear winners.

See you all Friday on the next Money Talks. The Revolution has begun!

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.