Today’s Topics:

- Altcoins on the move

- Ethereum 2.0 update

- Stablecoins be rockin

- Feds allow US banks to hold crypto

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

On this week’s episode of Money Talks: Altcoins on the move; Ethereum looking super hot as 2.0 preps for final testnet … the Ethereum 2.0 promise looks to become reality; Are Stablecoins the future of banking? Feds allow US banks to hold crypto! As always, we answer all your burning Abra questions!

Join us Friday at 9 AM PDT: https://youtu.be/dNhcq7RkVtE

Altcoins on the move

We’ve seen this show before. As Bitcoin’s price range gets narrower – we believe the rubber band is winding up for a huge bitcoin move – we’re seeing lots of movement in many altcoins supported by Abra. Bitcoin broke through a very narrow price range to the upside this afternoon. Let’s see if this is the breakthrough we’re waiting for. My gut tells me we’re still 3-4 weeks away from the big breakout either way.

Some big gainers over the past few days include:

- Augur (REP) – up over 20% this month on news that version 2.0 of its prediction market will be launching soon. Holders of REP will receive new REP tokens as part of the fork. Abra users need not take any action as the exchange will be handled for you.

- Digibyte (DGB) – up over 12% this week on the heels of several distribution deals on mid tier exchanges and a debit card project with ZelaPay in the Middle East that looks interesting.

- Dogecoin (DOGE) – up over 30% this month! The fun with Doge just never seems to end. Even Elon is getting in on the Doge commentary. (disclaimer: yes I’ve been in the one and only, true DOGE-car.)

- Golem (GNT) – up about 5% this week. A recent research project released by their foundation showcasing a concept for identity authentication using Proof of Device, based around Intel’s SGX technology which enables super secure instruction sets on their CPU’s.

- Navcoin (NAV) – also up about 5% this week. They seem to be riding the wave of crypto yield seeking investors. Something we’ll have more to say about in the coming days!

- NEM – (XEM) – up over 10% this week. While still down from its crazy spike early in the year, NEM is still up big for the year and seems to be on a methodical march towards that high. Their big ambitions to create a truly decentralized social ecosystem include the DAO Maker project.

- Stellar (XLM) is now up over 35% in the past 30 days as it continues its impressive growth. Thanks to the Stellar Development Foundation for having me on their quarterly update call last week. It was a lot of fun. We gave a sneak peek of our big announcement coming next week (sorry can’t give it away just yet.)

As a quick follow-up to last week’s commentary on Robinhood vs Crypto, Tesla has clearly broken out as the Bitcoin of the equities world. As of today, Tesla is up over 350% vs its March lows. That is an absolutely incredible run. As I said, I expect to see a big move in Bitcoin over the next 60 days, possibly big moves in both directions. The last two times Bitcoin volatility reached these lows it exploded in price soon after, once to the downside and once to the upside.

Crypto Spotlight

Latest Crypto News:

- Ethereum ‘Flippens’ Bitcoin to Become the Most Used Blockchain (Cointelegraph)

- U.S. bank regulator grants authority for national banks, federal savings associations to custody crypto

(The Block)

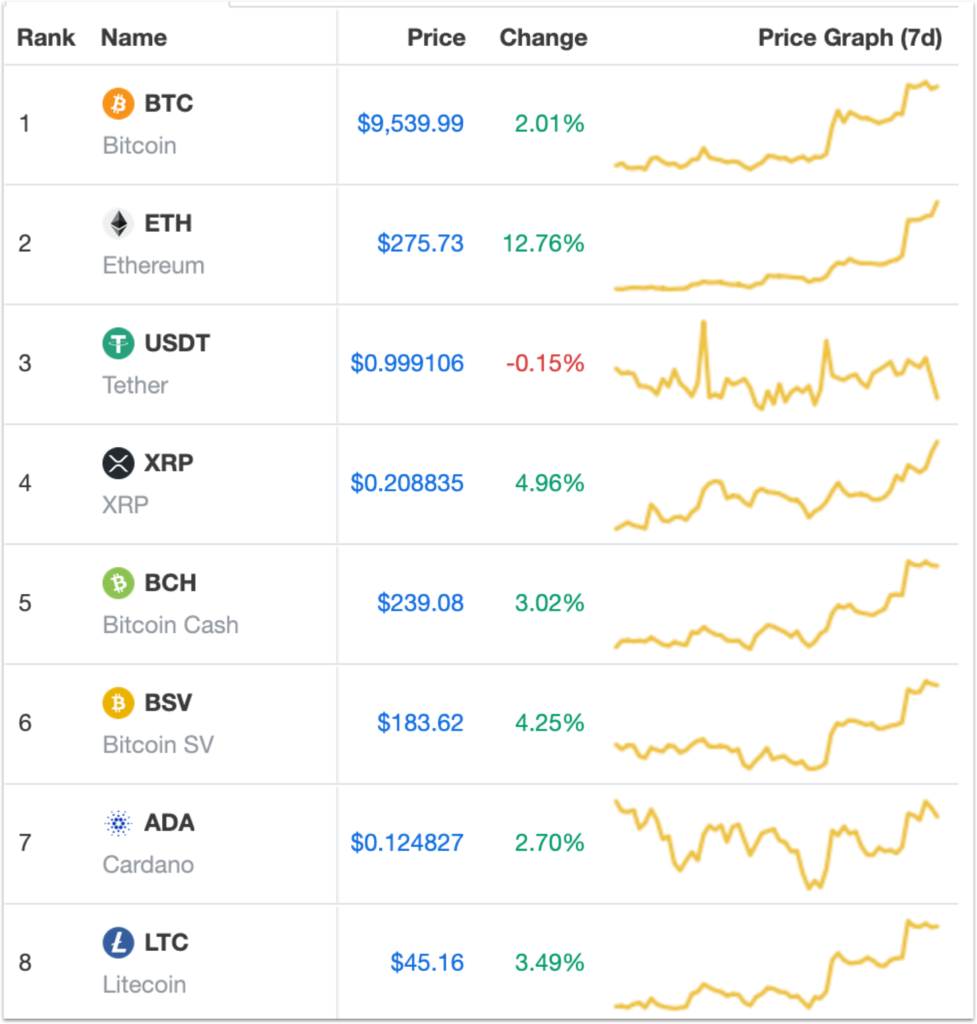

Market data summary via Coinmarketcap as of 9:45 AM PT July 23

Ethereum 2.0 Update

The official testnet for Ethereum 2.0, called “Medalla,” was recently released. It looks like Ethereum 2.0 may actually be official before the end of the year. Ethereum 2.0 developers released the specifications for the “official” testnet on Wednesday, ahead of a presumed end-of-year launch. Apparently “Medalla” is the name of a Buenos Aires metro stop. Shout out to Abra’s Argentina based devs!

This release has been multiple years in the making. I covered the details of Ethereum 2.0 in a previous newsletter here. This is certainly exciting and a big deal for both the cryptocurrency and the stablecoin ecosystem.

Stablecoins be rockin

As you all know, Abra supports a whole bunch of stablecoins: Tether, True USD, Paxos, USDC, Dai and others.

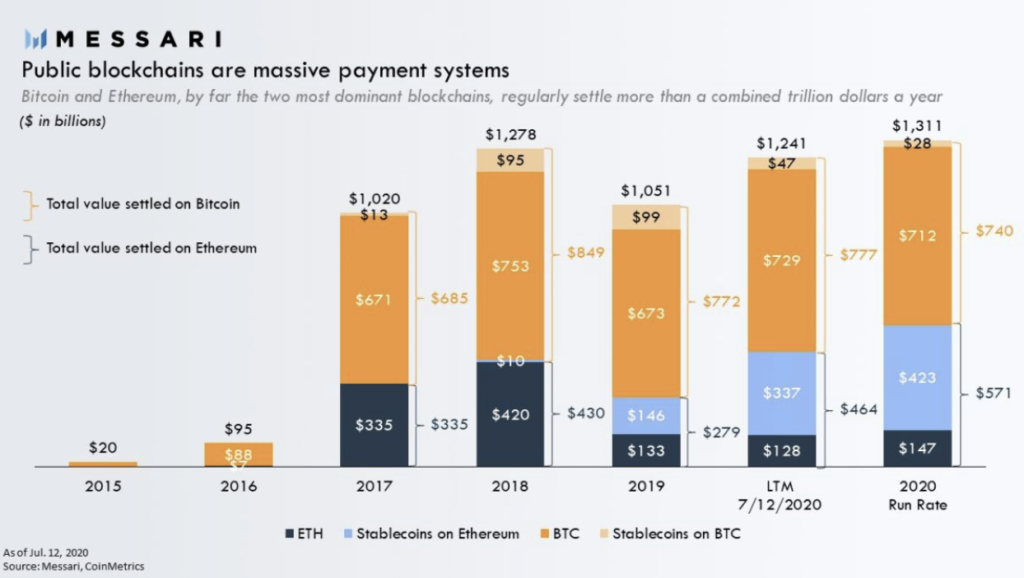

These stablecoins will account for about $500 Billion in crypto transaction volume in 2020 according to Messari. Abra estimates there are over $12 Billion in stablecoins in circulation today. Tether still commands the majority of the market but all of the USD backed coins are showing strong growth.

I believe that stablecoins will start to compete with traditional banking in three areas in the next 12 months:

- Lending – stablecoins are ideal for cross border lending and adding credit balances to debit cards via p2p loans

- Merchant payment – expect to see the major card networks and other payment processors start to dabble in stablecoin based merchant settlement. Removing the banks from this flow will save everyone (except the banks) a lot of money.

- Money transfer & remittances – Libra (via Facebook) was built on the premise that stablecoins and crypto could fix money transfer. Many crypto companies have their sights set on this problem.

Feds allow US banks to hold crypto

We had some breaking news come in just as we were about to go to press with our newsletter. The US Treasury Department oversees the issuance of national bank charters in the United States. The specific group within Treasury that issues these charters and oversees banks is the ominous sounding OCC or Office of the Comptroller of the Currency. Today the OCC clarified in a public letter that national banks have the authority to provide fiat bank accounts and cryptocurrency custodial services to cryptocurrency businesses. That is a very big deal indeed.

The implications of this are far reaching. That means that Abra could in theory become a nationally chartered bank in the US. It also means that existing national banks could eventually compete with Abra. Welcome to the party banks!

Tweet of the Week

Banks in the US can now provide custody for cryptocurrencies.

USDT as an easier, faster “checking account” than USD and Bitcoin as a 1000x better savings account.

Crypto people are not crazy, just a few years ahead of trends.

— Muneeb (@muneeb) July 22, 2020

Simple and to the point, Muneeb Ali, co-founder of Blockstack nails it with this tweet. Stablecoins are a better way to move money. Bitcoin is a better way to save money and fight the inflation bug. Well said @muneeb!

See you all Friday on the next Money Talks!

Peace and Love,

Bill

Disclaimer:

Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary, and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

Se abren las compuertas: Los usuarios de EE.UU. están teniendo más accesibilidad a las criptomonedas | CriptoGuru

1367 days ago[…] explicó además en una entrada del blog de Abra que las implicaciones de las acciones de la OCC son de gran alcance, escribiendo: «Abra […]