At the advent of Bitcoin, the cryptocurrency market was in its infancy, with very few users. It remained primarily underground and very niche. Most financial institutions ignored and wrote off cryptocurrency as a fad, a fleeting trend.

Fast forward 12 years, and we’re looking at a much more mature crypto market that boasts over 300 million holders and a market size above $2 trillion.

Coupled with the explosion of NFTs and the Metaverse, banks are scrambling to catch up and meet consumer demand for this new financial asset class.

Banks are Creating CBDCs to Compete with Crypto

Several banks have developed their own central bank digital currencies, or CBDCs, to compete with the widespread adoption of cryptocurrency. CBDCs are government-issued or central bank-issued digital forms of money.

CBDC Drivers

According to a 2020 report from the BIS, Banks For International Settlements, key drivers of CBDCs are payment safety and efficiency, monetary policy, financial stability, and financial inclusion.

CBDCs by The Numbers

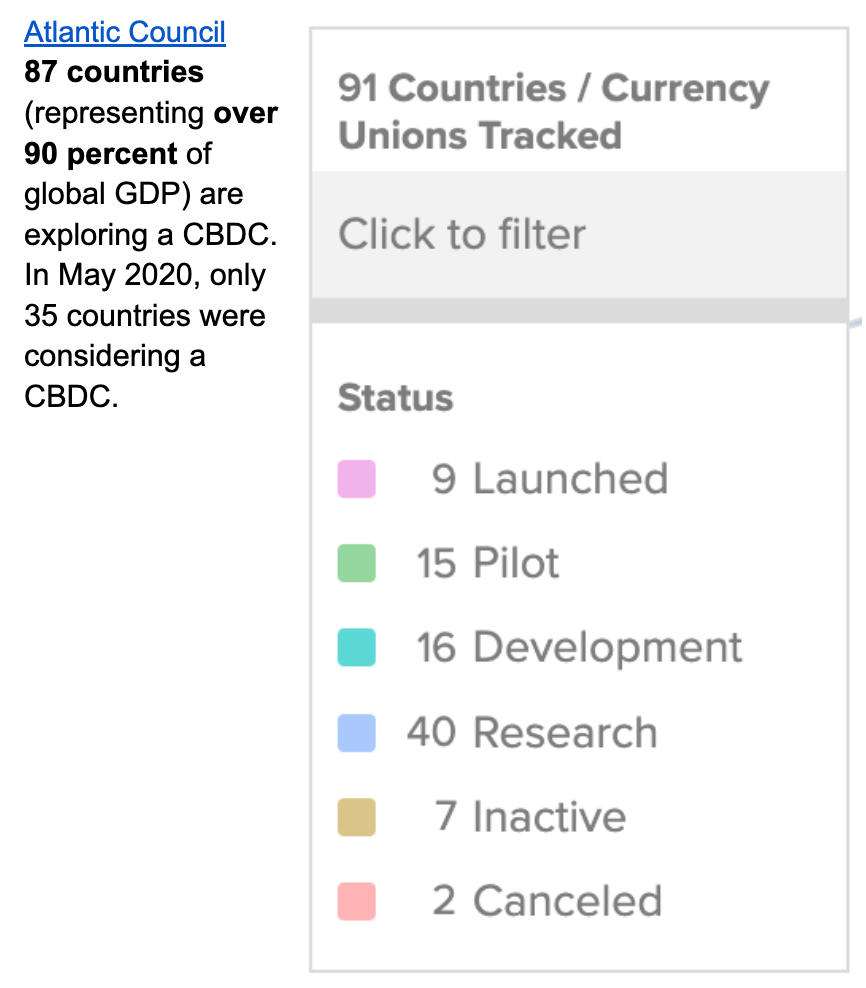

Let’s look at a breakdown of countries developing or deploying CBDCs from the Atlantic Council’s Tracker.

Why Do CBDCs matter?

CBDCs are significant because of their potential to replace traditional forms of cash. Their usage in banking will create greater financial inclusion for underbanked and unbanked populations, allowing them a safe and secure way to have a store of value via mobile phone.

Who’s Banking on Public & Private Blockchain?

Public vs. Private Blockchains

There are two main types of blockchain, private and public blockchains. Public blockchains are very decentralized and open to all; private blockchains operate on fewer computers (less decentralized) and are available only to a select group.

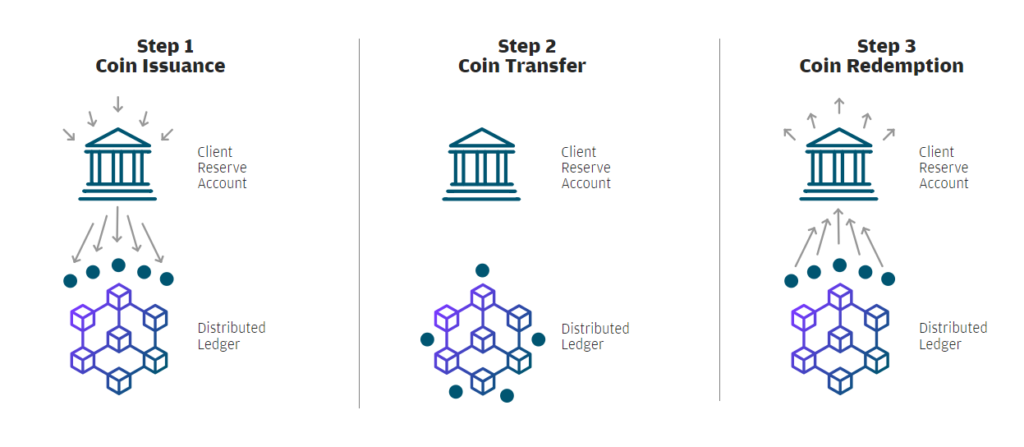

A great example of a bank using a private blockchain is Liink and JPM coin by J.P. Morgan. Liink enables “financial institutions and corporate users to make secure, peer-to-peer data transfers with faster speed and more control.”

Image Credit: JP Morgan

Incorporating blockchain technology into traditional banking will make it incredibly cost-efficient and results in lower transaction fees. Blockchain also provides faster transaction speeds and quicker cross-border payment settlements than legacy systems like SWIFT.

Crypto Cross-Border Payments Settlement for Banks

An increasingly popular crypto trend amongst big banks is adapting the technology for cross-border payments.

In traditional finance, international payments can take a few days or even a week plus for payment to post/settle. Fees for international transactions are high with banks and traditional financial institutions.

According to a Mercy Ventures report on digital work and cross border payments, “Cryptocurrency payment cuts down the transaction fees by 93% regardless of the size of the payment,” according to the pilot, which was conducted in Nairobi, Kenya to test whether digital stablecoins and mobile wallets could ease frictions and reduce costs in cross-border payments.”

Banks are partnering with blockchain technology companies like Ripple for cross-border payments solutions.

Partnerships with blockchain solutions providers are a prime example of how blockchain can solve real-world problems plaguing the finance industry, such as cross-border payments.

Banks Opting Out of the Crypto Frenzy

Cryptocurrencies are on the rise, but some banks are still hesitant to adopt them. A few banks have chosen not to embrace cryptocurrency. Institutions, in some cases, block customers from using their accounts to purchase crypto for several reasons.

Some of these reasons include (1) Fears of fraudulent or illegal activities, (2) It’s illegal in some of the countries they operate in to accept crypto, (3) Concerns over their brand reputation being tarnished by accepting cryptocurrency, and (4) Unwillingness to change; easier to stick with the status quo.

On the other hand, there are entities like online-only banks, such as Revolut, that have embraced the change and proudly promote their acceptance of cryptocurrency.

The Future of Finance

At the heart of the push for banks to address the changing financial landscape is their desire not to become obsolete or for cryptocurrency to supplant them in the race to control the future of finance.

The challenges faced by banks concerning cryptocurrencies are numerous. The future of banking is still uncertain, but it’s clear that cryptocurrencies are here to stay. As such, banks must adapt or risk being left behind.

Trade With Abra

Abra supports 75+ cryptocurrencies and counting.

Download the Abra app and conquer crypto today!

Download App

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.