You can finally sit back and relax when it comes to trading crypto. Abra just released a new, simple feature to automate your crypto trading experience on Abra — recurring transactions.

Our recurring transaction feature enables you to schedule automatic ACH deposits from your bank and execute recurring crypto trades on the Abra app.

Recurring transactions give you full control and flexibility, making your crypto journey quick and easy.

Sit Back and Invest

When scheduling recurring transactions, all you need to do is choose the crypto you want to buy, choose an amount, and then choose how frequently you want to buy the asset — weekly, twice a month, or monthly. It’s up to you.

Abra will then automatically repeat that purchase until you change or cancel it. This feature makes it easy to build good saving habits or use Dollar Cost Averaging to mitigate the risk of volatility in the crypto market.

What Is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) is a trading strategy in which you purchase a specific amount at a set time interval — no matter the market conditions.

The idea behind DCA is that you don’t overreact when the value of your portfolio increases or decreases.

You’re simply focused on the long-term market trajectory, with the hope that the value of your portfolio increases over several months or years.

An automated DCA strategy is useful if you have a set amount that you want to trade, but don’t want the burden of trying to time the markets to trade all at once. Spreading out your trades over weeks or months makes it less likely that you purchase during all-time highs or local highs.

How Recurring Transactions Work — ACH Deposits

Here’s a look at how it works:

- Open up the Abra App

- Click on “Add Money”

- Then click on Bank ACH Transfer

- Once you’re on that screen, you can choose the asset you want to buy, and the amount.

- Now, right below the amount, you’ll see “Schedule.”

- And from there, you can set the amount and frequency — again weekly, twice a month, or monthly — for your recurring ACH deposit.

How Recurring Transactions Work — Crypto Trades

Here’s a look at how it works:

- Open up the Abra App.

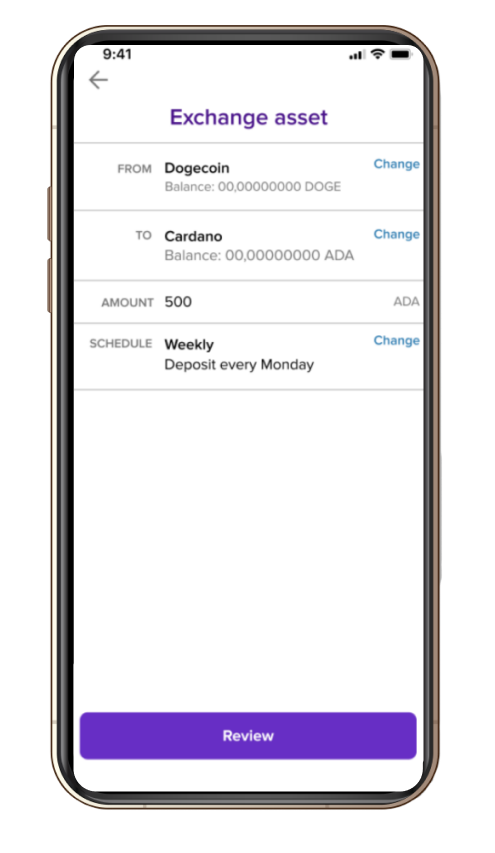

- Click on “Exchange”

- Click on “Schedule a recurring transaction instead” at the bottom of the screen.

- On the “Exchange from” screen, select a cryptocurrency you want to sell from the list. You must already have an available balance of that cryptocurrency in your Abra wallet.

- On the “Exchange to” screen, select a cryptocurrency you want to purchase.

- Finally, on the “Exchange asset” screen, you can set the amount and frequency — again weekly, twice a month, or monthly — for your recurring crypto trade.

Recurring Transactions Limits

Please be advised that there are limits to how many transactions and the amounts you can purchase.

There is a maximum of five simultaneous recurring transactions allowed per user.

The daily minimum is $5 per transaction, and the maximum is $20,000 per day across all scheduled transactions per user.

Recurring ACH deposits are only available in the U.S. Recurring crypto trades are available in the U.S. and globally.

Try Abra Recurring Transactions Today

If you haven’t already done so, download the Abra app (iOS, Android).

Once you’re on the app, be sure to try out the new feature by scheduling recurring transactions for ACH deposits and/or crypto trades.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.