Today’s Topics:

- A Brief History of Failed Money

- Currency Inflation

- Gold Standard and the Dollar

- Stablecoins, CBDC – Lipstick on a Pig!

- Enter Bitcoin, Exit Everything Else

- Tweet of the week

This week on Money Talks, Friday at 9 am PT (noon ET).

- In this episode, we will have a special focus on inflation of fiat, the history of failed currencies, and what it means for Bitcoin and Ethereum.

- Love #MoneyTalks? Help us spread the word for a chance to win $200 in Bitcoin(BTC). More details here.

As always we will answer all your questions on crypto and investing. Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT: https://youtu.be/vEdddsPQ9O4

I believe one can not fully appreciate why people like myself are so bullish on Bitcoin as an unbelievable investment opportunity without understanding the history of money. There are awesome books out there if you want to read about this in detail. Here is my somewhat oversimplified perspective.

A Brief History of Failed Money

For thousands of years, people have transacted. Barter, collectibles, IOU’s, ledger entries, and currencies have all had their place in the history of economics. Barter is the simplest form of transaction. Two sheep in exchange for one bag of rice is a simple barter transaction. Collectibles have taken dozens of forms from precious metals, to yap stones or even seashells. In theory, any item’s value could be negotiated to be the equivalent amount of some collectible. An IOU (or I owe you) means that if you give me two sheep today, I promise to give you the equivalent of two sheep, or possibly more than two sheep, in the future. Generally, an IOU is recorded in an explicit or implicit contract between two parties.

Ledger entries allow productivity to be shared across a larger group of people. If you provide something to the group, such as time spent building a hut, you receive a credit in your ledger. Take something from the group, such as a cow to feed your family, and you have a debit in your ledger. If your credits and debits get too far out of whack the group may ban you or forcibly take your possessions. In small groups, a ledger can completely replace the need for other forms of money.

Currencies have generally taken two forms. The first being collectible backed currency, such as currency backed by gold. The second being government backed currency where the currency, not backed by anything other than the government, i.e., police with guns and the judicial system, is the only legal tender you’re allowed to use to fulfill obligations such as tax payments. Today every government in the world forces us to transact in government backed currency only. The last vestiges of gold (or collectible) backed currency disappeared 30 years ago.

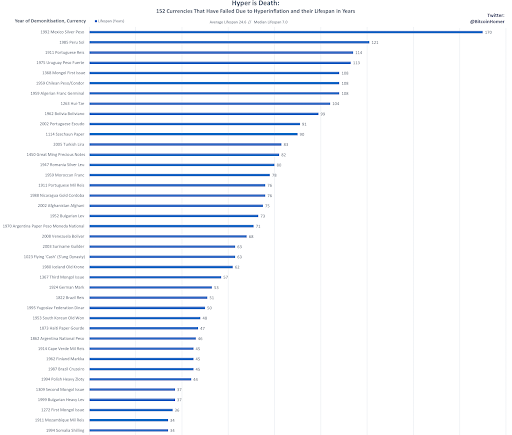

The above chart is a sliver of a much larger infographic showing over 150 currencies that have failed and their life spans. You can see the entire infographic chart here.

Over time every form of money created by man has failed in some way with one exception. Gold backed money has been a resounding success throughout history in maintaining its value. We’ll come back to gold in a moment. In the meantime, governments don’t want money to retain its value. Governments want to erode the value of your money to incentivize you to spend it in order to manage their economy. I refer to the government driven economy as the Great House of Cards. It was evident in 2008 what happens when the Great House of Cards starts to fall. Things get really scary really quick. This is the great lie of government driven capitalism versus true free enterprise. I would claim that the latter truly doesn’t exist today but will soon enough. Government driven capitalism was great to get us all this far but its time is coming to an end.

Currency Inflation

Yap stones were actually a very good store of value for certain items. But they were terrible for bartering in small items. They were too big to move and proving ownership was often difficult. It was also difficult to use them for bartering in cheap items as the stones were considered too valuable.

Currency on the other hand is very easy to move around and very easy to transact in.

Why does currency keep failing? To understand that we need to understand the difference between price inflation and currency inflation. Currency inflation exists in order to prevent deflation or contraction in an economy.

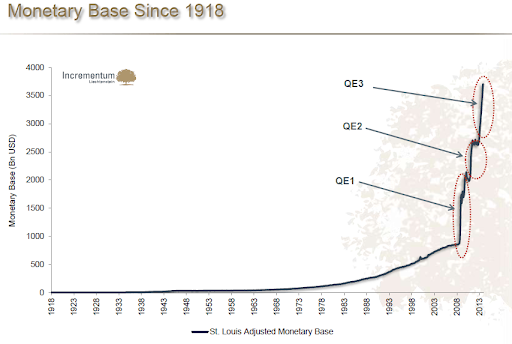

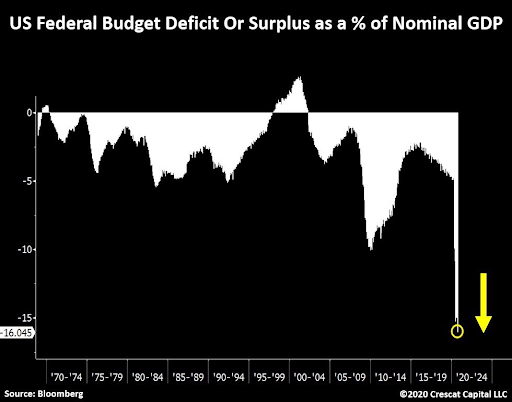

Governments believe that they can affect the unemployment rate directly by growing and contracting the money supply. This has proven to be true. However, when the currency is based on gold there is only so much currency inflation that can be achieved since the gold supply is limited. Without a gold standard currency, inflation can be infinite by simply printing more money. Governments have been using exactly this tactic over the last 30 years. They simply increase the money supply without end in the belief that inflating an economy that is in a deflationary mode will create jobs while keeping the value of the currency from falling at the same rate. That is a folly as history has proven time and again.

As stated, currency inflation usually causes price inflation but the two are different. People tend to focus more on price inflation as it affects them more in the short run but in the long run currency inflation is way more important. Think of currency inflation as death by a thousand small nicks and cuts over a protracted period of time.

Look at this way. If you owned the Mona Lisa and found it was worth $1 billion and then found out that Da Vinci painted two Mona Lisa’s back-to-back it would stand to reason that the first one would now be worth less than $1 billion, probably a lot less. However, when we keep printing money, we seem to forget this basic idea.

Part of the reason Americans forget this idea is that so many other countries utilize dollars which creates artificial demand. You’ve heard this idea referred to as the dollar’s reserve currency status. Other countries are less likely to forget this idea. Just ask people in Argentina, Belarus, Hungary, Peru, Zimbabwe, Turkey, Venezuela, or anyone of over 50 countries if printing more money decreases the value of their currency dramatically.

Gold Standard and the Dollar

“We have gold because we cannot trust governments,” – President Herbert Hoover in 1933.

According to Investopedia: “The gold standard is a monetary system where a country’s currency or paper money has a value directly linked to gold. With the gold standard, countries agreed to convert paper money into a fixed amount of gold. A country that uses the gold standard sets a fixed price for gold and buys and sells gold at that price. That fixed price is used to determine the value of the currency. For example, if the U.S. sets the price of gold at $500 an ounce, the value of the dollar would be 1/500th of an ounce of gold.

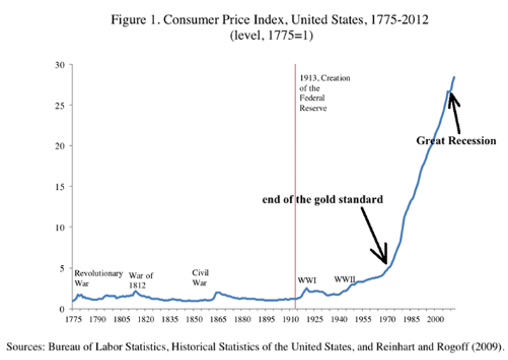

The gold standard is not currently used by any government. Britain stopped using the gold standard in 1931 and the U.S. followed suit in 1933 and abandoned the remnants of the system in 1973. The gold standard was completely replaced by fiat money, a term to describe currency that is used because of a government’s order, or fiat, that the currency must be accepted as a means of payment. In the U.S., for instance, the Dollar is fiat money, and for Nigeria, it is the Naira”

The gold standard has been a resounding success in that it has proved an outstanding means of preserving wealth creation for over 4,000 years. This makes sense given that there is a relatively fixed supply. I say “relatively fixed” since we do “find” more gold every year. But this property of wealth preservation is exactly why governments don’t like gold today. When an economy is contracting governments want to flood an economy with money. But with a fixed supply of money, they can’t do that. Gold not only fixes the supply of money, but trade imbalances can also mean that a country’s gold supply can shrink dramatically. So, while gold backed money is excellent at preserving your wealth it is bad as a tool for managing an economy. As history has shown so are governments.

Saifedean Ammous who appeared on our podcast a few weeks ago has written an excellent book, called “The Bitcoin Standard”, which describes in excellent detail why the gold standard worked so well. An excellent brief history of the gold standard can be found here on Investopedia.

The bottom line is that poor government planning and policies have led to an almost perfect inverse correlation between the value of money and the value of gold. This didn’t need to be the case.

Stablecoins, CBDC – Lipstick on a Pig!

In the same way that paper money is used to tokenize gold in the analog world, we have figured out how to create digital tokenization of fiat money in the form of a stablecoin. Central banks, particularly in China, are now looking to get in on the action by issuing their own central bank issued digital currency or CBDC. The difference between a CBDC and a stablecoin is that the CBDC is the fiat money itself whereas a stablecoin is a token representing fiat money stored in a bank account somewhere. In other words, CBDCs require one less layer of trust to make the tokenized fiat currency work.

USDC, Tether, Dai, True USD, Paxos all use Ethereum smart contracts to store dollars. While Ethereum is currently the blockchain of choice for tokenizing fiat that will likely change in the future with more currencies being issued across many different blockchain platforms. Stellar, an investor in Abra, is a highly scalable platform for creating new currencies. USDC recently announced support for Stellar. Tether was originally created on Omni but now supports multiple chains. The biggest risk in centralization around Ethereum is scalability. It is now impossible to do person to person transfers of less than $10 on the Ethereum blockchain due to scalability issues. Ethereum 2.0 promises to change this but that will take time and has technology risk.

In the meantime, the value of stablecoins is clear. The ability to tokenize money in the crypto world so that crypto users can avoid the banking system while moving in and out of traditional cryptocurrencies is a big deal and a big-time hassle saver. In the future, stablecoins and CBDCs will be used for money transfer, lending, and other payment services traditionally served by banks.

Ultimately stablecoins erode in value along with the underlying fiat currency they represent. That is the irony of the poorly named stablecoin.

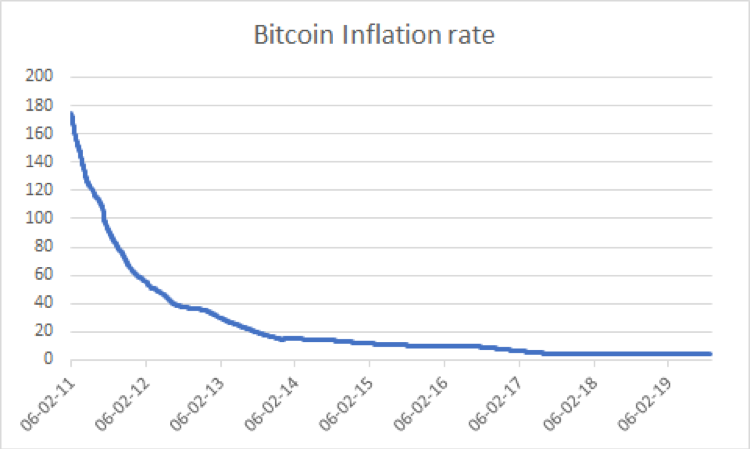

Enter Bitcoin, Exit Everything Else

Bitcoin combines two of the concepts of money into a new form of currency: collectibles and the ledger. Bitcoin is a form of digital collectible that is scarce. It is scarcer in fact than any other item used as money in modern history. Bitcoin’s ledger or blockchain implements a banking system that requires no village accountant to track its whereabouts. The ledger does all the heavy lifting of tracking debits and credit across every user globally. No central trust required.

Unlike gold, Bitcoin is provably scarce over time. In fact, we know exactly the maximum number of Bitcoin that will ever exist. We have no idea how much gold there is on our planet, solar system galaxy, or universe.

While fiat inflation will ultimately lead to its demise it will help accelerate bitcoin to new and stratospheric highs. Never before have we had a hard asset like this and I can’t imagine there will be another one anytime soon.

Tweet of the Week

It is the beginning of the end for the banks.

Adapt or perish.

Time to pivot towards the digital asset ecosystem.#Bitcoin is the pristine collateral at its center.

Whole new world now growing up alongside the legacy system.

“It’s never too late to do the right thing.” pic.twitter.com/MiFLs30a61

— Dan Tapiero (@DTAPCAP) October 16, 2020

This week’s Tweet is from Dan Tapiero, one of the most-known veteran global macro investors today. As Dan says, it’s time to pivot towards the digital asset ecosystem after all “It’s never too late to do the right thing”!

See you Friday morning for Money Talks, 9 AM PT sharp!

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.