Today, at the North American Bitcoin Conference, I announced the next phase of Abra’s global expansion: Next month, we’ll be enabling Abra worldwide, activating a global network of Tellers who can transact in over 50 currencies, including directly in Bitcoin. This means that anyone with a smartphone in any country can send or receive funds in most major currencies and can cash in or out of their Abra wallet, even without a bank account.

Bitcoin is key to these efforts. While Bitcoin has always been a large part of what we do, it’s been hidden in the background up until now. Last year we launched Abra in the Philippines and the US, and validated that we could release a digital currency product using Bitcoin that didn’t confuse the average consumer. Yes, my 70+ year old mother can use Abra with no help from me. Cool.

Now we’re adding direct Bitcoin support (for depositing and withdrawing) in the Abra App while maintaining the super-user-friendly experience from stage one. Once we launch, any Abra user can use Bitcoin via any third party Bitcoin Wallet to add and remove funds from their Abra App regardless of which currency they’re holding in their Abra Wallet. (As a reminder Abra is a non-custodial digital currency wallet. Abra has no access to the user’s private key, even in the instance where the consumer chooses to hold US Dollars.)

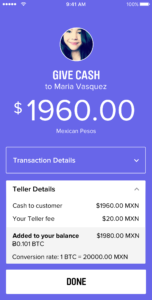

We’ll also be launching a network of Abra Tellers – what some people call our Human ATMs – to enable people around the world to use Abra.

So at global launch, we’ll support the following scenarios:

- Bitcoin wallet: Buy, hold, and sell Bitcoin with Abra in addition to any of 50 fiat currencies

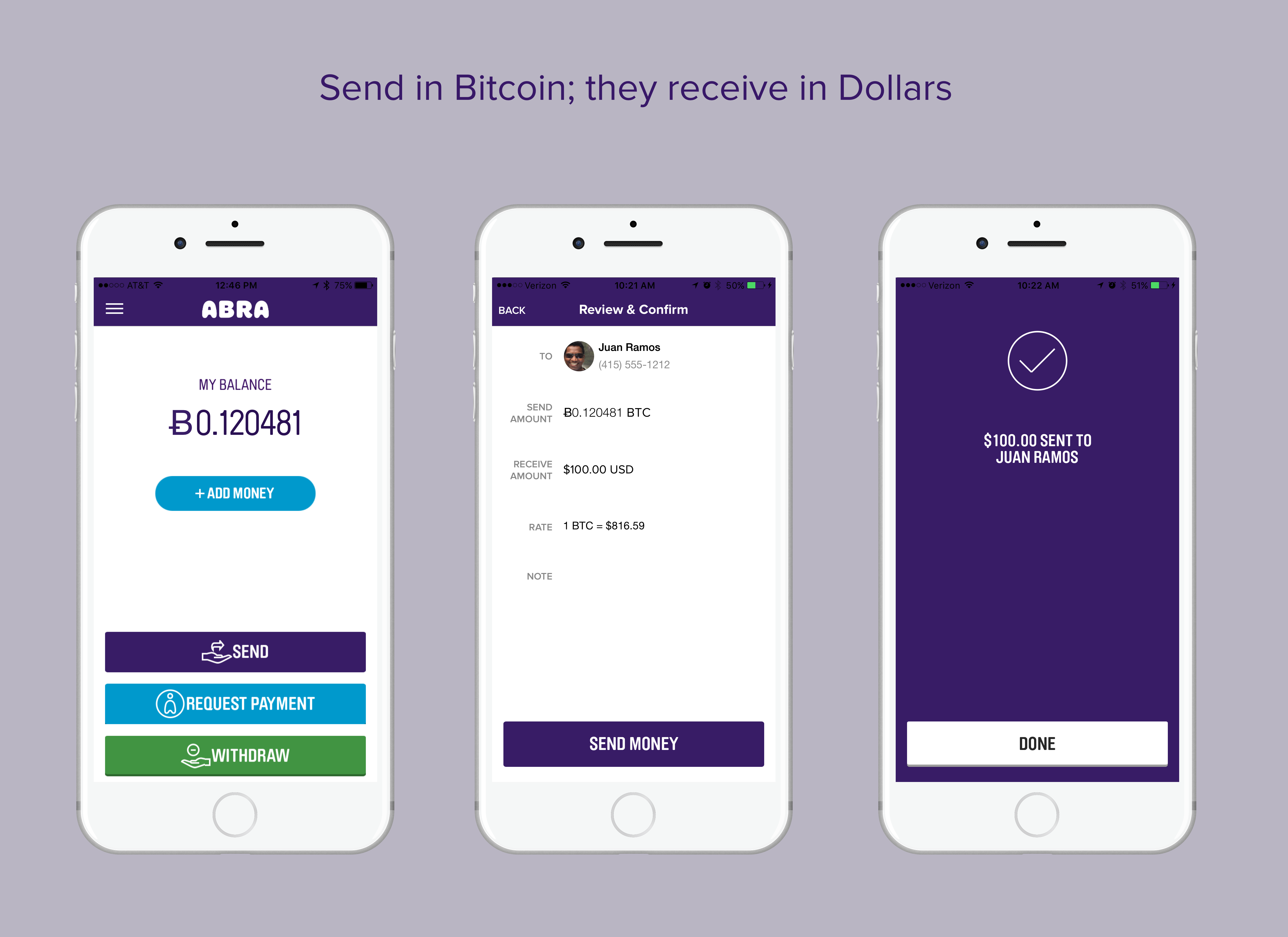

- Bitcoin to fiat: Send Bitcoin to anyone worldwide, and the recipient can receive in any of our supported currencies, which they can then cash out via a Teller. The recipient doesn’t even have to know what Bitcoin is, as we’ll take care of the currency conversion.

- Fiat to Bitcoin: Cash in via a Teller in any of our supported currencies (again, without needing to know about Bitcoin), send to anyone worldwide, and the recipient can receive and/or cash out in Bitcoin

- Fiat to fiat: any user can send money in any of our 50+ supported currencies to any other user, and both parties can cash in and out via their local Teller.

- Become a Teller using Bitcoin: This is huge! If you’re an existing Bitcoin trader you can now use that Bitcoin to become an Abra Teller and process deposits/withdrawals for people who don’t know what Bitcoin is (Build your own Travelex for digital currency!)

One of the things I’m most excited about is our support for the global Bitcoin trading community. We estimate that $30-$40 million per week is now traded in person in “fiat vs Bitcoin” in over 75 countries. With our support for Bitcoin Traders as Abra Tellers, Bitcoin Traders can now hold Bitcoin in their Abra App but process deposits and withdrawals in any world currency that the Abra App supports. A consumer holding US Dollars meets a Teller, and processes a withdrawal to receive Argentinian Pesos. Neither party even knows that a dual currency trade transaction took place! Wow.

One of the things I’m most excited about is our support for the global Bitcoin trading community. We estimate that $30-$40 million per week is now traded in person in “fiat vs Bitcoin” in over 75 countries. With our support for Bitcoin Traders as Abra Tellers, Bitcoin Traders can now hold Bitcoin in their Abra App but process deposits and withdrawals in any world currency that the Abra App supports. A consumer holding US Dollars meets a Teller, and processes a withdrawal to receive Argentinian Pesos. Neither party even knows that a dual currency trade transaction took place! Wow.

This is a huge step forward in realizing our vision of anyone being able to send money easily to anyone else in the world, instantly, privately, and securely. We’ll be rolling our Teller program out globally, starting next month. Tellers can make money while helping their community send and receive money.

If you’re interested in becoming an Abra Teller, we encourage you to apply right away! Please make sure you have the latest app version downloaded, and submit your details right from within the app. Our onboarding team will contact you as we review applications.

We’re excited for this next stage in our development, and look forward to getting your feedback as we progress!

[For additional images, please see the Downloads section of our Press page.]

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app on Android or iOS to begin trading or earning interest on cryptocurrency today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

karazencefilsurubu

1459 days agonice job.