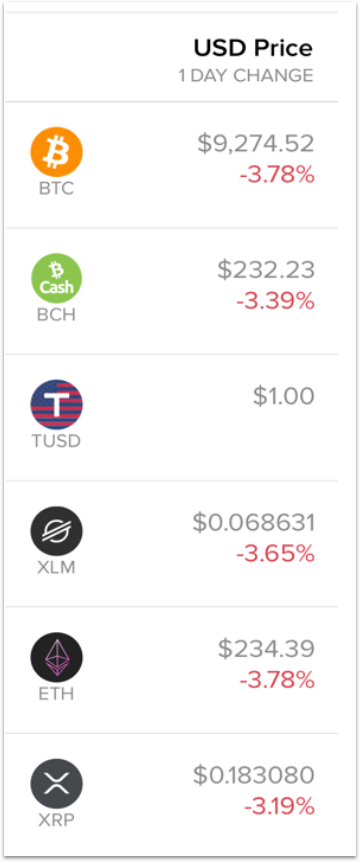

Market data summary via Abra App as of 5:30PM PDT June 24

This week on Money Talks, Friday at 9AM PDT (noon EDT)

Our next Money Talks AMA will air live on Friday at 9AM PDT on our YouTube channel at https://youtu.be/vukwCIAUrwI. I’ll be going deeper on topics covered in this blog as well as answering Abra community questions on any topic. You can submit topics or questions for the team in real time in the chat stream or in advance to [email protected]. See you all on Friday!

A Reckoning is Coming… Who are the winners and losers going to be?

Bottom line… I believe that the number of government fiat currency failures is going to increase dramatically over the next five years. Even the Euro is at serious risk as German citizens’ interest in supporting the economies of Spain and Greece is going to fall off a cliff. Consumers and mid-sized businesses in emerging markets will create massive demand for the US Dollar in the short term. Bitcoin and gold exposure among institutional investors and the global upper middle class will dramatically increase in the next 36 months but Bitcoin is going to be the big winner. There is a coming “lost decade” for stocks and bonds that means real returns on savings will be at an all time low for some time. Now let me explain how I come to these conclusions.

First let’s talk about stocks

I’ll start with the last point first. It’s clear to me that unlike popular belief, the US Federal Reserve (i.e. the Fed) is not directly propping up stocks. The Fed is reinflating banks and the treasury, not the stock market. The Fed is clearly giving a positive psychological boost to the markets but the bottom line is that the Fed is not directly reinflating the stock market. How do I know this? The math is actually simple.

The Fed has pumped $2.3 Trillion into the US economy in about 100 days. But where did the money go? Not into the stock market. The money went into bank reserves held at the Fed, and the US Treasury’s checking account, also at the Fed. Together, these have risen $2.5 trillion, $180 billion more than the Fed’s liquidity injections. Woah, what?

So why the hell is the stock market going up? As I said, the Fed’s effect on the stock market is psychological, not direct. By buying debt and keeping interest rates at zero, the Fed is giving a psychological boost to stocks. However, this is compounded by a combination of institutional investors expecting a V-shaped recovery while ignoring this year’s macroeconomic situation or the fact that there is no vaccine or herd immunity clearly in sight; and retail investors day trading on Robinhood, Ameritrade, e-Trade and the like. In other words, the crazies are now running the asylum. That often doesn’t end well for either the crazies or the innocent bystanders.

The US Household savings rate in May was the highest ever recorded at over 30%. That is a staggering number for a non savings culture. US citizens are scared and are preparing for the worst while at the same time taking advantage of lower monthly expenses due to sheltering in place. Some of that money has made its way into stocks but not as much as many believe. Remember stocks are up over 40% since their low in March but are still below their peak reached in February of this year and the decline started before the government mandated lockdown. I do not expect stocks to reach their prior February peak again this year. Of course, I could be 100% wrong. We’ll see.

As the savings rate starts to decline in June and July and the effects of a second wave of business closures become apparent, stocks are in for a bumpy ride. The full recovery will likely take years and real returns on stocks will be hard to come by. The winners will be in tech and healthcare, particularly enterprise tech as businesses look to increase productivity as they did in the 90’s. Healthcare will get a boost from the global Covid-induced paranoia.

Now let’s talk about fiat currencies

I was rereading an excellent article from Brookings on the coming euro crisis: “The devastating impact of COVID-19 now threatens to reawaken the unfinished business of euro crisis that had already left behind deep social inequalities and animosities between EU member states over the imposition of austerity policies. Such animosities ultimately led populist and nationalists gain momentum and political strength. Now, the potential failure to come together in the face of a pandemic that disproportionately affects some countries more than others threatens to undermine the quest for shared long-term prosperity and the future of European integration, unity, and economic cohesion.”

The bottom line is that any reinflation via massive shared debt issuance is going to be opposed by Germany, France and the Netherlands while being supported by the southern European countries plus Ireland. It’s going to get ugly folks.

Emerging markets including many countries in Latin America, South East Asia and Africa have it much worse than we do in the US or Europe as their currencies have been hit really hard by the Covid19-crisis. These markets have started to see a flight to dollars which is likely to accelerate after initially abating. As a result, local banks will be forced to limit consumers’ ability to hold US Dollars which will cause an explosion in new service providers offering alternative accounts including crypto based stablecoins blacked by US Dollars such as those offered by Abra. People in Venezuela, Zimbabwe, Libya, South Africa, India were already experiencing this phenomenon pre-Covid19.

What about Gold and Bitcoin?

This price of gold just reached an eight year high. Why? Gold is the de facto reserve asset held by many central banks. It’s the most commonly held hedge against inflation and geopolitical uncertainty. While many emerging market and savings conscious consumers are forced into US Dollars in the short term, many institutions fearful of a global trade war post Trump and Brexit may simply also buy gold more instead of just holding dollars. Hedge funds are already starting to flock to gold in larger numbers as a hedge against the S&P 500.

Bitcoin and the stocks are temporarily correlated because of the increased consumer savings rate I mentioned above. I expect the two to diverge early next year as the consumer savings rate starts to move towards pre-Covid19 levels. That means any S&P 500 induced dip in the price of Bitcoin is likely an excellent buying opportunity for those looking to dollar average into their Bitcoin positions.

Bottom line is that Inflation is eventually going to catch up with the US Dollar which is clearly headed towards a massive failure at some point in the future – like every other government issued, non-asset-backed currency. I don’t know when, maybe 5 years, maybe 25 years, but it’s going to happen. I believe now is the time to put 5% of your savings in Bitcoin and dollar average in for the next 6 months given these potential S&P 500 induced price swings (i.e. $8,000 before $80,000 is definitely possible.) As a reminder I don’t give investment advice, I give personal opinions. Please do your own research and make an informed decision commensurate with your risk tolerance.

Tweet of the Week

Check out my latest piece for Bloomberg…Bitcoin: The Perfect Schmuck Insurance http://t.co/jyRhU0hdp7 via @BloombergView

— Chamath Palihapitiya (@chamath) May 30, 2013

Our friend Chamath has been saying for almost seven years that Bitcoin is schmuck insurance against almost everything and I completely agree.

Lastly, we have some big news coming up for Abra. Now is a great time to install Abra and get started to take advantage of what’s coming. See you Friday!

Peace and Love,

Bill

Disclaimer:

Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary, and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.