- Why Top Analyst Predicts An Altcoin Rally on Key Ethereum Breakout (Bitcoinist.com)

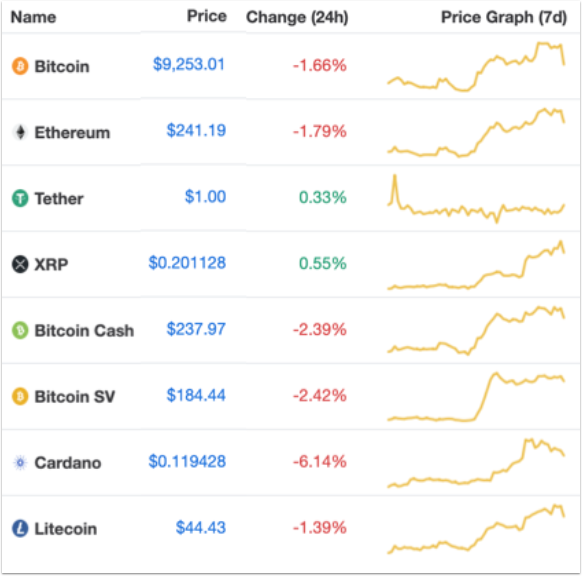

Market data summary via Coinmarketcap as of 9:20 AM PT July 9

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

On this week’s episode of Money Talks: Is a new altcoin season emerging? Who will be the winners? Is a Bitcoin breakout forming? How the culture of Euro sports betting has made its way to the US in the form of stock betting (and how it will impact crypto). TikTok and the Doge-Pump. A visit from our live panel and a live AMA with our global audience. Join us Friday at 9 AM PDT: https://youtu.be/30BvrefjmuY

The Altcoin-Spring?

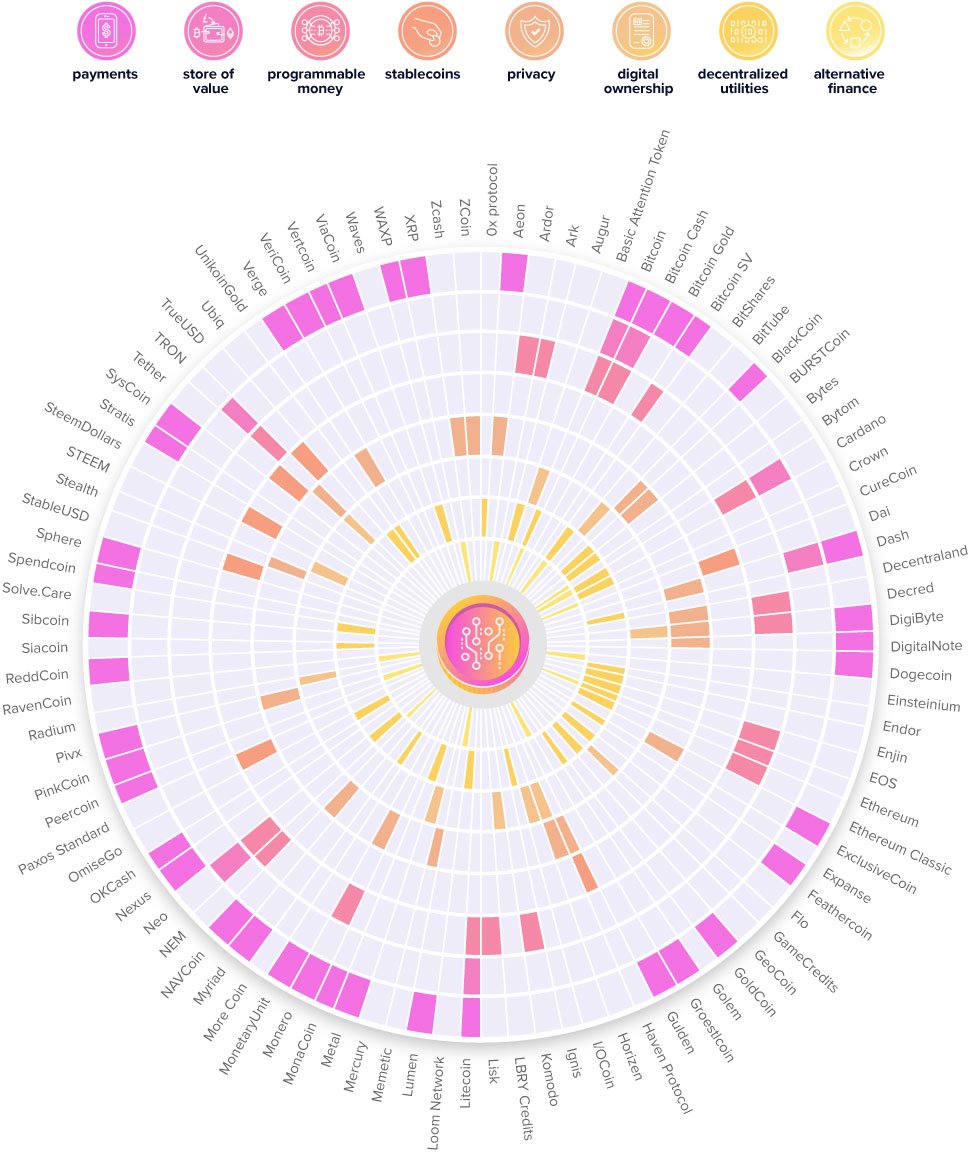

Altcoins are generally a reference to all cryptocurrencies that don’t include Bitcoin. I’m not a fan of the term as it doesn’t do justice to the technological advances some of these great projects have developed.

Early signs are indicating that the long dormant altcoin market may be starting to thaw. Are we really at the beginning of a new altcoin season? At least 100 small cap altcoins have gained over 22% in the past seven days according to Messari, a leading crypto research firm.

Consider… (as of Wednesday evening San Francisco time…)

Cardano (ADA) is up an awesome 85% in the past ten days reaching top 5 status in terms of crypto market cap. The rise was on expectations of Cardano’s upcoming hard fork to implement its Shelley upgrade which includes its new staking system enabling users to earn interest on their Cardano holdings. As a result, Cardano now joins Tron, Neo, Dash, Tezos, Cosmos, and eventually Ethereum as proof of stake based protocols.

Doge (DOGE) is up a startling 111% in the past seven days. While unsubstantiated, the rise has been attributed by some, to a series of TikTok posts purporting to kids pumping the price of DOGE to at least $1 which is about a 20,000% increase from current levels. Can you say “Robinhood?” More on that in a moment.

Tezos (XTX), QTUM, Augur (AUG) and Algorand (ALGO) are all up over 20% in the past seven days.

Of the major alts…

Stellar (XLM) is up over 24% in the past seven days.

Bitcoin SV (BSV) is up over 20% in the past seven days.

And the list goes on.

One of the most oft quoted stats is the so called “Bitcoin dominance” stat, showing the percentage of the total crypto industry market capitalization represented by Bitcoin. This number, now at 64%, is on a downtrend of late and looks poised to retest the March lows caused by the Covid sell off. Another bullish sign for altcoins.

I’d say we need at least a couple of weeks, preferably a month, of reasonable continuation in altcoin prices to see the latest run up as a sign of a new bull market.

I think this run up in alts could get a boost from an interesting source: a migration of the Robinhood Effect to altcoins when stocks come back to earth. What do I mean by Robinhood Effect?

Online Sports Betting in Europe and the US Robinhood Effect

Online sports betting is a huge business. The industry leader Bet365 is available in over 50 countries including countries in Europe, the Americas, and Asia. Of course, the service is banned in the US (with the exception of New Jersey which allows sports betting.)

Sports betting is a culturally acceptable activity in the UK, Germany, Australia and honestly in most countries. Bet365 did over USD $3.5 billion in 2019 revenue. That is a staggering number. There is no major sport that Bet365 doesn’t broker wagers on including, ironically, all major US sports.

So where am I going with this and what does this have to do with crypto?

It turns out that we actually do have our own form of sports betting evolving very quickly in the US. It’s what I call the Robinhood Effect. The Robinhood Effect is driven by twenty-somethings opening trading accounts on Robinhood and making bets on all kinds of stocks while promoting and pumping their favorite stocks via Snapchat, TikTok, Instagram, Reddit and any other online service providing an audience for these eager go-getters. Robinhood’ers were blamed for recently driving up the price of Hertz’s stock after the company filed for Bankruptcy, which normally would guarantee a stock becomes worthless.

This effect has been personified in the transition of David Portnoy’s highly watched Barstool Sports videos which moved its focus temporarily from sports to stocks during the Covid-shutdown. Portnoy now has a massive army of followers buying stocks on Robinhood. He was recently quoted on Fox Business as saying that ‘my plan is that stocks always go up.’ Oh my.

What happens when this rule fails and stocks don’t go up? This is where I think altcoins will get a big boost. When the music stops and stocks don’t always go up I believe this army of Robinhood sports bettors is going to look for the next big thing and I believe they’re going to find it in crypto altcoins. If that happens we could see a meteoric rise in altcoin prices that makes 2017 look tame in comparison. Also, keep in mind that it’s nearly impossible to short most altcoins which means this army of casual bettors can only place one bet… up. It’s also clear that when this transition happens that these Robinhood users will turn their attention to Abra.

Of course, we highly encourage you all to invest responsibly and when it comes to crypto, no more than 10% of your savings should be invested. Do your homework!

Tweet of the Week

They are rare. Such relationships take time to build and can only be built if you treat such people well. #principleoftheday pic.twitter.com/hHlbvwb7nl

— Ray Dalio (@RayDalio) June 29, 2020

This week’s tweet is a testament to the hardworking team at Abra who not only provide a fantastic product they are hard at work on our next big thing. And we can’t wait to show it to you. Soon! So thank you team Abra. You’re the best!

See you all Friday on the next Money Talks!

Peace and Love,

Bill

Disclaimer:

Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary, and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.