Today’s Topics:

- Abra launches 18 new cryptos

- Abra raises interest rates on Bitcoin and Ethereum

- Deep dive on $LINK

- “The Great Yield Hunt” – DeFi vs CeFi

- Tweet of the Week

This week on Money Talks, Friday at 9 AM PDT (noon EDT)

On this week’s episode of Money Talks: We’ll provide an update on the crypto markets and give more details on the Abra Interest Account product. As always, we answer all your burning Abra questions!

Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT: https://www.youtube.com/watch?v=b5O1kHXfEo4

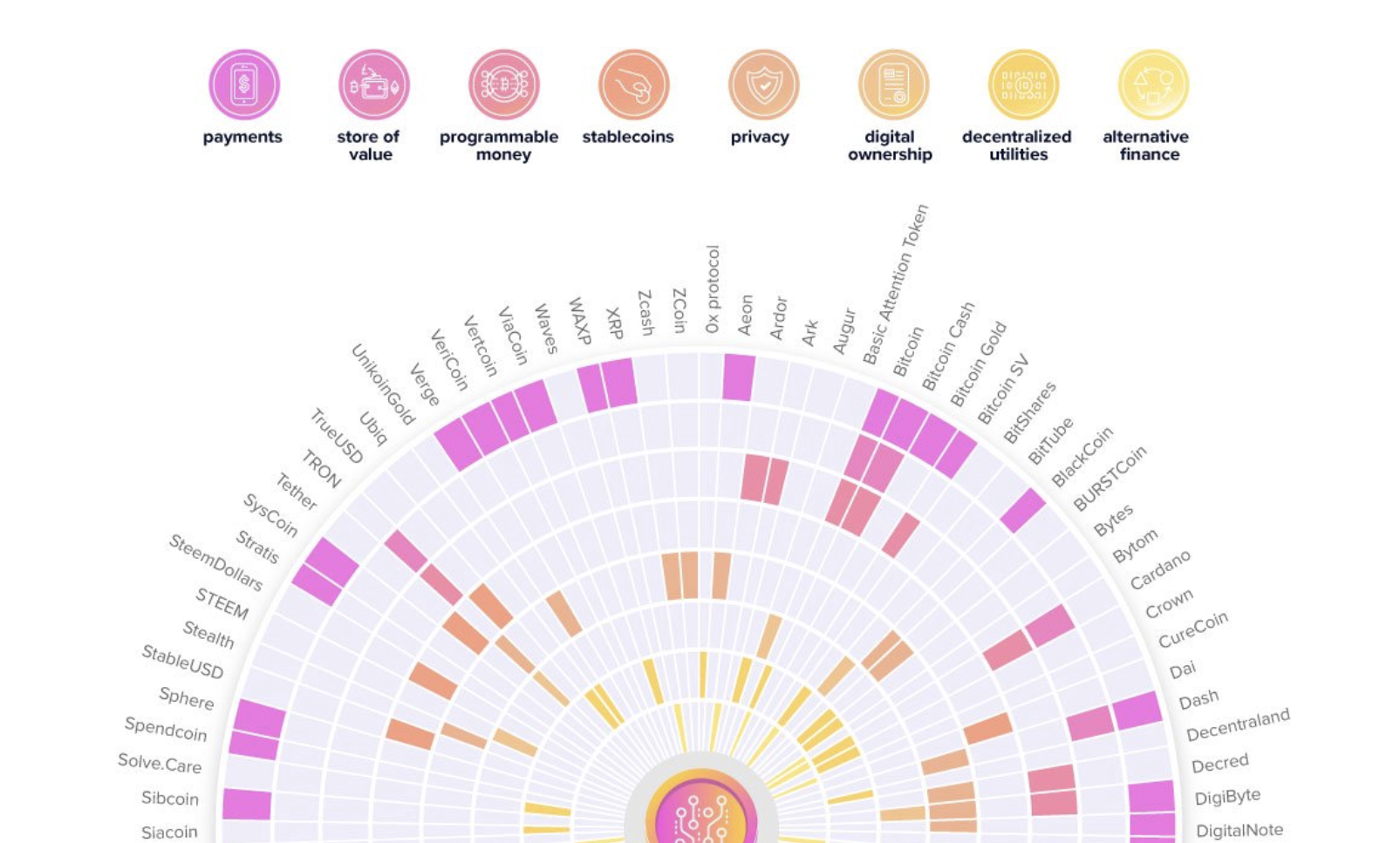

Abra Launches 18 New Cryptos

We are super excited to announce that Abra has added 18 new cryptocurrencies to our platform.

Top new cryptos on Abra include Chainlink (LINK), Compound (COMP), Algorand (ALGO), Tezos (XTZ), VeChain (VET), Steem (STEEM), CELO (CELO), Hedera Hashgraph (HBAR), WAXP (WAXP), and BitShares (BTS). A complete list of new cryptos can be found here.

Abra’s amazing standard feature of exchanging directly between ANY TWO supported cryptos remains intact. That means Abra users can trade across 7,000 different crypto pair combinations (e.g. USDT to BTC or BTC to ETH or LINK to BTC.)

Abra Raises Interest Rates on Bitcoin and Ethereum

We’re pleased to announce that we just raised interest rates for Bitcoin and Ethereum to 4.25% while keeping the US Dollar rate steady at 10%. As always the dollar rate includes all supported stablecoins.

We recommend a portfolio allocation of no more than 5 – 10% of personal assets in Bitcoin and no more than 5% of personal assets in other cryptocurrencies.

We also recommend a portfolio allocation of no more than 15 – 20% of personal assets into US Dollars in the Abra Interest Account at this time. We don’t give investment advice, We just give our opinion. Please do your homework and invest wisely.

As a reminder funds can be deposited via bank wire, ACH (US), cash at retail (where supported), transferred via external crypto wallets, or transferred from an existing Abra trading balance.

Here’s a video showing how it works:

Deep Dive on LINK

To understand LINK we need to understand the idea of an oracle in a smart contract.

Let’s say we have a smart contract running on the Ethereum blockchain that represents a call option on Ethereum expiring on September 30th at a strike price of $600 per ETH. This means that if the price of Ethereum is above $600 at expiration on September 30th then the holder of the call option can buy Ethereum for $600 per ETH and pocket the difference. How does the smart contract know what the price of ETH is in order to determine what to do at expiration? That’s a problem since cryptocurrencies have no inherent knowledge of the real world. I liken this to being inside The Matrix versus being outside The Matrix. In the movie, people on the outside could hack into the inside via a hardline. In crypto smart contracts these hard lines are represented by “oracles.” Oracles tell computer programs (or smart contracts) information about the real world that they otherwise would not know but need to know.

Image courtesy of Chainlink

Oracles are a BIG problem in crypto because they often represent a weak link in a decentralized system. In other words, if my oracle has an off switch so does my smart contract. Ouch. I’ve said many times that I’m not yet convinced that this oracle problem is completely solvable.

The good news is that many companies are trying to solve this problem. One such company is Chainlink. Chainlink, in their words, “provides reliable tamper-proof inputs and outputs for complex smart contracts on any blockchain.” The inputs would generally be things like the pricing details in my example above. Outputs are usually payments, i.e. where do I send the money you made when the contract expires. ChainLink is a decentralized network of nodes that provide data and information from off-blockchain sources to on-blockchain smart contracts via these oracles. Naturally, and ironically the first solution they’ve chosen to tackle is DeFi. Makes sense. I hope it works in practice!

Finally, that brings me to LINK. Simply put, LINK is the digital asset token used to pay for services on the Chainlink network. Will LINK be worth anything? Well, almost all DeFi applications require some sort of price data feed. A robust, preferably decentralized feed is essential to the prosperity and security of most DeFi apps. Since Chainlink is the best-known player in this space, I believe it could end up being a big winner in the DeFi space. Time will tell. Invest wisely.

The Great Yield Hunt – DeFi vs CeFi

Ultimately DeFi may win but I believe that in the next 3 years, at least, CeFi services like Abra will continue to rule. There are simply too many things that can and will go wrong with DeFi at any kind of scale. Ryan Selkis, Founder of Messari, a fantastic crypto research, and information service, did a great tweetstorm on this recently. Ryan said:

“The DeFi bubble will pop sooner than people expect.

We’re nearing the apex of Ponzi economics, rug pulls, and “yield” hopping and ETH fees are going to eat too heavily into non-whale profits.

ICOs boomed for a while because everyone (laughably) thought there would be a coordinating utility token for every industry.

DeFi is just one big pool of capital sloshing around a small group of insiders and mercenaries who will soon run out of victims to fleece.

I’m open to changing my mind, but a good rule of thumb is “if it looks too good to be true, it is.”

That’s 50% APY yields and greater fool investing in a nutshell.

A better way to play DeFi may be to own a couple of blue chips, and forget about them for 3-5 years.

FWIW, I LOVE this experimentation. Like ICOs, yield farming / incentivized liquidity provisioning is a novel innovation in capital formation.

Smart people are making a killing.

But I don’t recommend DeFi to most people because I don’t recommend high-stakes Vegas poker to fish.

I completely agree with Ryan on this. This also doesn’t take into account that DeFi is currently built on Ethereum and Ethereum simply can’t handle any kind of DeFi scale (at all) right now. When we had peak DeFi two weeks ago many exchanges had to limit ETH deposits and withdrawals because the gas fees reached $10-$20 per transaction. You can’t reliably transact $15 worth of ETH on chain when the transaction gas costs $20. We’re probably 18 months away from Ethereum 2.0 completely solving this problem.

The smart money in crypto will be in CeFi for the next few years. Abra’s team of experts spends long hours hunting for high quality yield generating opportunities. No DeFi system will be able to reliably do that and not end up generating a high percentage of losing scams. Eventually, that may change but not now.

For now, the smart money will stay with Abra!

Tweet of the Week

Thanks Ryan for the great DeFi tweetstorm today.

The DeFi bubble will pop sooner than people expect.

We’re nearing the apex of ponzi economics, rug pulls, and “yield” hopping, and ETH fees are going to eat too heavily into non-whale profits.

— Ryan Selkis (@twobitidiot) September 10, 2020

See you all tomorrow (Friday) on the next Money Talks. The Revolution has begun!

Don’t forget to follow us on Youtube, Twitter and Facebook to stay updated with the latest from the crypto world.

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.