$50K!!!

Bitcoin hits a major milestone by reaching $50k for the first time!

This week:

- New Format and Schedule for Money Talks!

- Bitcoin hits $50,000 then $51,000

- Ethereum hits $19k

- ETH and Alts ready for a breakout?

- Big players moving into Bitcoin

New Format and Schedule for Money Talks!

Big changes are coming to Abra on the content front. We’re going to provide you even more great content to meet your crypto appetite!

- First, starting next week we’re launching daily 10-15 minute video updates on Youtube, Facebook, Twitter/Periscope, Twitch as well as LinkedIn! You’ll also be able to download the update on our Abra podcast channel on Apple

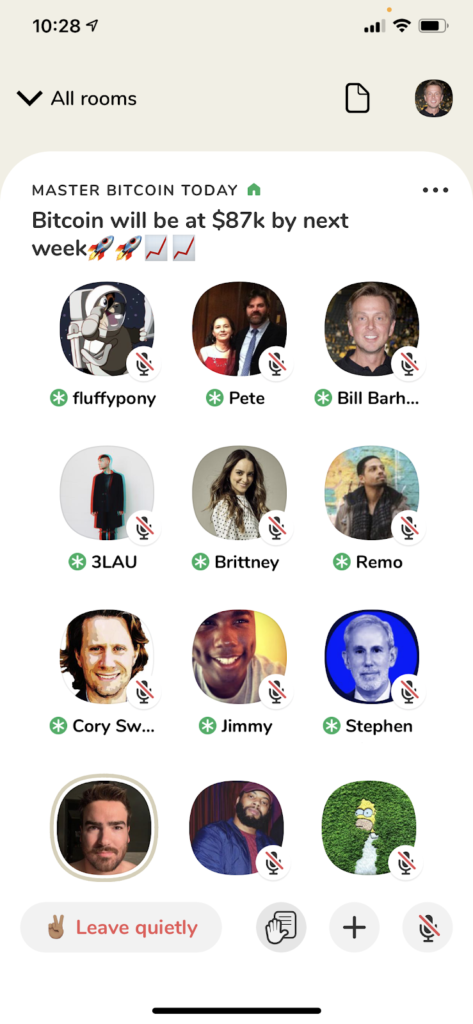

- Our weekly AMA will become monthly, on the first Friday of every month starting March 5 and will be centered around Clubhouse with live streaming video to all of the same channels mentioned above.

- We will host regular Clubhouse channels. Follow me at @billbar on Clubhouse to get notified of these regular events. I’ll pull in special guests, friends and Abra users for fun and informative conversations.

Bitcoin hits $50,000 then $51,000

$950B market cap

Morning Brew published a succinct timeline on Bitcoin today. Here are the highlights:

2008: Satoshi Nakamoto published the bitcoin white paper that laid out the principles of a “new electronic cash system that’s fully peer-to-peer, with no trusted third party.” To this day, one knows who (or what group of people) Satoshi is.

2010: A programmer bought two pizzas for 10,000 bitcoin in what will go down as the most expensive pizza transaction ever. Let’s just assume there were 16 slices between the two pies and you take 15 bites per slice—at today’s bitcoin price, that’s about $2 million per bite.

2017: JPMorgan CEO Jamie Dimon called bitcoin a “fraud” (a comment he later walked back).

2018: The NYT ran an article with the headline, “Everyone is getting hilariously rich and you’re not” after bitcoin jumped from $830 to $19,300 in the span of one year. Things stopped being quite so hilarious later in 2018, when bitcoin crashed to $3,200.

2020–2021: After hovering below $10,000 for months, bitcoin refueled its rocket ship. It’s already up about 75% this year alone.

Ethereum and Alts ready for a breakout?

Ethereum is in another one of its classic “consolidation patterns.” These consolidation patterns have been incredibly bullish for several months now, almost all breaking out to the upside. While Bitcoin seems to be leading the price action I expect a big move in Ethereum in the coming weeks. We may get a small head fake to the downside first. Just buy and hold if you’re investing. But do your own homework in any case.

We’ve seen some big moves in Altcoins this week… LTC has been on fire. Up over 75% in February. ADA is up over 25% peaking at $.98. BCH is up over 20% and is also consolidating around 700,

Elon’s favorite meme coin Doge is taking a big breather. Is WallStBets gearing up for another Doge pump? No idea. We’ll see. Invest wisely. For me that means Bitcoin first, Ethereum second and alts third. Alts only get play money.

Big players moving into Bitcoin

Many updates coming out of corporate Bitcoin this week:

- Tesla has purchased $1.5 Billion worth of Bitcoin onto their balance sheet

- Blackrock, one of the largest investment management companies in the world, is now purchasing Bitcoin futures in some of their funds

- Microstrategy, the venerable Bitcoin bull managed by Michael Saylor, is selling another $900 million worth of bonds to be used to purchase Bitcoin.

- Gartner announced that 16% of businesses will invest in Bitcoin in the next few years. If each business invests on average $25 million then I believe Bitcoin will go up at least 10-20x just based on these purchases alone.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.