We recently caught up with researcher Alejandro Machado, who spent part of 2018 investigating how people are using cryptocurrencies in Venezuela.

The country is in the throes of a prolonged hyperinflation spiral, which basically means the government-backed Venezuelan bolivars are becoming worthless. In fact, the bolivar is now among the most worthless fiat currencies on the planet.

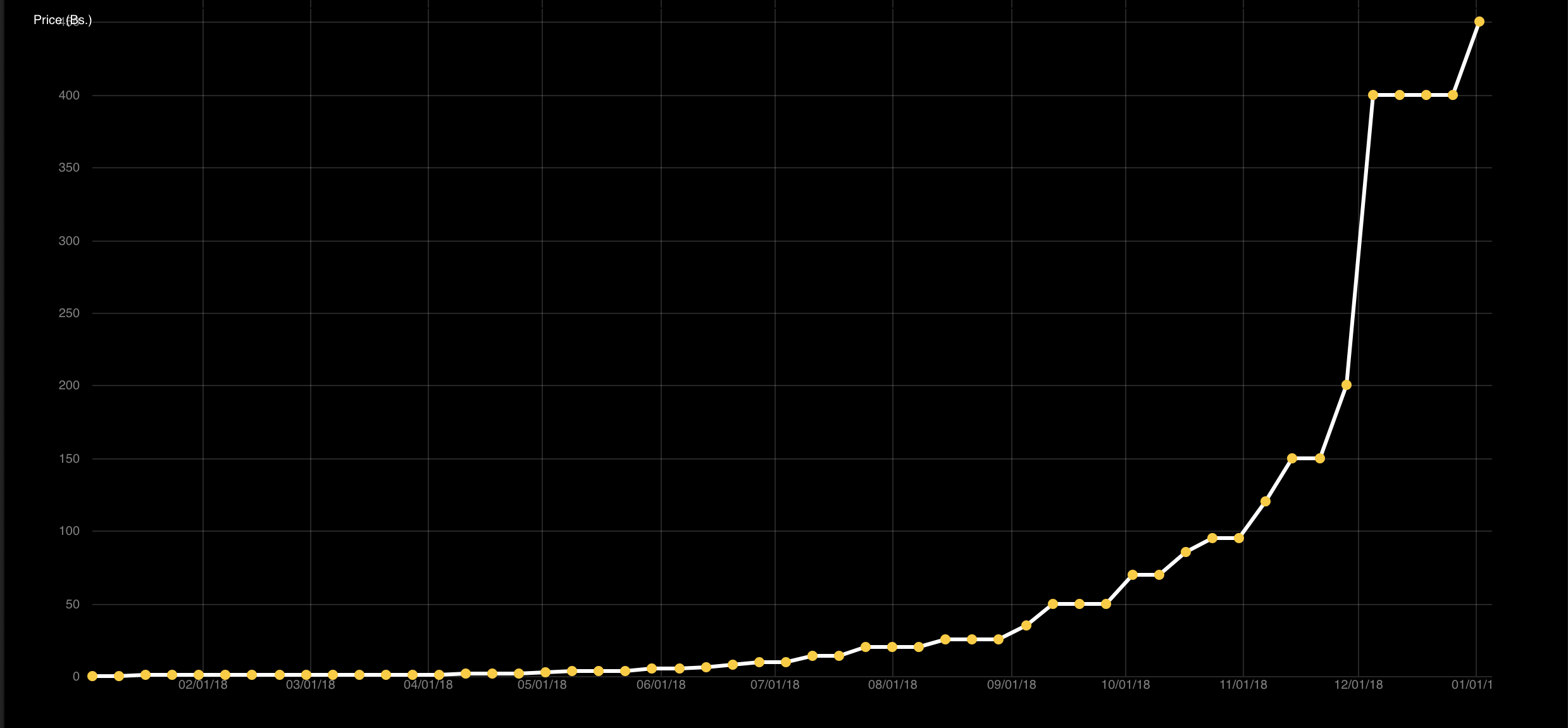

“Prices in Venezuela double every 18 days,” says Machado, a researcher with a background in computer programming and human-computer interaction. “So if you are planning for the future, or trying to manage your cash flow, you are losing purchasing power really quickly by keeping money in bolivars.”

The Venezuelan bolivar has had an interesting ride. In the currency’s 139-year history, it’s been backed by silver, gold, the dollar, and most recently tied to the controversial petro digital currency. Petro or petromonedas, was launched this year by the Venezuelan government as a way to use state-owned oil and mineral deposits to collateralize crypto, which in turn would be used to back the latest iteration of the bolivar, the bolivar soberano (the sovereign bolivar, which was created to drop some zeros of prices listed in bolivar fuerte (the strong bolivar), which was created to drop… you get the idea).

For stretches of decades, the bolivar was a useful currency. It became a stable store of value and an accepted way to settle debts and payments across the entire region. During those times, the Venezuelan economy flourished.

But beginning in the 1980s, government officials started issuing currency controls to stave off economic fears fueled by increasing foreign dept, lack of currency reserves, and dim oil futures.

All of the currency controls and heavy-handed economic policy has shattered the Venezuelan economy, leading to scarcity of basic goods and services. The economic wobbles were made worse by Venezuela’s heavy-handed government and policies over the past 20 years.

In the face of worsening money-related issues, Venezuelans have gone looking for alternatives, which is where the underlying strengths of cryptocurrencies start to emerge.

Crypto, despite its volatility, provides a liquid form of value that can be transferred peer-to-peer both locally and globally, it’s resistant to government censorship and seizure, and it can be used as a long-term store of value (compared to the bolivar, at least, which has experience inflation of 224,900% in the past year alone).

“If you are living in a liberal democracy, you can trust institutions,” Machado says. “In Venezuela, there is zero trust in institutions, including the institution of money itself. So crypto might not be good money when compared to the dollar, but it is good money compared to the bolivar.”

On the ground

Machado and his colleague Jill Carlson, an independent crypto researcher and consultant, were hired by Zooko Wilcox, the founder and CEO of Zcash for four months during the summer of 2018 to find out more about how people are using cryptocurrencies in Venezuela.

While the team did learn some specifics about Zcash, they also found out that despite the privacy emphasis of the Zcash technology, many Venezuelans are mostly still using just bitcoin as their crypto of choice.

More specifically, what the research team found out is that despite its volatility and reputation as a speculative asset, people in Venezuela are using crypto in four main contexts: As a means to earn an income, a store of value, protection against government seizures, and a way to send and receive money.

Mining: Make money, making money

Crypto mining requires computer equipment to run specially designed software to compete against other miners to solve mathematical puzzles. If miners win the competition, then they get the block reward of whatever crypto they are mining (block intervals are crypto-specific — some payout rewards every two minutes, while cryptos like bitcoin, pay a block reward every ten minutes).

In most parts of the world, mining for valuable crypto is becoming harder. For one, the mining competition for bitcoin, for example, requires specialized equipment, and lots of it. This has led to the consolidation of mining power to industrial-strength operations. The second issue is that mining requires heavy computation, which requires lots of electricity. In many parts of the world, the economics of mining (especially in a down market) doesn’t make sense, because it costs more money in electricity bills than the current value of the crypto.

But miners in Venezuela are taking advantage of the country’s subsidized energy, which makes it a great place to run a crypto mining operation. Most of the computer hardware available is lightweight (old desktop GPUs, mainly), so tech-savvy Venezuelans are setting up small-time mining operations focused on some of the easier to mine cryptos (like Zcash).

“Cryptocurrency mining is like a money printing machine,” Machado says. “People are taking advantage of the cheap energy, but generally miners keep a low profile because they’re required by law to be part of a central registry. So there is some distrust.”

For Venezuelan crypto miners, cryptocurrencies present opportunities beyond just investing or speculating on future valuations.

“I have friends who are doctors and engineers and they should be making a good salary,” Machado says, “but they are now mining $100 or $200 of Zcash or ether. They mine these smaller coins and then trade to bitcoin, hold the bitcoin, or they cash out.”

Store of value: During hyperinflation bitcoin is better than storing money in a mattress

In the developed world, and against the backdrop of the crypto boom of 2017 and the bust of 2018, the argument about bitcoin’s suitability as a store of value rages on. But the fitness of bitcoin as a store of value varies depending on perspective.

“In the context of Venezuela, the bolivar is not working,” Machado says. “So people are flocking to other (fiat) currencies, but there’s no way to store them. So the question becomes, how do you enable people to store money in a way that isn’t physically offshore. And if this becomes possible, what kind of activity would it unlock? Well, we have a way to do it with cryptocurrency, and then people are no longer subject to the restrictions of traditional finance.”

While crypto is still maturing, it may not be the easiest solution in terms of day-to-day price stability. Nonetheless, in places like Venezuela, where suitable alternatives like cash or public markets don’t really exist, bitcoin and other cryptos present an option or an alternative that wasn’t available before.

“I think crypto gives tools to solve super bad problems of monetary policy,” Machado says. “It’s good that we have other systems that we can go to.”

Control: Cryptocurrency is censorship- and seizure-resistant

One of the core attributes outlined in the original Bitcoin whitepaper is that cryptocurrencies should be designed as permissionless, decentralized, and peer-to-peer.

These foundational criteria ensure that cryptocurrencies offer superior privacy and security when compared to centralized systems (such as the current banking and payment services model). These features will ultimately give crypto users more choice and control over their data and finances.

But, right now, real-time in Venezuela, seizure-resistant isn’t just some ideal that gets thrown around Twitter by crypto diehards, it’s an actual feature that people are using to protect their day-to-day financial activity.

Since most forms of information, anything from utility bills to work records and bank information can be weaponized by Venezuelan authorities against everyday citizens, having a means of sending, receiving, and storing value in an encrypted format on a smartphone is a critical security blanket.

While bitcoin may not be completely private, it does still offer — at least for now — more layers of protection for everyday users than just storing money in state-controlled financial institutions.

Relief: Money that doesn’t recognize borders

Crypto is sometimes portrayed as rebel money, or as a form of money that doesn’t respect the lines drawn by authorities. In some contexts, that can be problematic and lead to situations that benefit people or organizations that are already operating outside the rule of law.

But the lack of centralized control is also a great utility when people welding power are infringing on the basic human rights of others. In those situations, having a form of money that doesn’t recognize borders — or currency exchange laws — is beneficial.

Right now, in Venezuela, fiat money is subject to search and seizure. The law also gives the government the authority to control the flow of money to international development and relief agencies, effectively making money a tool of control.

But it doesn’t have to be that way. Instead of traditional bank and wire transfers, crypto can be sent peer-to-peer, ensuring privacy and becoming a more cost-effective way to transfer value.

“If you want to send money to someone in Venezuela,” Machado says, “An app like Abra can become your bank. Crypto becomes a more scalable and more interesting way to send money, store the money wallets on phones. If I go through the Abra network, I could send money to my friend’s account and he could use it selectively, keep it in dollars, and only use whatever necessary.”

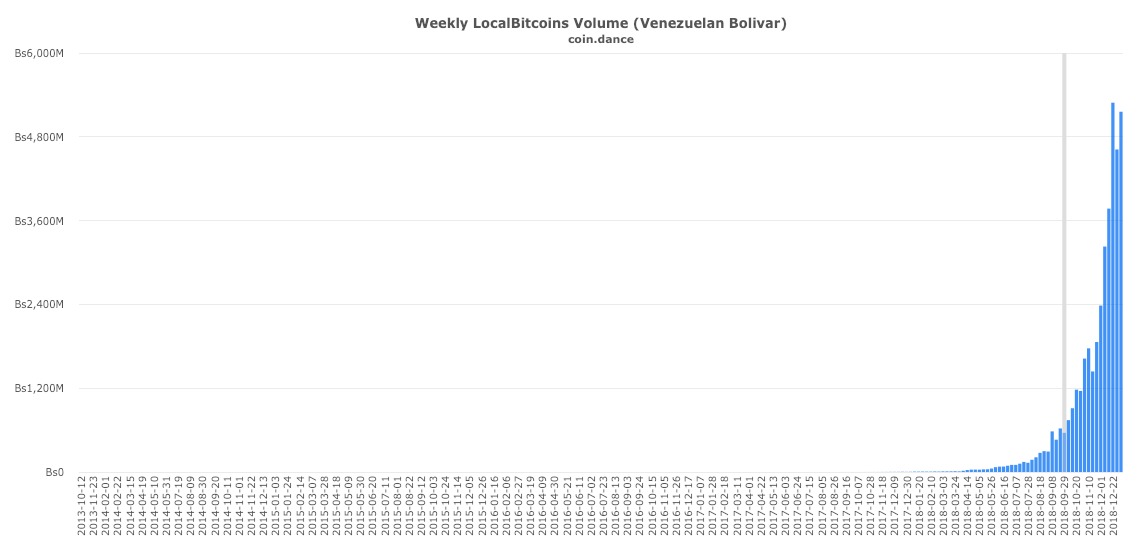

Most people in Venezuela use LocalBitcoins as an exchange between bitcoin and bolivars and back again. There currently aren’t a lot of options for exchanging between crypto and fiat, although as inflation continues to increase, there’s been a sharp uptick in bitcoin exchanges.

The Open Money Initiative

This summer’s Zcash-funded research project, lead Machado and Carlson to realize that really what’s needed is more research.

“We came to the conclusion that if we want crypto adoption to happen in Venezuela,” Machado says, “There needs to be someone with a mandate of making that happen. And they have to be crypto agnostic.”

So, along with Jamaal Montasser, Machado and Carlson founded the Open Money Initiative, a San Francisco-based nonprofit that will continue studying how people are using crypto in places like Venezuela. They will use that research to make recommendations to the wider crypto community about what kinds of features are needed for crypto to become the kind of tool that matches the grand mission of true economic freedom for everyone.

“We want to bridge the gap,” Machado says, “between crypto companies with grand visions, and people that need services today.”

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.