Topics

- Abra Crypto Giveaway!

- Apple Pay comes to Abra

- Crypto Trading Movers and Shakers

- “Asset Allocation” in crypto

- Abra raises interest rates on BTC and ETH

- Tweet of the Week

Abra Crypto Giveaway!

Abra is giving away $200 in crypto to one lucky winner. Check out the tweet below to participate. And if you like the idea we may keep doing it!

The winner will be chosen randomly and will be announced in this week’s episode of Money Talks on Friday, Sep 18 (9 AM PDT) at https://t.co/uhS6HfaOBp

— Abra (@AbraGlobal) September 15, 2020

Money Talks, Friday at 9 AM PDT (noon EDT)

Note you may want to update or install your Abra app before the show starts to get a head start on the demos we’ll be doing!

Join us Friday at 9 AM PDT: https://youtu.be/dSCwOW7CGSQ

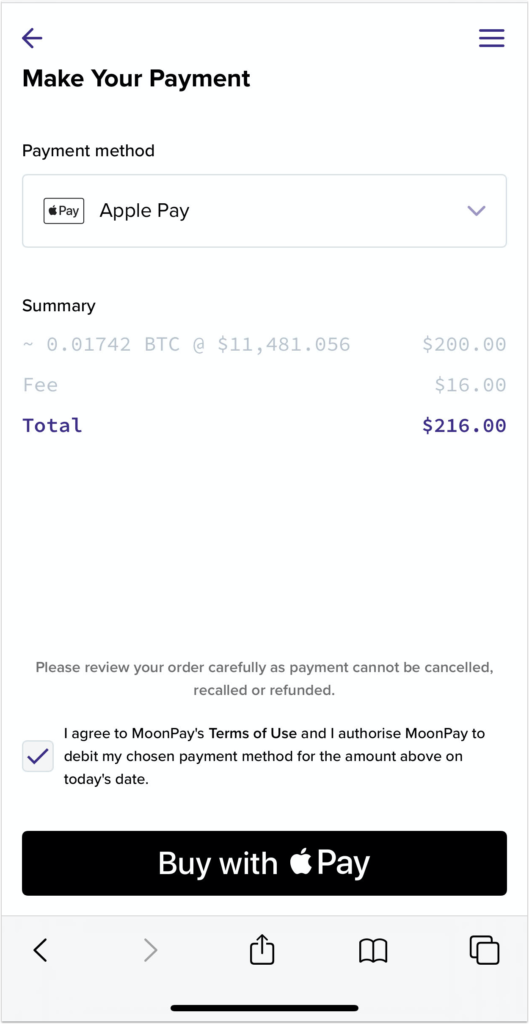

Apple Pay comes to Abra

We’re super excited to make Apple Pay based purchases of dozens of cryptos available from Abra.com. Please use your debit card if possible as some credit cards may be blocked by your local bank – they still don’t get crypto for some strange reason!

The process is very easy:

- Generate a deposit address for your desired crypto via the Abra app.

- Go to abra.com and use the buy via credit card service from the top menu. Remember to use the Safari browser for using Apple Pay.

- Choose which crypto you want to buy.

- Accept the quote and paste the deposit address into the buy widget.

- Enter your card details and complete your purchase.

First time users will have to complete the identity verification with our partner (Moonpay) one time. That’s it. On the iPhone, it took me about 60 seconds to onboard and complete an XRP and LTC purchase with my US debit card.

For US users it’s way cheaper to buy crypto using your bank account in the Abra app, but if you don’t have bank access or don’t want to use your bank account directly then debit card based purchases are a great alternative.

Crypto Trading Movers and Shakers

Source: Commonsensemedia.org (Sound of Music)

“Cryptos and tokens and moves with big candles. These are a few of my favorite things.” Isn’t that how the song goes? I can never remember. Oh well.

Well here are a few of my favorite things… in crypto!

XRP – the team at Ripple is investing huge amounts of money into creating an XRP ecosystem with a particular emphasis on remittances. Bitso and Moneygram are leading the charge processing significant cross border transaction volume with XRP based settlement. This is a very exciting development for sure. Go Ripple!

LTC – Litecoin is the best testbed for new crypto technologies in the world. If you want to see what Bitcoin might look like in 3 years, use Litecoin today. Litecoin (and sometimes Bitcoin Cash or Monero) are my go-to cryptos for small dollar person to person money transfers. The fees are low, wallets are now pervasive and I trust the underlying technology. If I receive payments in Litecoin, I can also easily use Abra to convert it back to Bitcoin if I want to.

ADA – with the Shelley upgrade now mostly complete, I’m excitedly anticipating Abra’s upgrade once our custody partner is ready. Cardano is a very advanced based smart contract platform. Now we get to see what developers will do with it and I can’t wait!

XLM – Stellar is the most underrated platform for new token creation. It’s so easy to create a new token with Stellar it’s almost scary. Abra is also going to be using the Stellar and Lumens based platform in future service offerings and I can’t wait!

LINK – Chainlink is a super interesting project trying to literally solve the missing link for DeFi services and smart contracts that need real-world data.

BTC – Every crypto project thinks they’re going to be the next bitcoin. That’s not going to happen. We’ll end up with lots of interesting cryptos but there can still be only one true bitcoin. Network effects, proven technology, huge and growing liquidity all points to a thriving ecosystem and long term future for the king of cryptos. Bitcoin will be our first trillion dollar digital asset.

On the horizon? I’ve got my eye on Sushi-/Uni- Swap and DeFi in general, and also crypto gaming (check out WAX and also Reality Clash) have also recently piqued my interest.

Hey, you may ask, “what about my favorite crypto project?” I can tell you that it’s getting harder and harder to keep up with the pace of token protocol innovations happening today. The implication is we’ll see more and more specialization of expertise in the crypto space since no one can keep pace with the inner workings of Bitcoin, developments in smart contract technologies, tokenization of real-world assets, etc. The opportunities in the space continue to explode.

“Asset Allocation” in Crypto

I got a lot of questions and comments about this last week. Let me address this head-on. First, we’re not in the business of giving investment advice. But I have my own opinions as to what I should as it relates to crypto investing and I’m happy to share that with all of you. That doesn’t mean you shouldn’t do your own homework as well.

My asset allocation looks something like this:

10% – Bitcoin (and some Ethereum) in Abra interest account

5% – myriad altcoins (see above) – these are actively held and traded

15% – USD in Abra Interest Account

70% – traditional investment portfolio (non crypto)

I may raise the 15% allocation of USD in my Abra Interest Account over time given the high rates possible there but I’ll likely never go above 20% of my portfolio.

The only short term speculation I do in this portfolio is with altcoins and that depends on market conditions at any given time.

I know many people have a much higher allocation to crypto than 10%. Long term this may turn out to be a great strategy, especially for younger people who can afford a much longer-term time horizon with lots of time for government-led inflation to help prop up certain crypto assets like Bitcoin and smooth out short term price volatility.

Do your homework and invest wisely!

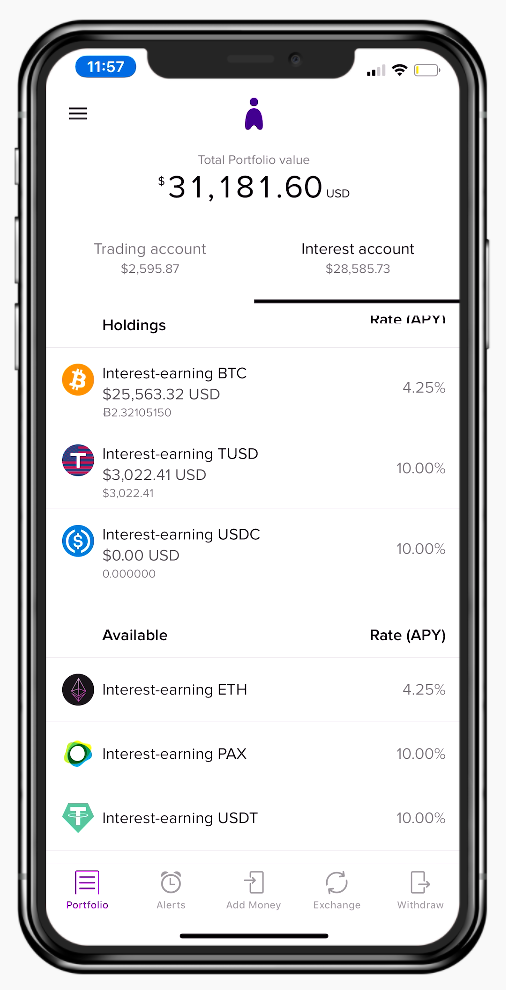

Abra raises interest rates on BTC and ETH

In addition to our industry topping 10% rate on USD deposits, we’re now giving an interest rate of 4.25% on Bitcoin and Ethereum

Are you getting push notifications every Monday morning to your smartphone alerting you to your free USD and crypto? If not, sign up for the Abra Interest Account now and start earning some crypto!

Tweet of the Week

Going all the way in on Bitcoin! Tweet of the week is from Michael Saylor, Founder and CEO, Microstrategy (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company.

On September 14, 2020, MicroStrategy completed its acquisition of 16,796 additional bitcoins at an aggregate purchase price of $175 million. To date, we have purchased a total of 38,250 bitcoins at an aggregate purchase price of $425 million, inclusive of fees and expenses.

— Michael Saylor (@michael_saylor) September 15, 2020

In words of Michael, “MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

See you all Friday on the next Money Talks.

Don’t forget to follow us on Youtube, Twitter, and Facebook to stay updated with the latest from the crypto world.

Peace and Love,

Bill

Disclaimer: Abra Interest Accounts are issued by Prime Trust a Nevada Chartered Trust Company. Rates for Abra Interest Accounts are subject to change. Digital currencies are not legal tender, are not backed by any government, and Abra Interest Accounts are not subject to FDIC or SIPC insurance protections. Any opinions, news, research, analyses, prices, or other information provided here is a general market commentary and does not constitute investment advice. Abra does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions. Abra will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

.

About Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.