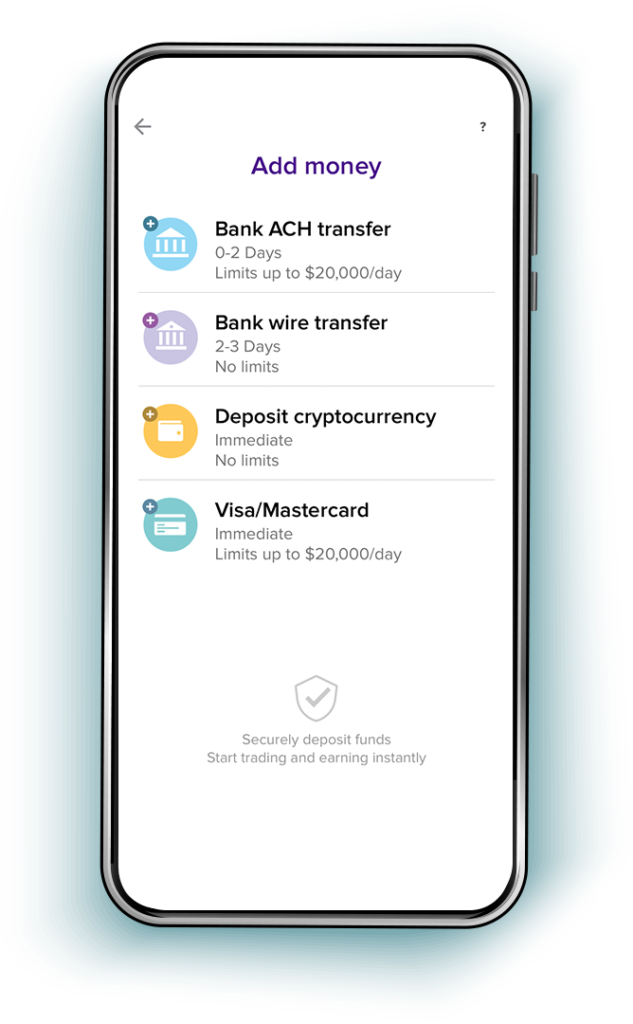

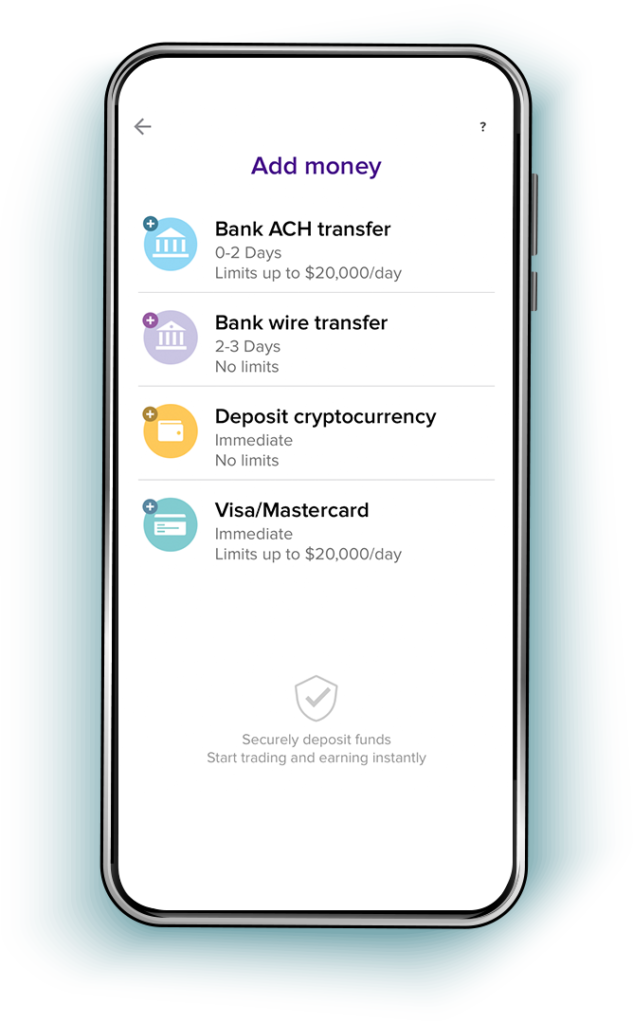

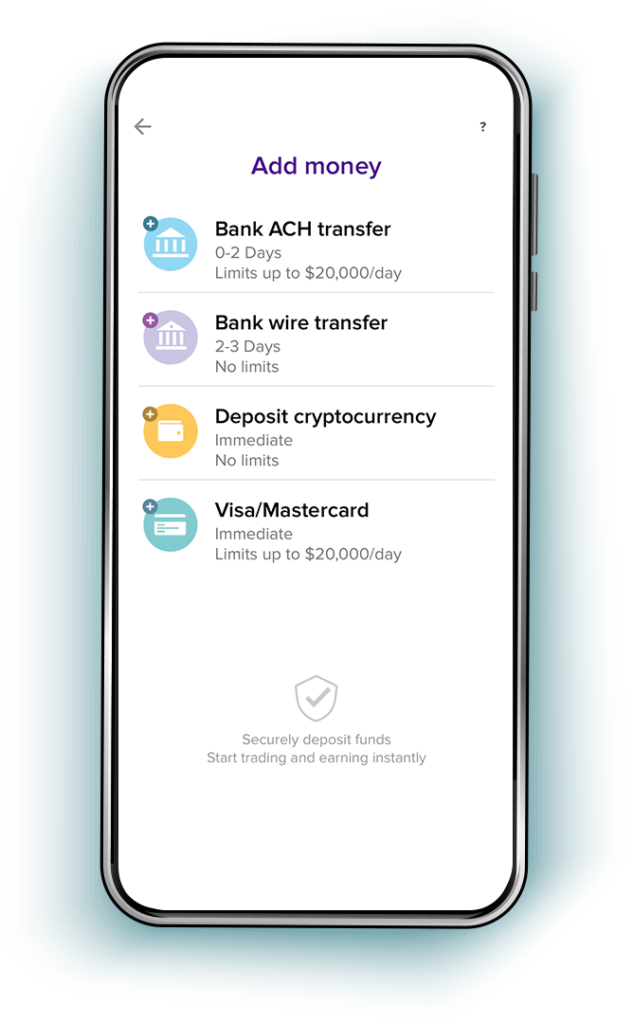

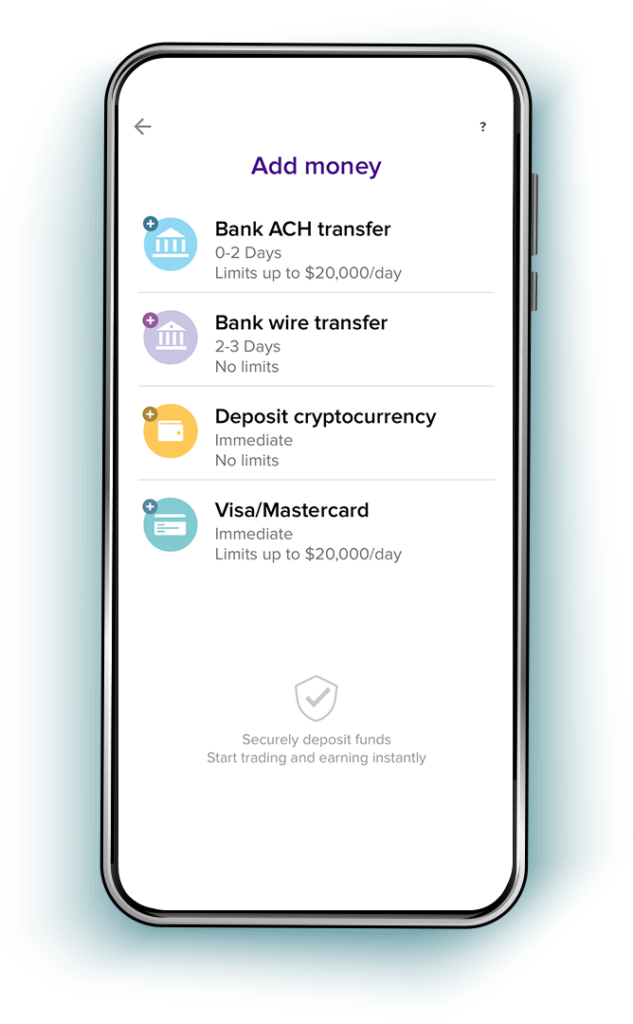

Did you know there are four ways to fund your Abra account? Options include bank transfer, bank wire transfer, cryptocurrency deposit, and Visa/Mastercard. Our blog post walks you through how to complete your crypto deposit with each option.

Getting Started

Open the Abra app on your device and enter your PIN.

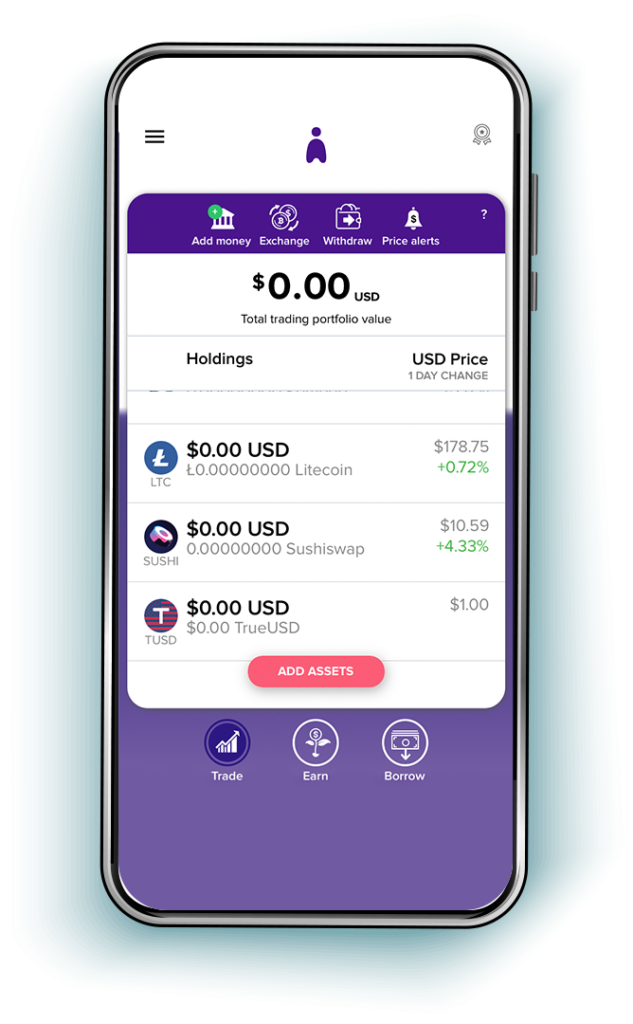

Tap on the “Add Money” button on the app home screen.

Next, the four options for funding your account will appear. Let’s go over each of these options.

Bank Transfer

To start a bank transfer, tap on the first button. In our example, the screen says “Bank ACH transfer”. Depending on which region you are located in, the text will reflect the deposit option available to you. For example, European users will be able to use SEPA for bank transfers. Deposits will take anywhere from zero to two days. The bank transfer limit is $20,000 per day.

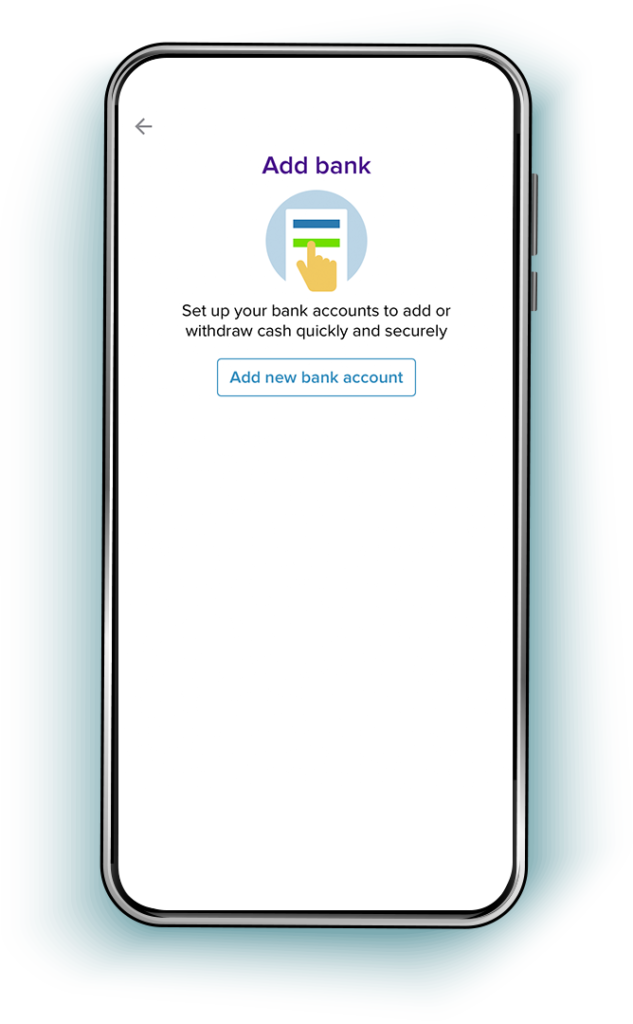

Tap “Add new bank account” and move to the next screen.

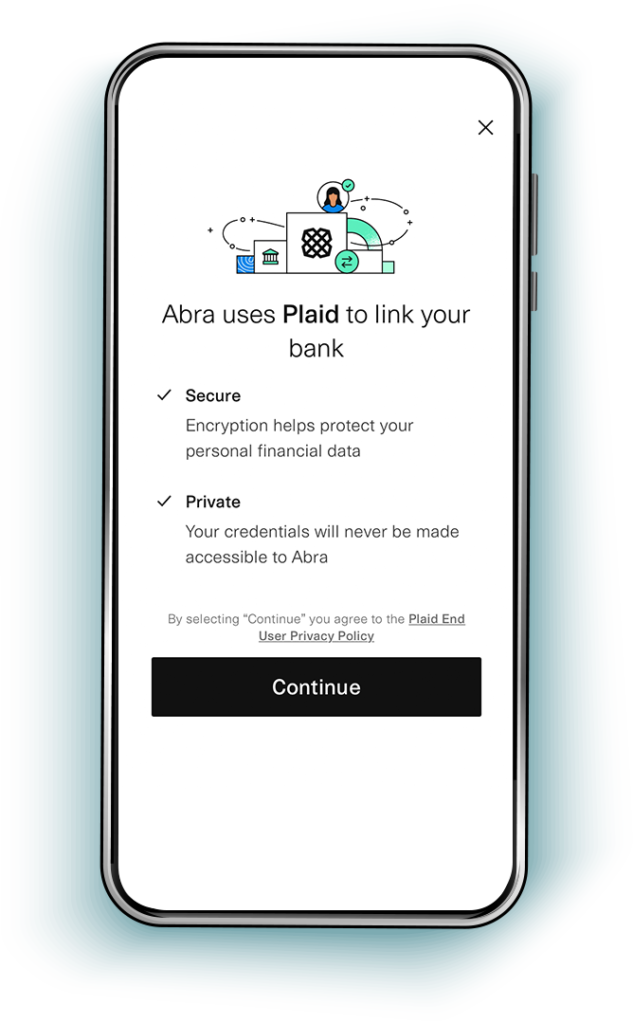

Abra uses Plaid to link your bank account. If you have used payment apps like Venmo before, you will be familiar with the process of linking your bank account with Plaid.

Tap “Continue” to go to the next step.

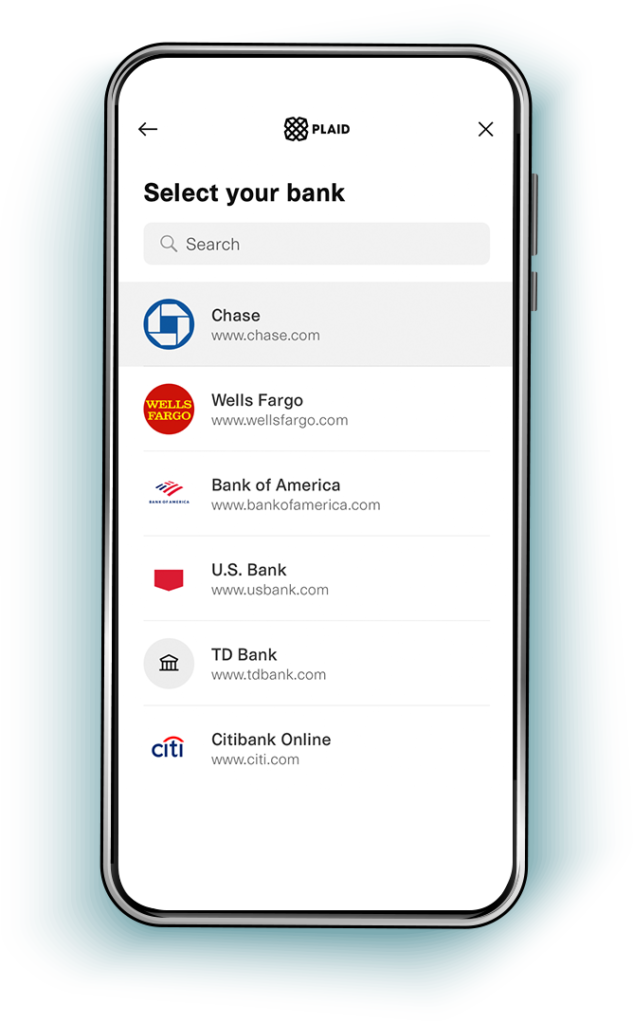

Now select your bank. If you don’t see your bank immediately on the list, start typing in the search bar to find it. You will then be prompted to log in with your online banking username/email and password. Note that you might receive a notification from your bank that asks you to approve the account linking.

After your bank account has been linked, it’s easy to add funds to Abra directly from your bank account. On the next screen, enter the desired amount. Tap “Next” and tap “Confirm Deposit”.

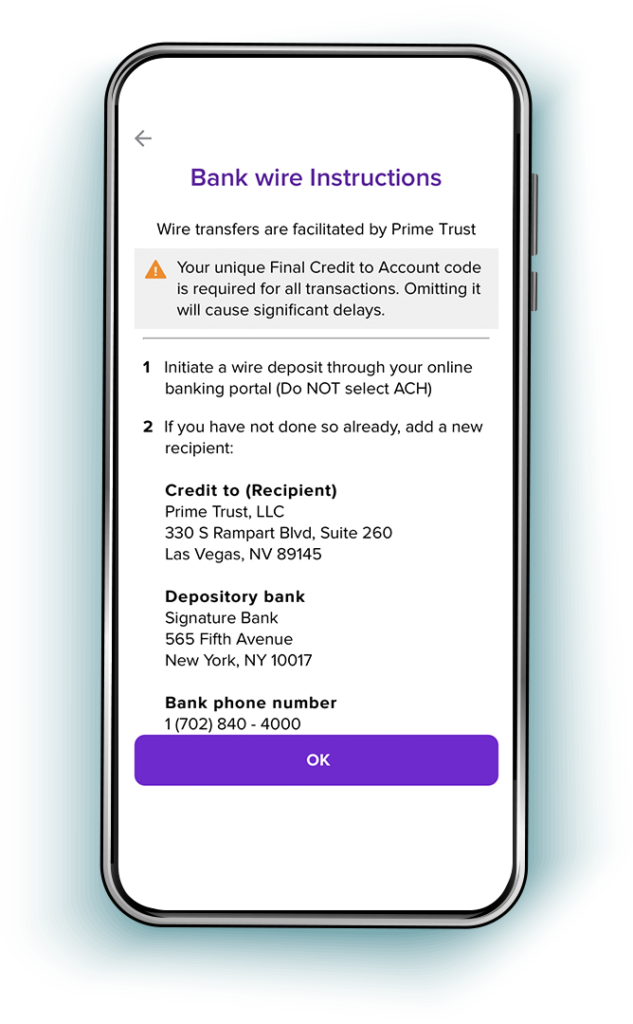

Bank Wire Transfer

To start a bank wire transfer, tap on the second button. Bank wire transfers will take anywhere from two to three days. There are no deposit limits for bank wire transfers.

The next screen will include the full instructions for sending a bank wire transfer to your Abra account. Read the instructions carefully before wiring funds.

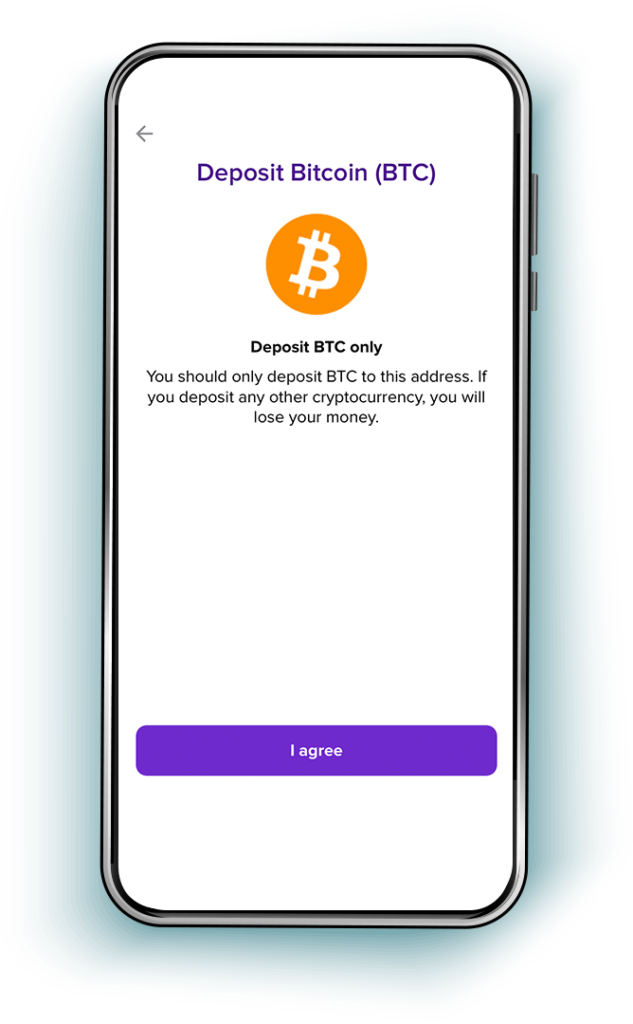

Deposit Cryptocurrency

To start a cryptocurrency deposit, tap on the third button. Cryptocurrency deposits are immediate. Depending on the blockchain network a cryptocurrency, it may take as less than a minute or a couple of hours for the updated balance to be reflected in your Abra account. There are no deposit limits for crypto.

Next, you can either scroll the list of supported cryptocurrencies or start typing in “Search assets”. Then, tap on the button to go to the next screen. In our example, we tap on the button that says “Bitcoin”.

You will see a screen to confirm that you want to deposit Bitcoin (BTC). Tap “I agree”.

Finally, you will see a screen with your Bitcoin (BTC) address. You can either scan the QR code from an external crypto wallet on another device or copy/paste your Abra address to that external wallet.

The address shown in the screenshot below is only an example. DO NOT send funds to the address shown in the screenshot!

Your crypto address will be different and consist of a completely unique string of numbers and letters.

Before sending any crypto to your Abra account, make sure you are using the correct address in your own Abra app. If you send funds to the incorrect address, your crypto is likely lost forever. This principle applies to every cryptocurrency wallet, including Abra.

Visa/Mastercard

To buy crypto with Visa or Mastercard, tap on the fourth button. Deposits are immediate. The daily purchase limit for Visa/Mastercard is $20,000 per day.

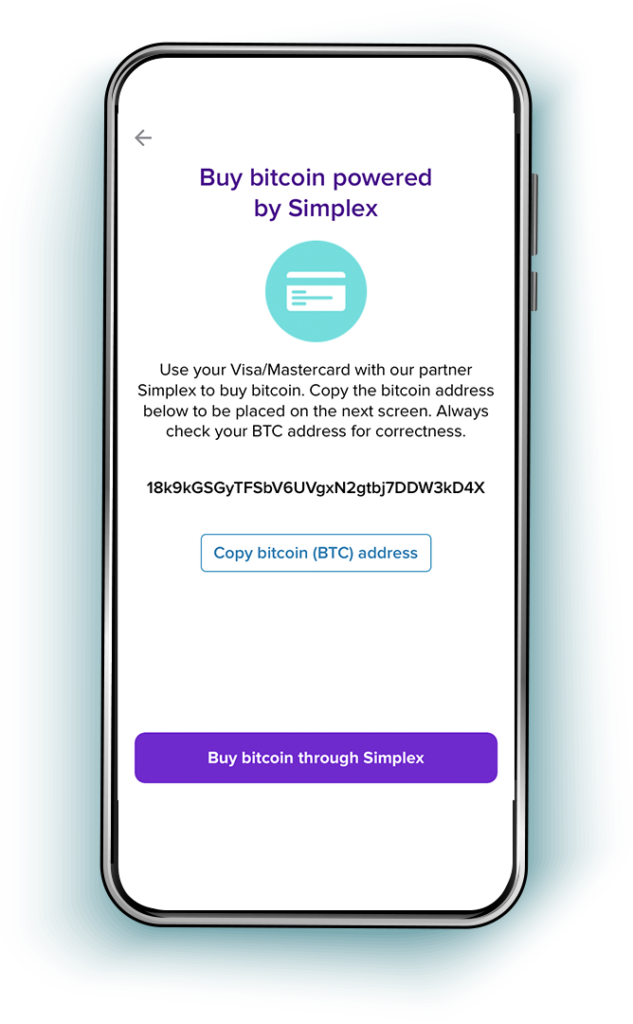

On this screen, you will see that your BTC address appears by default. This is the same address you’ll find if you selected BTC in the “Deposit cryptocurrency” funding option above. Tap “Copy Bitcoin (BTC)” address and then tap the button that says “Buy bitcoin through Simplex”.

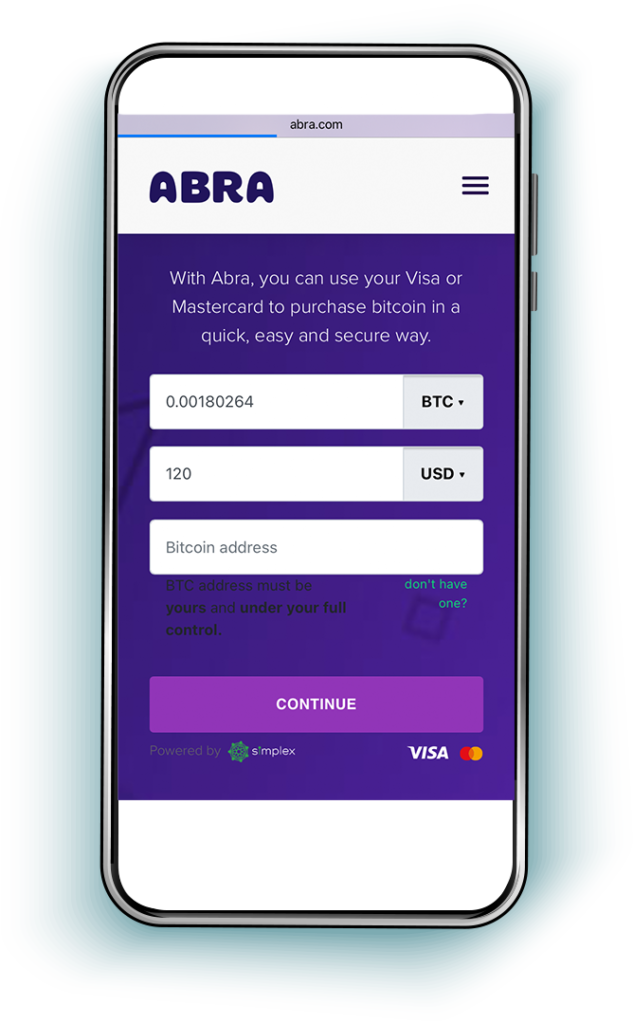

You’ll then be redirected to the abra.com website in your mobile browser. Here you select the amount of crypto you want to buy. The default cryptocurrency selected is BTC. If you want to purchase Bitcoin, you can paste the address from the previous screen in the box that says “Bitcoin address”. Tap “Continue” to go to the next screen.

If you want to purchase another cryptocurrency that isn’t Bitcoin (i.e. Ethereum), you can find your address by going to the second screen from the “Deposit cryptocurrency” section found above.

To purchase another cryptocurrency, tap on the first dropdown that says “BTC”. Here you will find the complete list of cryptocurrencies available for purchase with Visa/Mastercard.

Always make sure that the address you paste in the field reflects the crypto you want to buy. For example, only enter a BTC address if the drop-down says “BTC”. Only enter an ETH address if the drop-down says “ETH”.

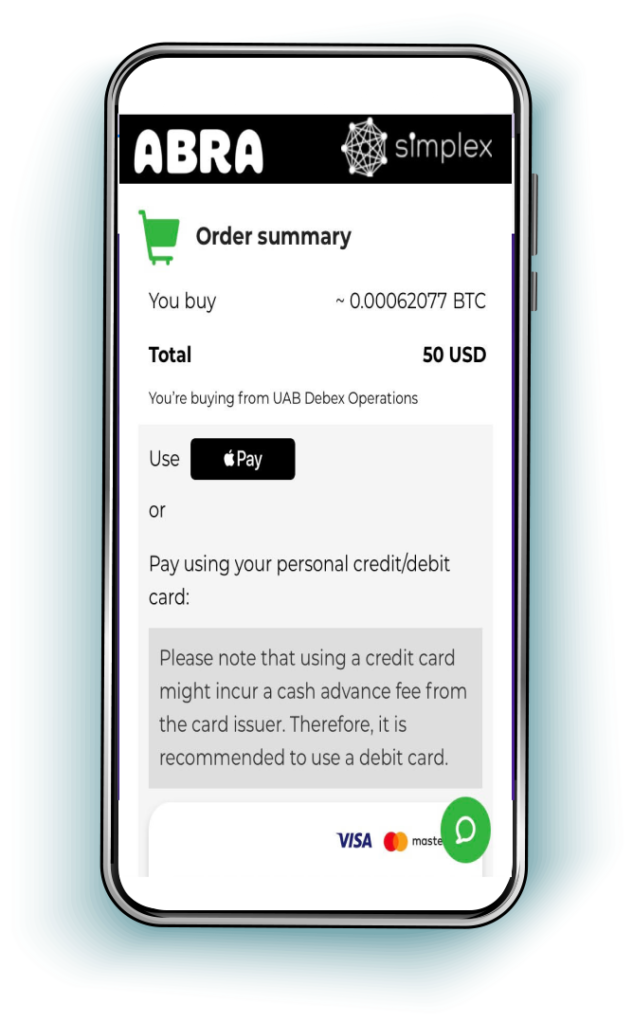

The next screen is where you add your Visa/Mastercard details and complete the purchase. Apple Pay is another accepted form of payment. You will need to scroll down to read and agree to the terms and conditions and privacy policy. Finally, tap “Next”. The cryptocurrency you purchased (Bitcoin in our example) will be sent to your Abra account.

Get Started With Abra

Now that we have walked through the four funding options, it’s time to get started on your crypto journey with Abra. Once your account is funded, it’s now easy to begin using Abra Borrow to receive a crypto loan or generate interest on your crypto with Abra Boost.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.