Just in time for the close of another fun-filled tax season, we are releasing new functionality that allows users to download their Abra transaction history from within the app.

Not only will this help with tax accounting, but the new transaction download will also help investors take a closer look at when they bought or sold various assets in the app, allowing for more precise cost-basis calculations.

The exportable transaction information is now available for all of the years that Abra has been in existence — and the files are downloadable by each calendar year.

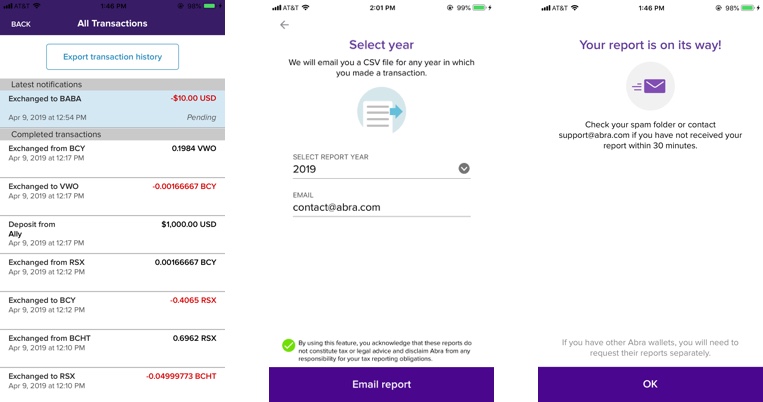

This new transaction record functionality can be found right in the transaction history screen in the app — you should see a big button at the top of the screen that says “Export transaction history.”

Export your Abra transaction history in three easy steps:

- You can find the export transaction function on the transaction history screen (image left).

- After clicking the “export transaction history button” you will see an option to choose the year and input an email. (image center)

- The last step will be a confirmation screen showing that you have completed the request. (image right)

Stop on top of crypto gains (and losses)

As we have mentioned earlier, one common investment strategy is to average into the market by making regular investments over a long period of time.

While this is a great strategy and helps to insulate against major market movements, it also creates a long trail of crypto trades that need to be accounted for and calculated before determining profit and loss.

Now, those steps are made easy by exporting your transaction history. Once exported, your history will be emailed to the address that you will be prompted to enter.

One thing to note is that if you have more than one Abra wallet, you will have to go through the transaction export download for each wallet. (This is because of Abra’s non-custodial architecture.)

Crypto tax functionality

This transaction history update comes in time for tax deadlines in the US.

When you have exported and emailed the transaction history, it will arrive in your inbox as a CSV spreadsheet. This format allows you to perform your own calculations, and it is also compatible with cryptotrader.tax, and likely other tax account software in the future.

If you are looking for the new app transaction history functionality, but don’t see it yet, make sure you have the latest version of the app downloaded.

Check out our FAQ for more info. If you have any other issues figuring out the transaction history, we are here for you: [email protected].

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.