We have some good news for European Abra users — we are rolling out Single Euro Payment Area (SEPA) bank transfers to buy bitcoin using the Abra app!

The goal of enabling European bank transfers accounts is to help make buying and selling cryptocurrencies easier worldwide.

How to buy bitcoin in Europe

Here’s how the Abra experience will work in Europe:

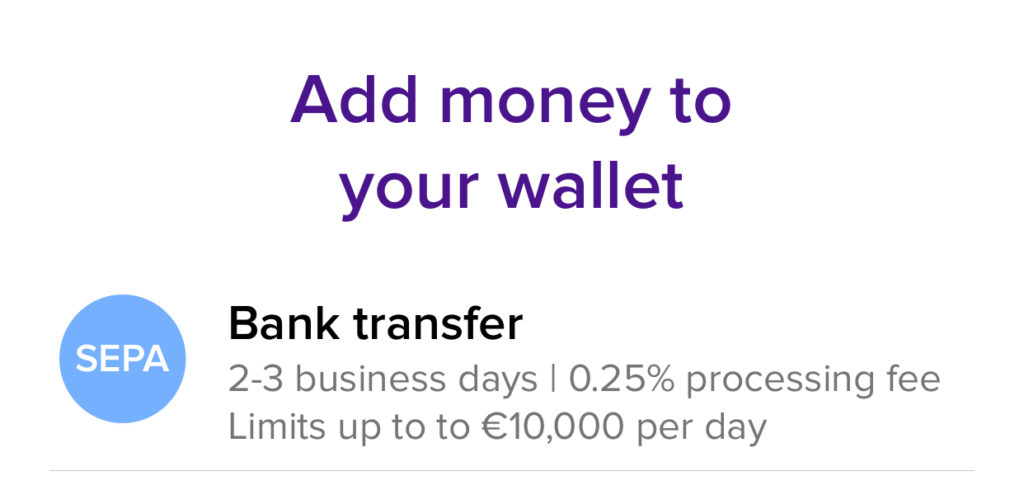

- After updating the Abra app, European users will see a SEPA option under the “Add Money” menu.

- In order to use a European account, Abra users will have to register with our partner, Coinify, as a trader. This will require submitting information such as your name, email, and basic geography. (By hitting the SEPA option in the Abra app, you will be redirected to sign up with Coinify).

- The next layer of bank-level security requires users to prove their identity using their name, date of birth, address, and photos of government-issued ID. (This will be handled through a service called iSignThis).

- After inputting your information, it may take up to 2 business days to be confirmed. Once you are, you will receive an email notifying you that you are ready to buy bitcoin.

- Now you will be able to transfer money from your local bank and into the Abra app.

There is a small fee (usually .25%) charged by our partner Coinify to complete these European bank transfer transactions.

This service is available in: Austria, Belgium, Britain, Bulgaria, Cyprus, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Republic of Ireland, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, Slovenia, Slovakia, Spain, Sweden, and Switzerland.

Abra in Europe

After purchasing bitcoin and transferring it into the Abra app, users will then be able to exchange that bitcoin for 28 cryptocurrencies.

If you have any questions or need guidance through the SEPA-enabling process, please reach out to [email protected].

Join our community and find more people achieving their financial goals through crypto.

Download the Abra app and conquer crypto today!

Download AppAbout Abra

Established in 2014, Abra is on a mission to create a simple and honest platform that enables millions of cryptocurrency holders to maximize the potential of their assets. Abra enables both individuals and businesses to safely and securely buy, trade, and borrow against cryptocurrencies – all in one place. Abra’s vision is an open, global financial system that is easily accessible to everyone.

Why Abra

Based in the United States, Abra is available in over 150 countries and makes it easy to convert between crypto and a wide variety of local fiat currencies. With over 2MM customers, $7B in transactions processed, and $1.5B in assets under management, Abra continues to grow rapidly. Abra is widely loved and trusted – in April 2022, pymnts.com reviewed and rated Abra amongst the top 5 most popular crypto wallets in the market. Abra is backed by top-tier investors such as American Express Ventures and First Round Capital.

How Abra Protects Your Funds

Abra places clients’ financial objectives and security first. Abra practices a culture of risk management across all levels and functions within the organization.

Abra employs a state-of-the-art enterprise risk management framework that comprises a comprehensive set of policies, procedures, and practices detailing all applicable risk-related objectives and constraints for the entirety of the business. Abra has instituted a complete set of requisite systems and controls that continuously enforce these policies, procedures, and practices to manage all operations, including credit and lending. Abra’s independent Risk Committee comprises experienced compliance, risk, securities, and fraud operations professionals with backgrounds in industries ranging from traditional and digital assets banking, payments, remittance, to fintech.

Please visit our FAQ to learn more.

keith

2043 days agohad to uninstall app as not really useful for GBP bank/debit card transfers.

sorry, i tried

Daniel McGlynn

2042 days agoSorry to hear that the bank transfers are not working for you. If you are still interested in the app, please contact [email protected] and they’ll be able to help you figure out what’s going on. Thanks.